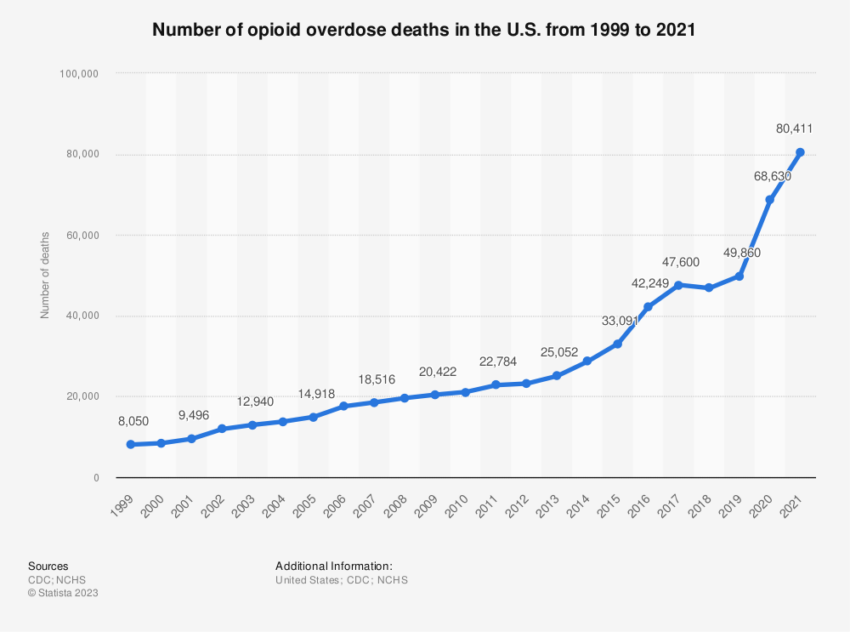

The opioid crisis remains a harsh reality in the United States. Over 100,000 souls are lost each year, a statistic that the Centers for Disease Control reports with chilling regularity. An unexpected player lurks in this grim drama – the cryptocurrency market and, more specifically, crypto wallets.

The cryptic underworld of the opioid trade uncovers the unexpected yet critical role of cryptocurrency. But what are the repercussions for the industry and the vital steps toward resolution?

Crypto Wallets in the Opioid Crisis

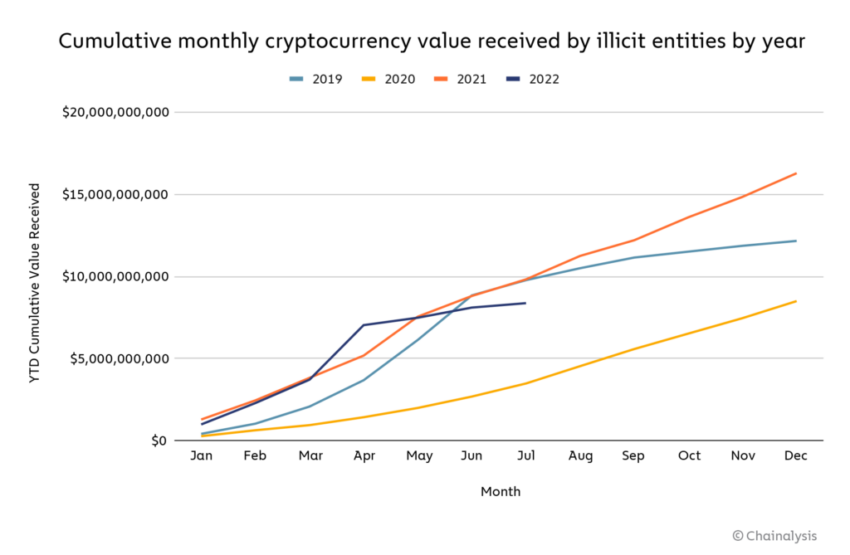

Chainalysis, a leading blockchain data platform, has recently shed light on a sobering reality. Since 2018, certain crypto wallets associated with China-based suppliers have received over $37.8 million in crypto transactions.

These transactions are intimately tied to the illegal fentanyl trade. This brings us to a pressing question: how entrenched is cryptocurrency in these illicit operations?

To unpack this, one must venture into the labyrinthine corridors of the dark web, a realm where anonymity is king and transactions are shrouded in layers of encryption.

In this concealed environment, crypto, especially Bitcoin, thrives as the currency of choice for illicit activities.

Crypto wallets serve as the perfect vehicle for these transactions. They securely store public and private keys, thereby facilitating cryptocurrency transactions.

Now, envision a scenario where a drug dealer in Mexico seeks to procure precursor chemicals from China. Traditional banking methods leave a discernible trail.

Crypto wallets, on the other hand, provide a cloak of anonymity, making transactions untraceable and making them the method of choice for illegal activities.

OFAC Enforcement Actions

The Office of Foreign Asset Control (OFAC) is a glimmer of hope in this grim scenario. Recently, they targeted a user of a crypto wallet who had been facilitating the provision of precursor chemicals from Chinese companies to Mexican cartels.

These chemicals were subsequently used to manufacture narcotics, which were transported across borders and sold on the streets of the US.

The enforcement action by the OFAC is a commendable step, akin to cutting off one head of a Hydra. But like the mythical beast, the problem regrows. Crypto wallets continue to serve as conduits for the opioid crisis.

The Impact on the Crypto Market

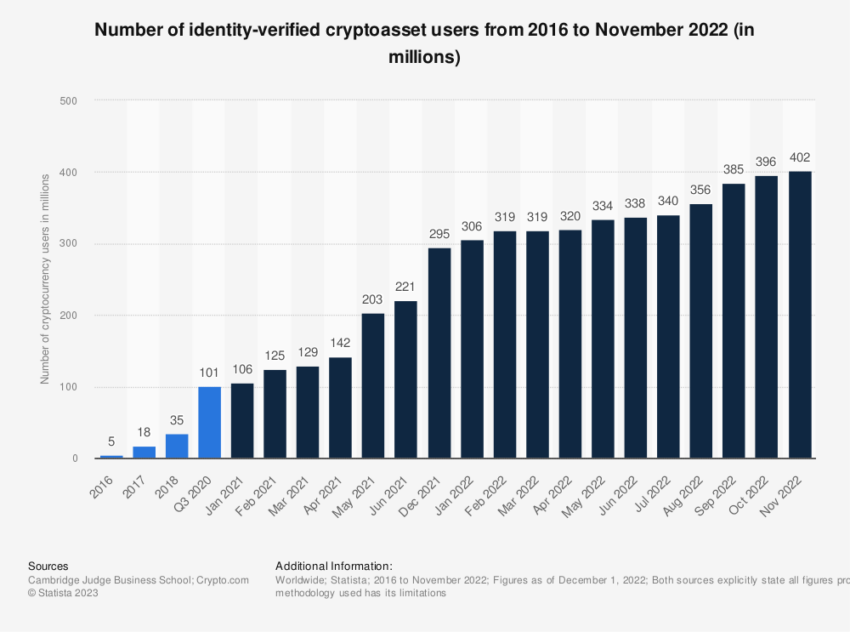

This shadowy facet of cryptocurrency is a significant hurdle for the burgeoning crypto industry. The association of cryptocurrency with illegal activities tarnishes its reputation, potentially stifling growth and deterring prospective investors.

The urgency for a solution becomes increasingly pressing. What could such a solution look like?

Blockchain technology, the backbone of cryptocurrency, inherently provides traceability. The system records and makes each transaction immutable.

Leveraging this, law enforcement agencies could potentially trace transaction patterns, identify illicit activities, and effectively shut down the offending crypto wallets.

Crypto companies can also contribute towards a solution. Enhancing Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures can potentially identify and prevent suspicious activities early.

The key lies in fostering cooperation between the crypto industry and law enforcement agencies.

Regulatory Solutions: Supervision of Crypto Wallets

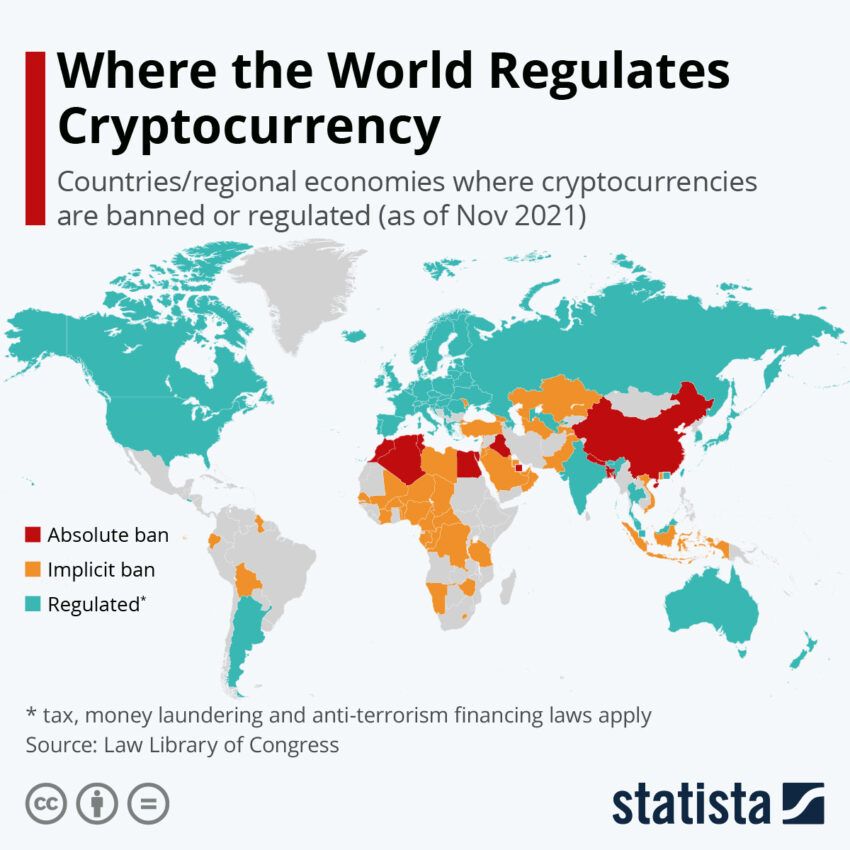

Regulators worldwide need to step in and formulate comprehensive policies targeting crypto wallets involved in illegal activities.

In the US, regulation has begun, albeit at a slow pace. The recent actions by the OFAC are a positive step, but more needs to be done.

Robust regulations, increased transparency, and enhanced supervision of crypto wallets could potentially dismantle the illicit opioid-crypto network.

Possible solutions might include implementing stricter regulations on anonymous transactions, requiring more thorough identification verification for crypto wallets, and increasing international cooperation in tracking and penalizing illegal cryptocurrency-related activities.

Technology companies could also develop advanced tools for detecting suspicious transaction patterns, further empowering law enforcement agencies.

Moreover, fostering partnerships between crypto platforms, government agencies, and non-profit organizations could facilitate comprehensive education about the risks and ethical implications of using cryptocurrency illegally. Such education could, in turn, discourage participation in these activities.

Technology and Regulation: The Need for Collaboration

In the fight against the opioid crisis, one cannot afford to overlook the role of crypto wallets. As one navigates this complex issue, it is clear that technology and regulation must collaborate to eradicate this scourge.

It is not easy, but the stakes are too high for inaction. As the crypto industry continues to evolve, it must take decisive steps to ensure it is not inadvertently facilitating the opioid crisis.

The path to extrication is complex yet achievable. The time for action is now.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.