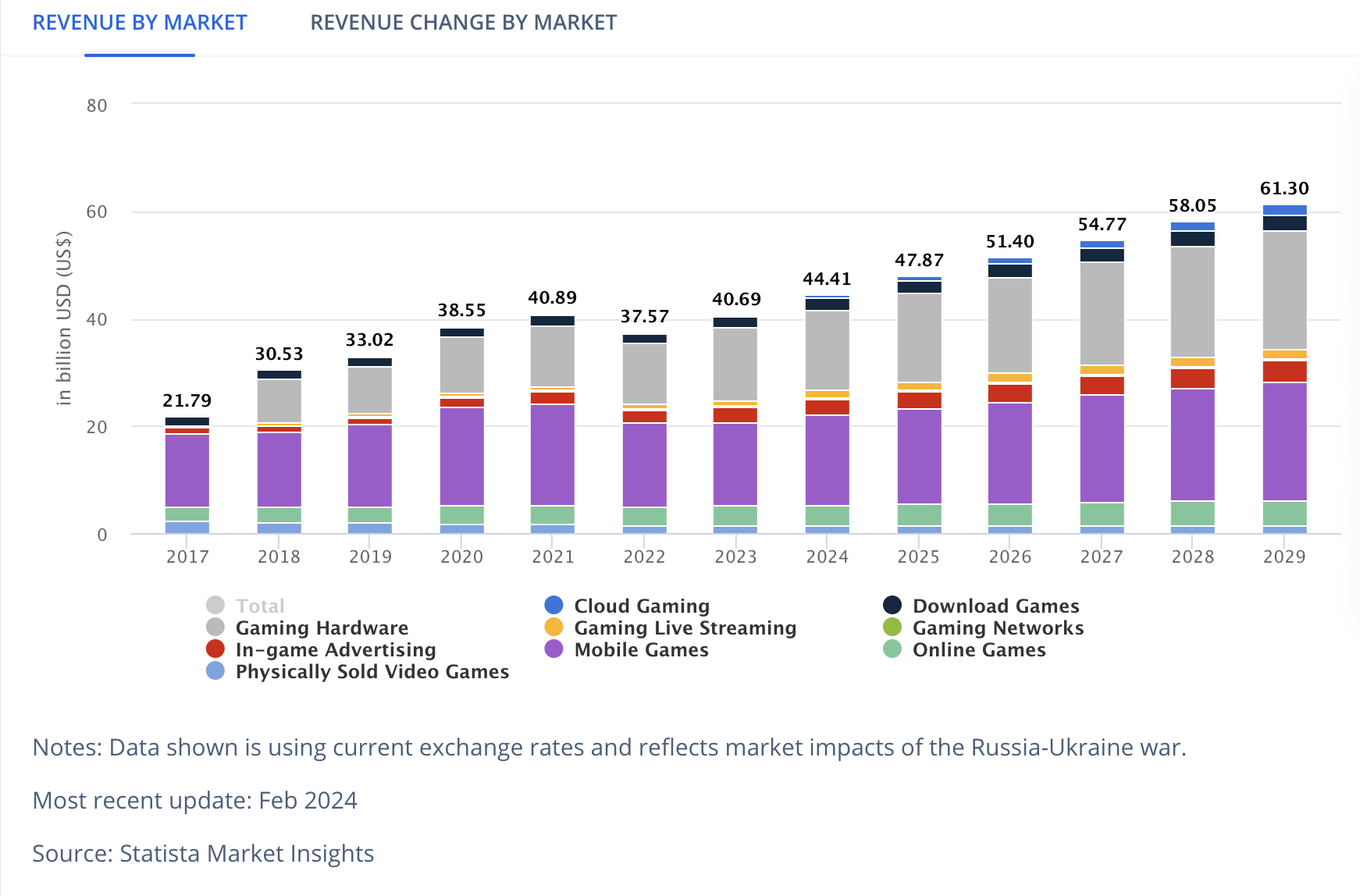

The Japanese blockchain gaming community is pushing to revitalize and capture a significant share of the $44 billion gaming market. They have approached the Liberal Democratic Party (LDP) to discuss enhancing the liquidity for Web3 games.

Ryo Matsubara, the director of the blockchain platform Oasys, spearheads this effort. Oasys claims it is optimized for gamers with instant transactions and zero gas fees.

Japanese GameFi Flagbearers Seek Government Support

Despite favorable regulations like the new taxation laws, stringent rules have stifled liquidity for the Japanese GameFi sector. This, in turn, hampers the growth of the GameFi ecosystem.

Matsubara has been vocal about the necessity of liquidity for Web3 game projects. He believes that the crypto market in Japan is grappling with liquidity challenges. This is due to a combination of incidents and stringent regulations. However, Matsubara remains optimistic. He believes that with enhanced liquidity, Japan could become a leading market again, especially given its rich content.

“I made presentation to ruling party and government how liquidity is important for Web3 game projects. The crypto market in Japan is running dry of liquidity after several incident and strict regulation. If Japan recover its liquidity, it will be hottest market as we have a lot of attractive contents,” Matsubara said.

Read more: What Is GameFi?

Collaboration with the government is a key part of Oasys’s strategy. The goal is to tweak regulations to encourage safer cryptocurrency investments. Such changes could quickly increase market liquidity. This, in turn, would attract more buyers and sellers, boosting the Japanese Web3 market’s competitiveness.

As of February 2024, the revenue of the Japanese gaming market stands at $44.41 billion. Moreover, it is forecasted to increase to $61.30 billion by 2029. If there are favorable regulations, it will allow the GameFi industry to capture a significant portion of this market.

Notably, the Japanese government has previously rolled out various laws favoring crypto innovation. For instance, in September 2023, the Japanese government considered allowing startups to raise funds through crypto-asset issuance. Prime Minister Fumio Kishida highlighted this initiative. Additionally, he stressed the potential of Web3 to transform the internet and ignite social change.

However, challenges remain. The Financial Services Agency (FSA), Japan’s main financial regulator, has proposed measures to protect users by halting transfers to crypto exchanges if the sender’s name doesn’t match the account name. This policy could affect both individual and corporate accounts.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

While designed to protect users, such measures could complicate peer-to-peer (P2P) transactions. This, in turn, could also affect liquidity.