Japan is taking bold steps to mitigate the risks associated with crypto-assets. With the rising tide of specialized fraud and unlawful money transfers, particularly through Internet banking, the Japanese authorities are eyeing a crucial pivot in financial security protocols.

The National Police Agency (NPA), in conjunction with the Financial Services Agency (FSA), believes a significant portion of these fraudulent activities leverages crypto-assets for illicit fund transfers.

Will Regulators New Recommendation Destroy P2P in Japan

The FSA and NPA are pushing banks to improve customer protection. Hence, they advise stopping transfers to crypto exchanges if there are issues like name mismatches. They also want better monitoring of unauthorized transfers to prevent fraud.

Read more: 12 Best P2P Crypto Exchanges You Need To Know About in 2024

“The Financial Services Agency, in collaboration with the NPA, encouraged financial institutions to further strengthen their user’s protection depending on the risks such as their status of transfers to crypto-asset exchange service providers,” the FSA wrote.

This action comes from a rise in phishing scam victims being pushed to send money to crypto exchange accounts. On February 6, 2024, they formally asked the National Bankers Association and others to enforce strict measures. This includes blocking transactions with mismatched names and upgrading transaction monitoring.

The implications for the peer-to-peer (P2P) market could be profound. P2P transactions, by their very nature, involve different names on the sender and receiver ends. Hence, if the banks implement the FSA’s recommendations, it could potentially bring a significant portion of these transactions to a halt.

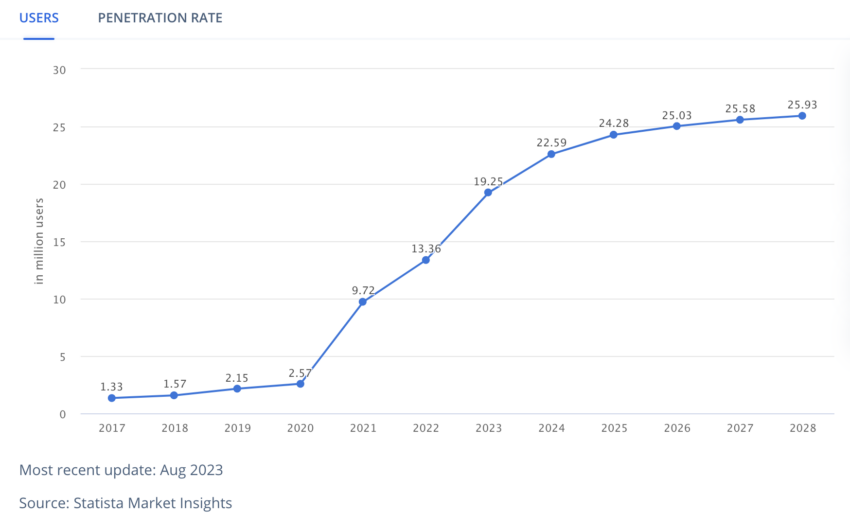

While the FSA’s recommendations currently stand as just that—recommendations—the actual impact on the banking sector and the P2P market hinges on how these institutions respond. The guidelines could directly impact Japan’s 19.25 million crypto users.

The government’s recent move to reform crypto taxation for companies, exempting them from taxes on “unrealized gains” from cryptocurrency holdings, underscores the nation’s intricate relationship with crypto. The reform, poised to redefine taxation for corporations, aligns corporate crypto taxation more closely with individual investors, taxing profits only upon selling crypto assets.

Read more: How to Reduce Your Crypto Tax Liability: A Comprehensive Guide

However, this progressive stance on crypto taxation contrasts sharply with the cautious approach towards P2P crypto transactions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.