Japanese fintech developer Soramitsu is building an interconnected payment network that binds Japan, India, China and Southeast Asia together through the use of Cambodia’s central bank digital currency (CBDC).

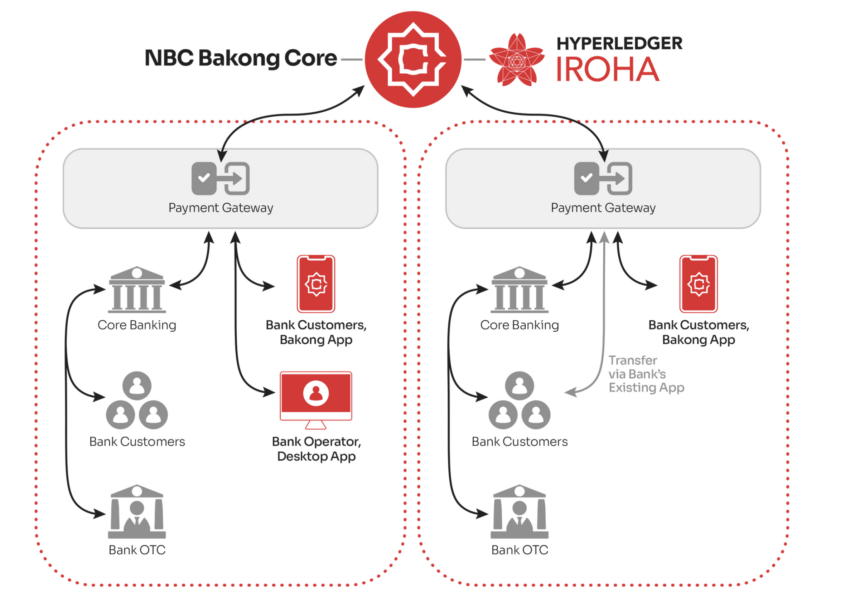

Bakong, the digital currency introduced by the National Bank of Cambodia in 2020, is a creation in which Soramitsu played a major role. Bakong now enables billions of dollars worth of transactions through QR codes across Cambodia, Malaysia, Thailand, and Vietnam.

A Cross-Border Digital Payments System in Asia

According to an Aug. 8 report, Soramitsu intends to create a similar cross-border payment system for various other regions of Asia, including India, China, Southeast Asia, and, hopefully, Japan.

Just this past June, a payment law change in Japan made it possible for banks to issue stablecoins, prompting several regional banks to consider introducing yen-denominated stablecoins, with a few aiming for a potential launch by 2024.

With this recent law amendment, Soramitsu plans to create a Japanese exchange for stablecoins aimed at streamlining the exchange of currencies from different nations.

A stablecoin is a cryptocurrency that maintains the same value, often pegged to the price of another asset, such as gold, a fiat currency, or another crypto.

To learn more about Stablecoins, read BeInCrypto’s guide: What Is a Stablecoin? A Beginner’s Guide

Swapping stablecoins issued within the same blockchain is relatively easy from a technological perspective. However, the process can become more complicated when dealing with stablecoins issued on different blockchains.

This difficulty emerges as it requires completing transactions across multiple blockchains at the same time. According to the report, Soramitsu has collaborated with multiple parties to tackle various aspects of this project.

Japan’s Mitsubishi UFJ Trust and Banking has been identified as one of the parties involved. The statement indicates that more partners will join Soramitsu in developing the exchange infrastructure.

Soramitsu partnered with Tokyo-based digital services company Vivit and the Tama University Center to create rule-making strategies. It also claims to have plans to partner with e-commerce businesses in the future.

How Will the Stablecoin Exchange Work?

Essentially the stablecoin exchange will serve as an intermediary, delivering swifter and more cost-effective transactions.

According to the report, suppose a shopper in Thailand wishes to make a purchase from a Japanese online store. They can use a QR code to initiate a payment in Bakong and then convert it into a yen-based stablecoin.

Additionally, stablecoins can be transferred independently of traditional interbank payments, thus bypassing the need for bank fees.

This will result in cost savings for residents in these nations wanting to transact in countries with different currencies.

Estimates suggest it could be less than “one-tenth the cost of a typical cross-border transfer.”

This follows several recent crypto developments in Japan. Crypto exchange Binance confirmed that it will offer its services on its Japanese platform from Aug. 14.

Most recently, the Prime Minister of Japan, Fumio Kishida, showed his support for the web3 industry at a recent conference.“I hope that the web3 industry will regain its attention and vitality and that various projects will be born,” Kishida stated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.