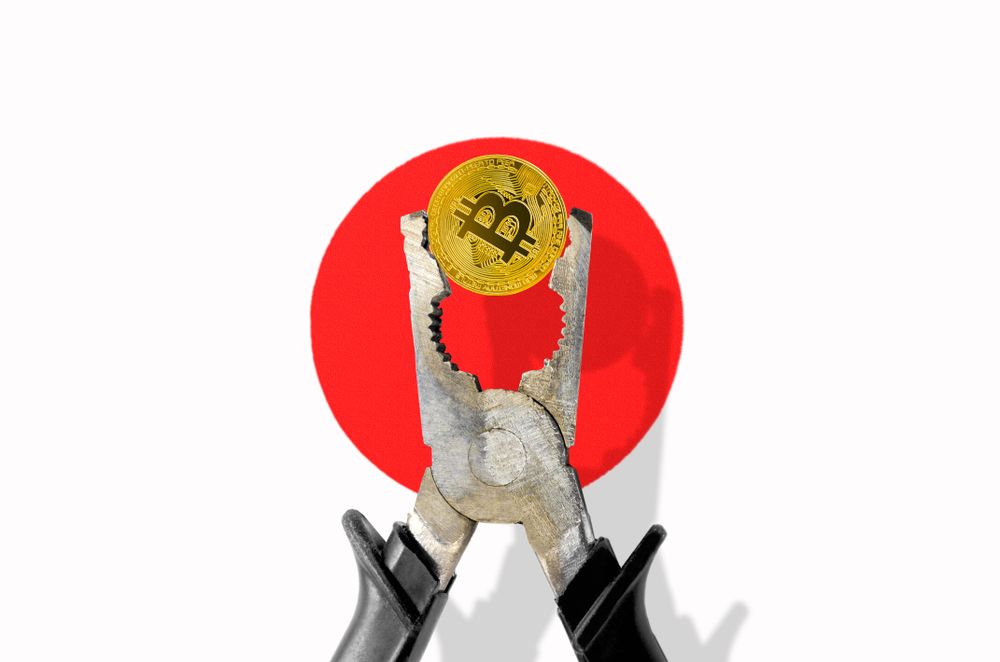

Japan’s Financial Services Agency (FSA) warned against investment solicitations from unregistered companies, including the cryptocurrency industry, in a tweet posted on June 3.

Japan’s financial authority, the Financial Services Agency (FSA), has issued a warning against investment advice doled out by individuals and groups with respect to cryptocurrencies and other asset classes. It states that entities must be registered before carrying out any related activity.

The tweet also hearkens to a recent policy that came into effect, mandating that cryptocurrency entities must be approved and keep their cash flow separate from customer funds. It also focuses on deterring unethical behavior for the selling and general engagement in cryptocurrencies.

Japanese authorities have been working to protect consumers from malicious actors. The nation now requires exchanges to be registered and follow a set of protocols. Over 20 exchanges are now licensed to operate within the country.

Japan has pioneered much of the regulation in the cryptocurrency space. Digital assets are popular in the nation, but its users have also been affected by several incidents that have prompted authorities to more closely supervise the market.

Banks have also been successfully conducting their own efforts into cryptocurrencies, with reports stating that some of the country’s biggest banks are looking into infrastructure for digital payments. Private companies are also testing alternative solutions. And of course, like many other countries, the Bank of Japan is considering a Central Bank Digital Currency (CBDC).

Japanese authorities have been working to protect consumers from malicious actors. The nation now requires exchanges to be registered and follow a set of protocols. Over 20 exchanges are now licensed to operate within the country.

Japan has pioneered much of the regulation in the cryptocurrency space. Digital assets are popular in the nation, but its users have also been affected by several incidents that have prompted authorities to more closely supervise the market.

Banks have also been successfully conducting their own efforts into cryptocurrencies, with reports stating that some of the country’s biggest banks are looking into infrastructure for digital payments. Private companies are also testing alternative solutions. And of course, like many other countries, the Bank of Japan is considering a Central Bank Digital Currency (CBDC).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored