While Bitcoin (BTC) is trading at its yearly highs, the Brazilian bank Itaú Unibanco launched Bitcoin and Ethereum (ETH) trading services for its clients.

Over the past few years, there has been heavy demand for the exposure of cryptocurrencies by institutions and high-net-worth individuals. Hence, traditional finance has started offering crypto services such as trading, custody solutions, exchange-traded funds (ETFs), and other services.

How Itaú Unibanco Plans to Stand Out, Offering Crypto Services

According to Reuters, Brazil’s largest lender, Itaú Unibanco, will facilitate Bitcoin and Ethereum trading for its clients. Guto Antunes, the digital assets head at Itaú Unibanco, said:

“It starts with bitcoin, but our overarching strategic plan is to expand to other crypto assets in the future.”

In June, BeInCrypto reported that the Central Bank of Brazil will oversee crypto regulations in the country. While the Brazilian Securities and Exchange Commission (CVM) will supervise the crypto assets that come under the criteria of “securities.”

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Indeed, regulatory clarity must have been one of the topmost factors motivating banks to offer crypto trading services for their clients. Not to mention, Itaú Unibanco has been considering plans for crypto trading offerings since July 2022.

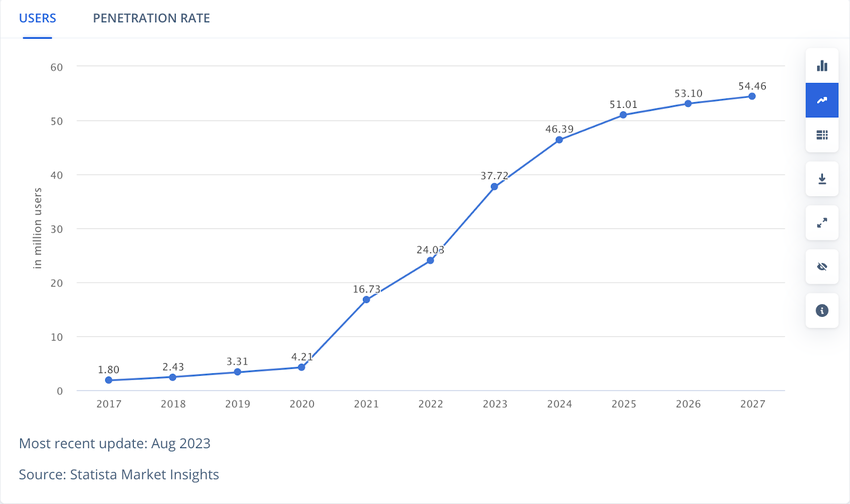

Brazil has around 37.72 million crypto users in 2023. Additionally, Statista forecasts that the number of users might grow to 54.46 million by 2027.

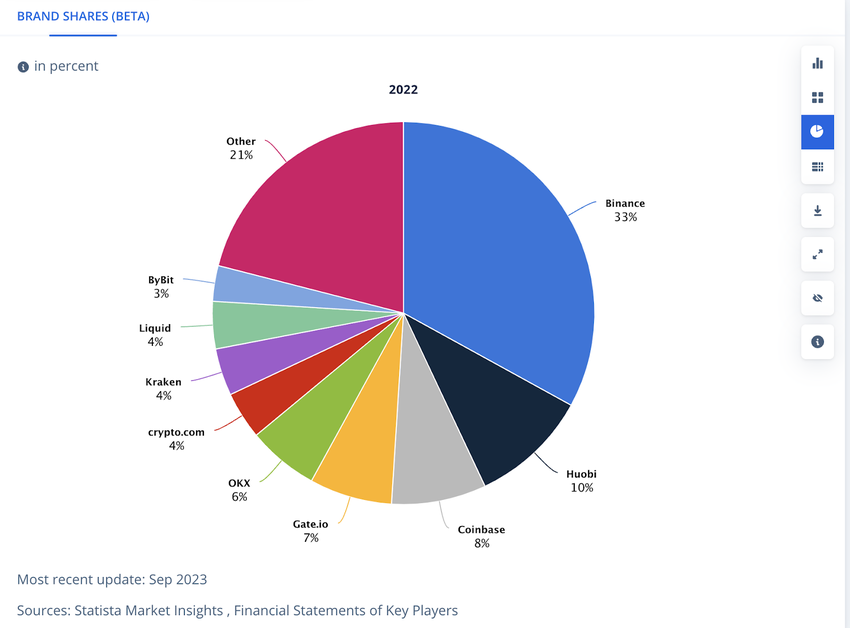

The screenshot below shows that well-established centralized crypto exchanges have significant market shares in the Brazilian market. But, last month, BeInCrypto reported that the Brazilian Senate approved a 15% maximum tax on cryptocurrency earnings from foreign exchanges.

Nonetheless, there are other local players, such as the crypto exchange Mercado Bitcoin. But Itaú Unibanco plans to stand out by also offering crypto custody services.

Read more: 7 Best Pro Accounts for Crypto Trading

Do you have anything to say about the Brazilian bank – Itaú Unibanco or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.