As Israel declares a state of war against the Palestinian military group Hamas, the crypto community is speculating on how Bitcoin (BTC) and the broader altcoin markets will react.

The market volatility tends to increase during geopolitical crises such as war or other military conflicts. While the price of commodities such as oil and gold increases, investors tend to move away from riskier assets such as stocks and crypto.

Crypto Analyst Expects Volatility in Shorter Term

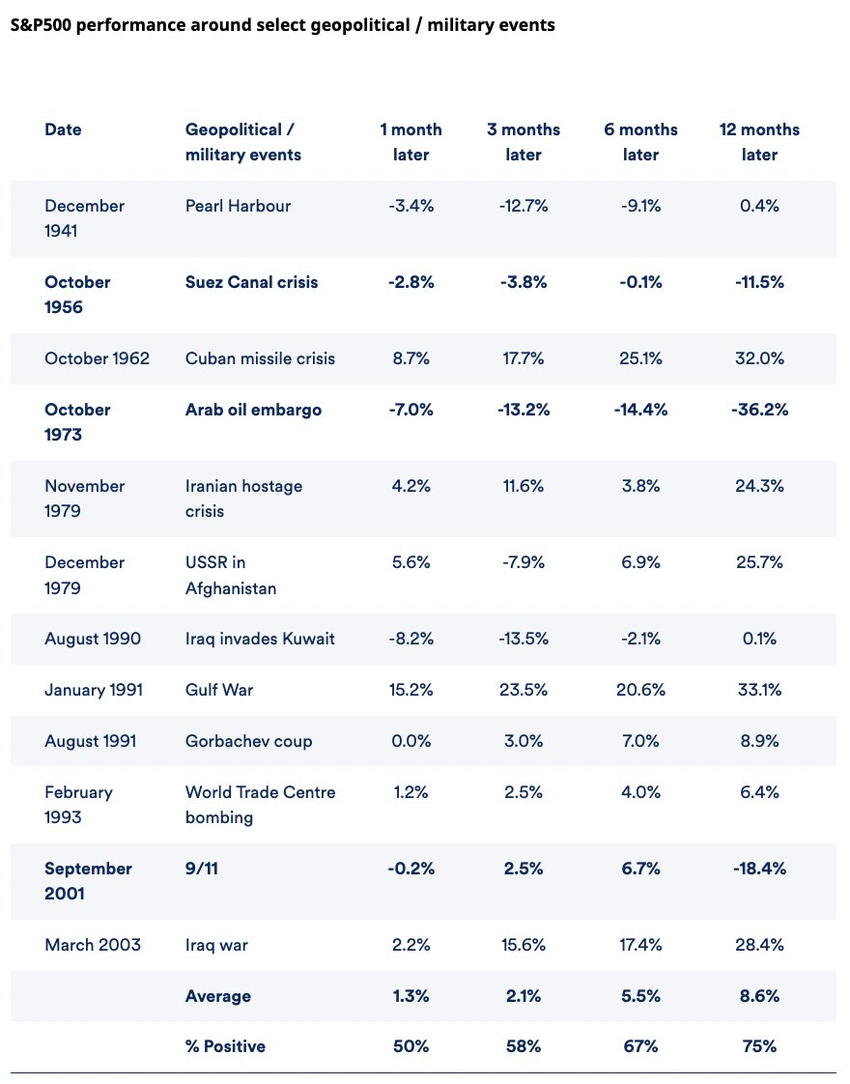

The renowned crypto analyst Miles Deutscher talked about the impact on the S&P 500 due to the Israel-Palestine war. He wrote on X (Twitter):

“Data suggests that markets typically recover quickly from wars and other geopolitical shocks despite experiencing initial volatility.”

The screenshot below shows that while there was uncertainty in the first month of the conflict, the market started turning positive after three months in most cases. In 75% of the cases, the S&P 500 was positive 12 months after the military event.

The data accounted for military conflicts in the period between the Pearl Harbor incident in December 1941 and the Iraq war in March 2003.

The cryptocurrency market has not witnessed major geopolitical conflicts, except the Russia-Ukraine war. Hence, it is difficult to determine the isolated impact on the crypto assets. However, there has been a correlation between Bitcoin and the S&P 500 index.

Read more: Crypto vs. Stocks: Where To Invest Your Money in 2023

As a result, along with the S&P 500, Bitcoin is also likely to show volatility in a shorter time frame.

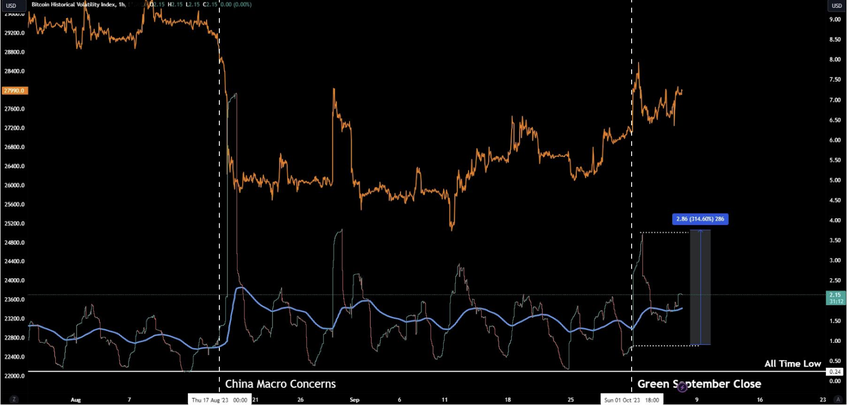

The Bitfinex Alpha report shared with BeInCrypto suggests that there will be “heightened levels of volatility” in Bitcoin’s price action. The screenshot below shows that the daily historical volatility remains above the 200-day exponential moving average (EMA).

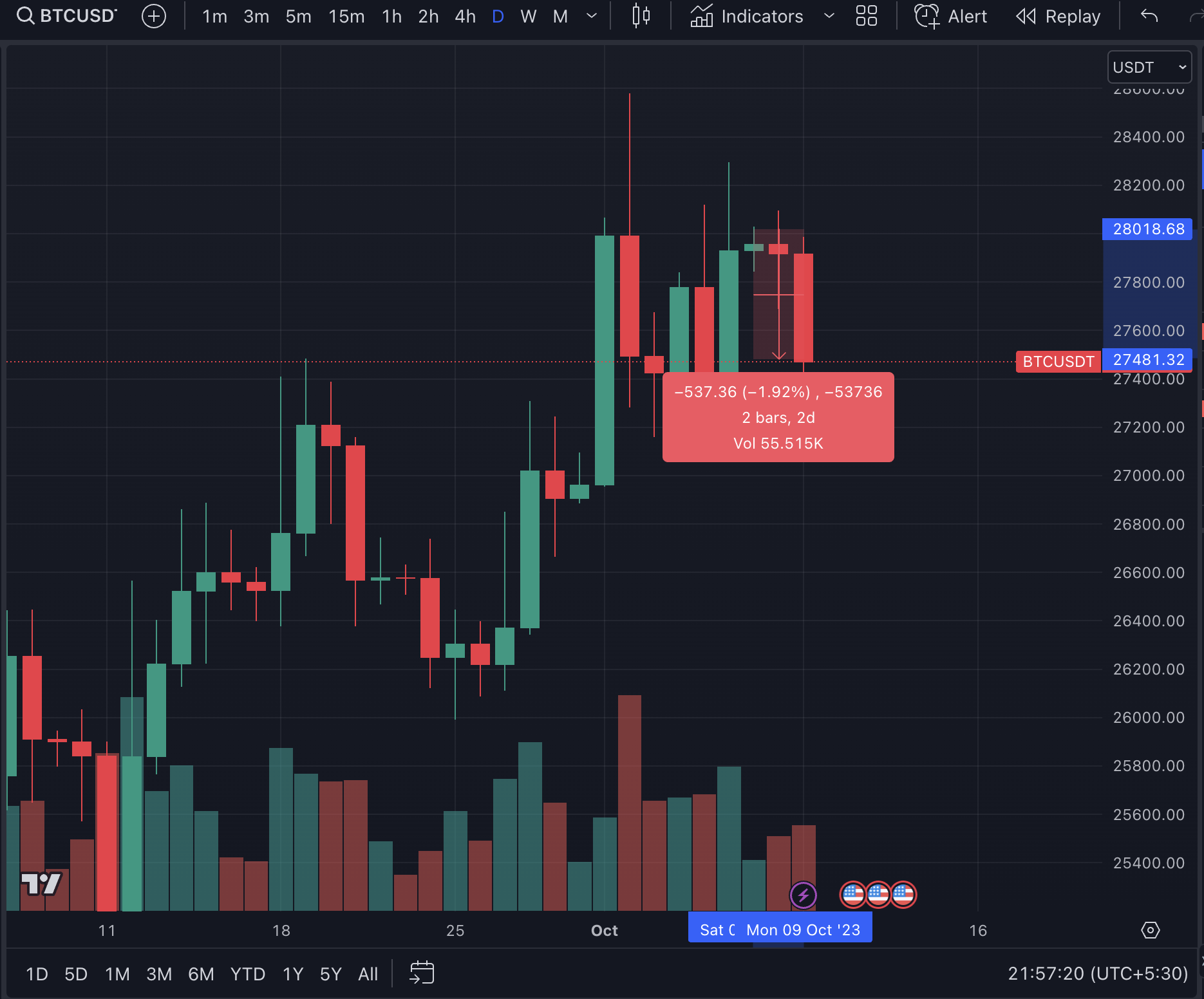

According to TradingView data, Bitcoin (BTC) has declined nearly by 2% since the Israel-Palestine war started on Saturday.

Read more: Cryptocurrency Trading Courses Tailored for Beginners.

Do you have anything to say about the impact on crypto due to the Israel-Palestine war or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.