Cardano (ADA) price gained 4% to surge above $0.37 as Whales made a flurry of large acquisitions on Monday. On-chain data shows that there could be room for more bullish activity in the coming days. Is the recent surge or bull trap, or will it validate the $0.40 ADA price prediction?

Cardano (ADA) has emerged as one of the top-performing Layer-1 coins this week. Notably, Cardano whales were spotted performing record numbers of transactions on Monday. Will the ADA accumulation frenzy continue with most holders still in a net-loss position?

Cardano Whales Spotted Buying the Dip

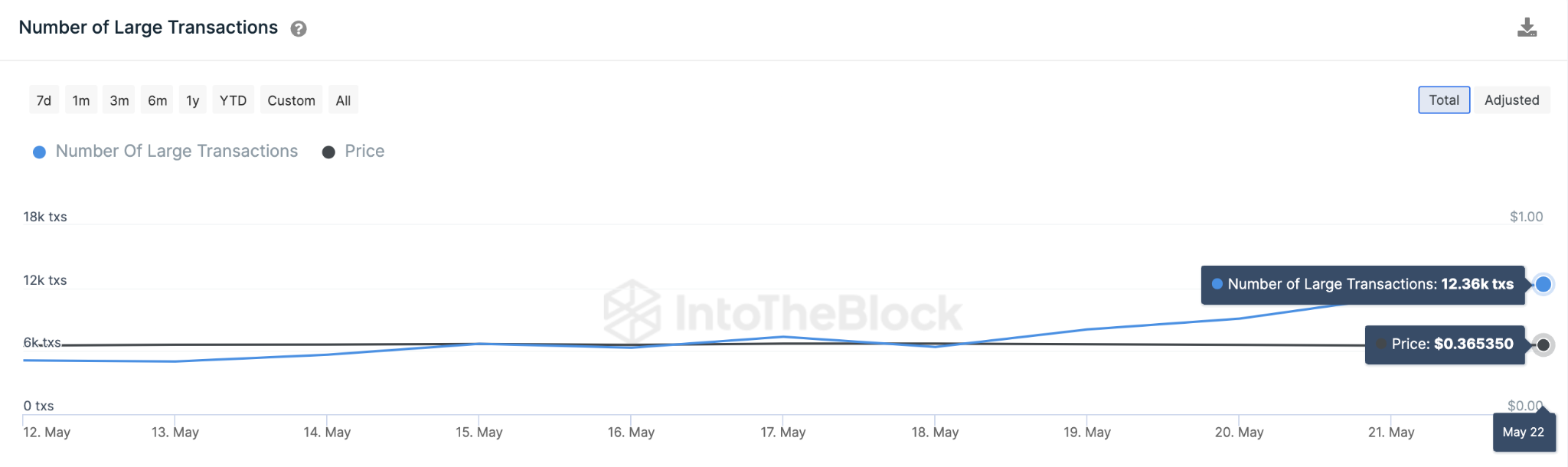

On Monday, Cardano (ADA) where was spotted conducting an unusually high number of transactions. The chart below shows how the number of Large Transactions involving ADA soared to 12,360 transactions on May 22.

This represents a 146% rise from the recent low of 5,020 whale transactions recorded on May 13.

Large Transactions measures the daily number of transactions that exceed $100,000. Notably, the last time Cardano attracted this whale activity was in May 2021.

Investors will expect more gains in the coming days since previous ADA price rallies have often been preceded by heightened whale activity.

Investors are Still Holding Losses

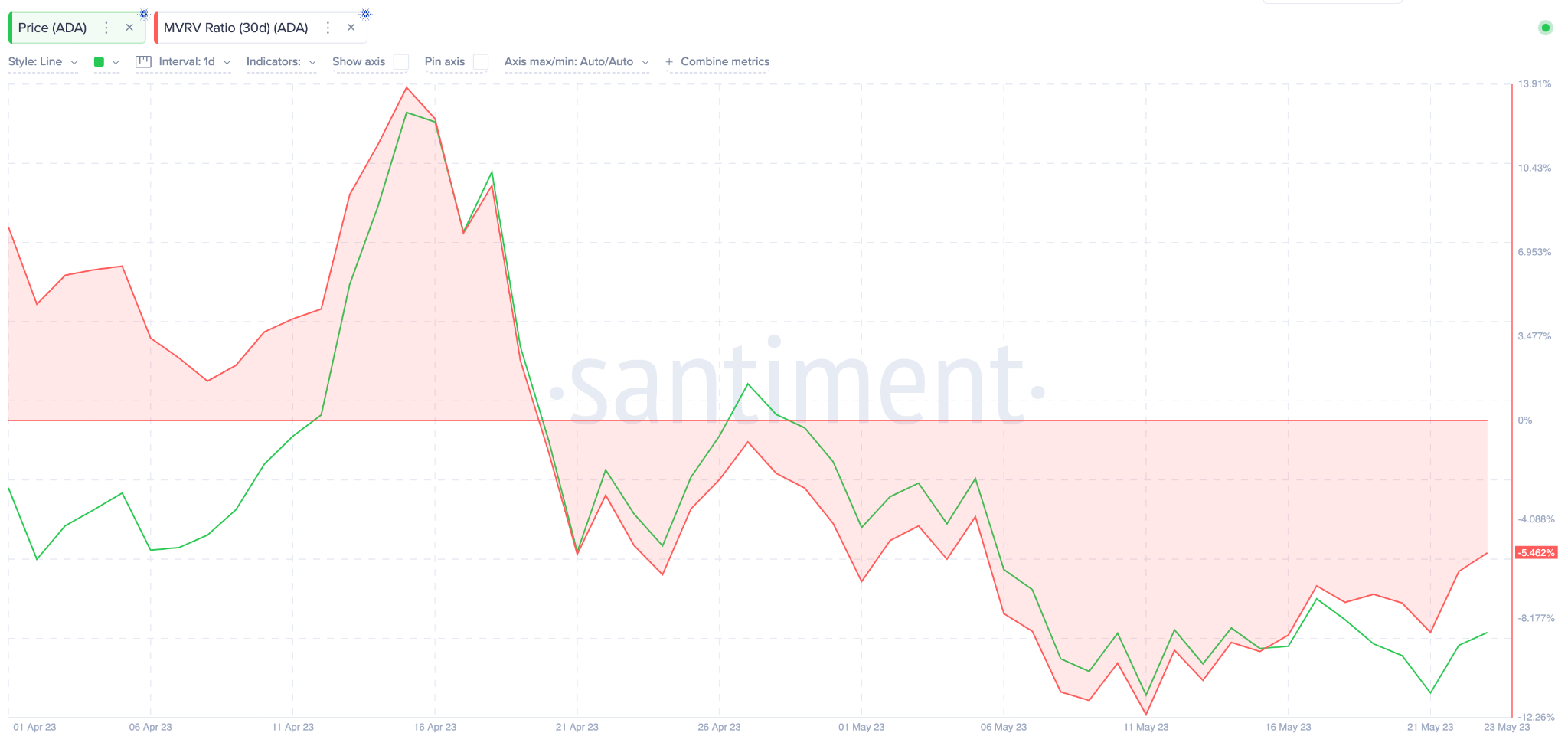

Despite the ADA Price Jump, the Market Value to Realized Value (MVRV) data shows that most Cardano investors still hold sizeable losses.

The MVRV ratio evaluates the net financial position of investors by comparing their purchase prices to the asset’s current market value.

The Santiment chart below shows that, with prices at $0.37, investors that bought ADA in the last 30 days are holding nearly 6% losses.

Typically, investors hold off selling until the price approaches their break-even point. Most Cardano investors will likely continue consolidating their holdings in the coming days.

However, that could change once the ADA price approaches $0.40. Hence, prospective investors will be wary of a potential bull trap.

ADA Price Prediction: All Eyes on $0.50

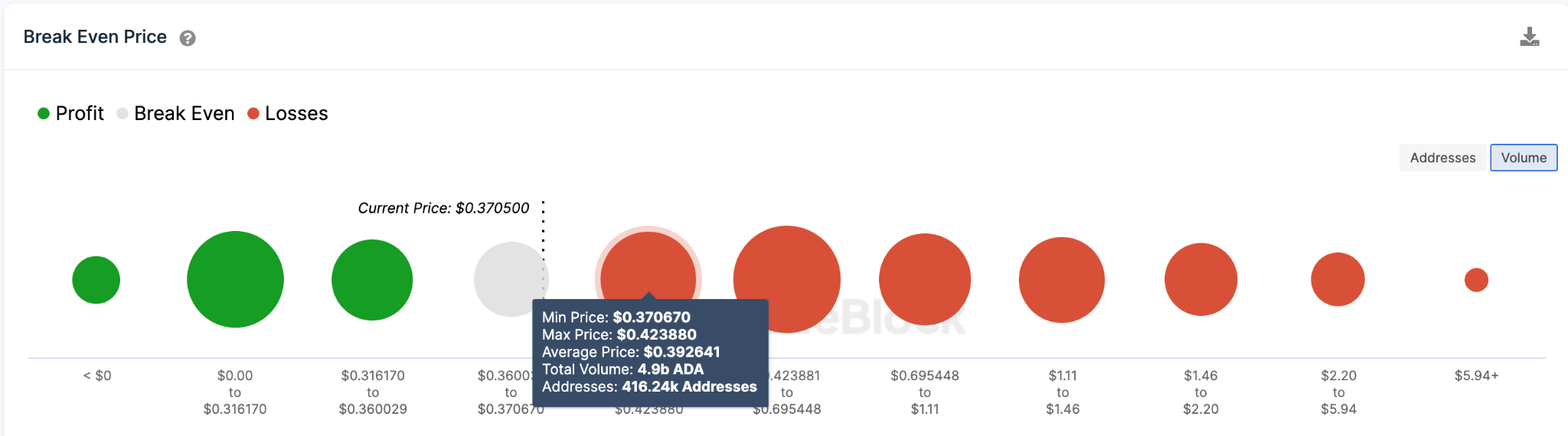

IntoTheBlock’s Break-Even Price Distribution data signals that Cardano could soon reclaim the $0.50 milestone.

However, ADA could have a hard time breaking above the $0.40 resistance zone. In that zone, 416,000 investors holding 4.9 billion could sell when they break even at $0.39, inadvertently triggering a pullback.

Nevertheless, as predicted, those holders could turn bullish if there is strong bullish momentum. If that happens, ADA can break out and rally toward $0.50.

Still, the bullish Cardano price prediction could be shortlived if the ADA price drops below $0.36. However, the 151,000 investors that bought 2.5 billion ADA at the minimum price of $0.36 can offer some support.

But failure to hold that key support level could force another downswing toward $0.31

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.