The International Organization of Securities Commissions (IOSCO) has now released its final report along with nine policy recommendations dedicated to managing DeFi risks.

The primary goal of these policy recommendations is to increase market integrity and investor protection in the rapidly evolving DeFi space.

IOSCO Emphasizes Consistency With Regulations

In a recent report, the IOSCO emphasized the importance of consistent regulatory frameworks and oversight across its member jurisdictions.

However, the recommendations cover critical areas such as understanding DeFi structures. Additionally, achieving standardized regulatory outcomes, and identifying and managing key risks. This ensures clear and comprehensive disclosures, enforcing applicable laws, and promoting cross-border cooperation.

These DeFi Policy Recommendations work in tandem with the policy recommendations for Crypto and Digital Assets (CDA) Markets. These were issued by IOSCO in November 2023.

Both sets of recommendations align with IOSCO’s Crypto-Asset Roadmap 2022/2023, and the coordination between them is detailed in the accompanying Umbrella Note released alongside the DeFi Final Report.

Having delivered these comprehensive recommendations, IOSCO is now turning its focus to the implementation phase, monitoring progress, and addressing the capacity-building and technical assistance needs of its diverse membership.

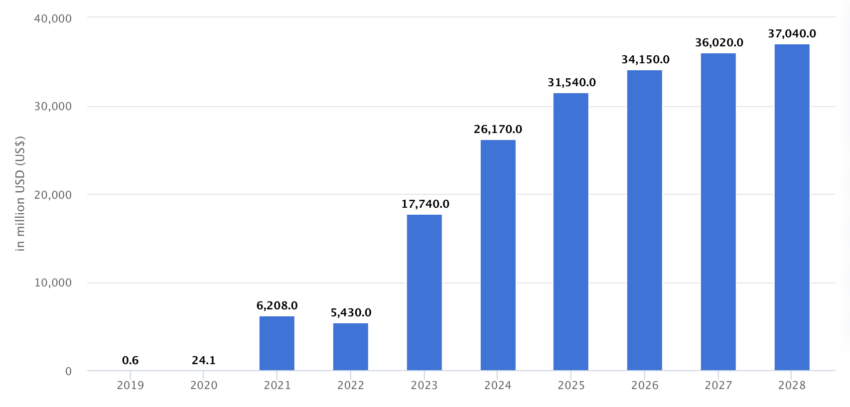

Statista predicts that the DeFi market will reach a revenue of $37.04 billion by 2028.

Read more: DeFi Community Building: A Step-by-Step Guide

IOSCO Acknowledges the Need For a Tailored Approach

The IOSCO recognizes that jurisdictions are at various stages of addressing crypto-asset market risks. Furthermore, IOSCO acknowledges the need for a tailored approach. Meanwhile, where some jurisdictions already have existing regulatory regimes, others are lagging behind.

However, Jean-Paul Servais, IOSCO Chair, expressed satisfaction with the organization’s swift progress.

“The risks of crypto-asset markets are real. And we are tackling these in a coordinated manner, seeking consistent implementation of these IOSCO Recommendations across our membership to best protect investors globally.”

According to the report, Tuang Lee Lim, Chair of the IOSCO Board-Level Fintech Task Force, highlighted the coherence and robustness of the policy framework. He emphasized its role in fostering responsible innovation, investor protection, and market integrity outcomes in the crypto-asset markets.

Read more: Identifying & Exploring Risk on DeFi Lending Protocols

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.