Ethereum (ETH) spot exchange-traded funds (ETFs) became tradeable on July 23. However, despite initial enthusiasm, these investment funds have struggled to maintain investor interest.

In recent weeks, ETH ETFs have faced substantial net outflows, with only one week of inflows recorded since their launch.

Ethereum ETFs Record Steady Outflows

According to data from SosoValue, ETH spot ETFs recorded a net outflow of $341.35 million in their first week of trading, marking the largest outflow to date. The second week saw a reduced outflow of $169.35 million, indicating that while investor interest continued to decline, the pace of withdrawals slowed slightly.

Within the two weeks, the total net assets plummeted from $9.24 billion to $8.33 billion. This decline was due to funds withdrawal from these ETFs as ETH value plugged. Between July 23 and August 8, the price of the leading altcoin dropped by 7%.

Although ETH’s value declined further in the third week, the ETFs recorded their first and only inflows, totaling $104.76 million. Interestingly, despite this positive inflow, the total net assets in these funds dropped by another 13%.

By the end of that week, the combined net value of all assets held by US Ethereum spot ETFs stood at $7.28 billion. This remains the only week of net inflows these funds have seen since their launch.

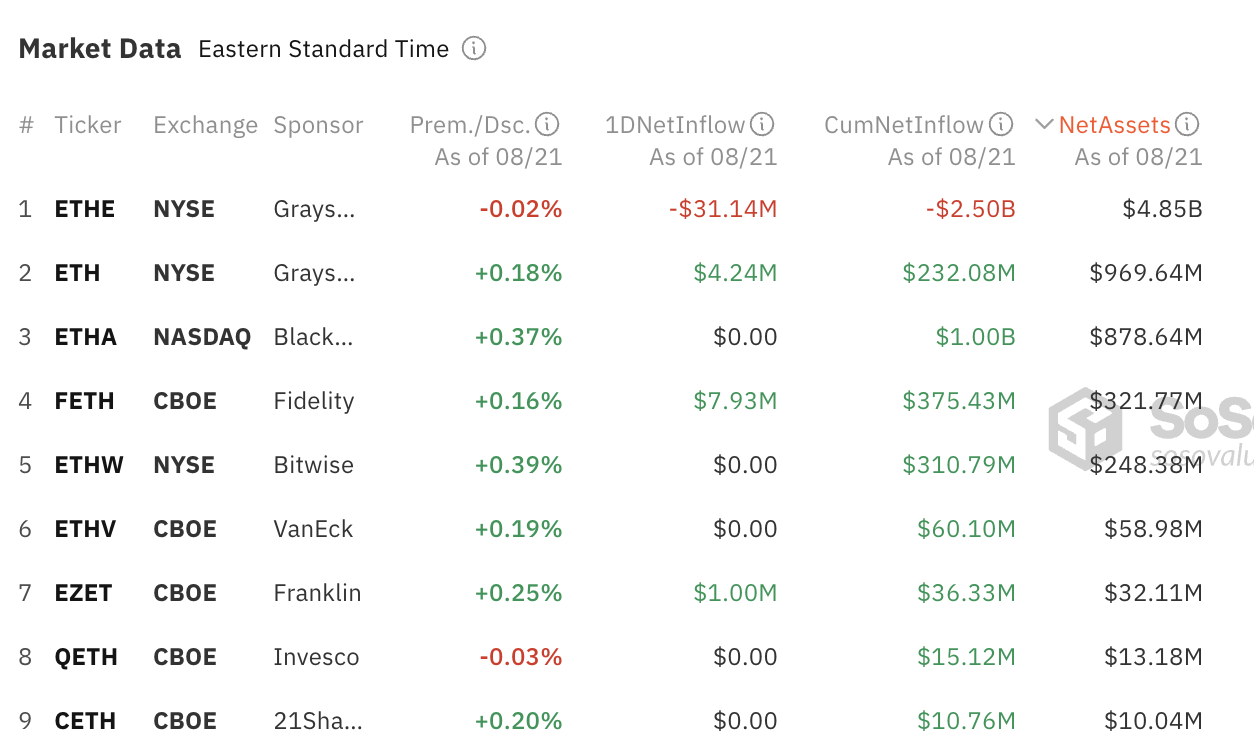

Outflows have amounted to $38 million so far this week, with total net assets at $7.38 billion. This represents 2.3% of ETH’s market capitalization.

On Wednesday, BlackRock’s iShares Ethereum Trust (ETHA) surpassed $1 billion in cumulative net inflows, making it the only fund to reach that milestone. According to SoSoValue data, this surpasses the combined inflows of the next three highest ETFs.

Read more: How to Invest in Ethereum ETFs?

However, ETHA’s net assets rank third, behind Grayscale’s mini Ether trust (ETH) and Ethereum trust (ETHE), which have total assets of $4.85 billion and $969.64 million, respectively. ETHA holds total assets of $878.64 million.

ETH Price Prediction: Coin Flashes Buy Signal

At press time, ETH is trading at $2,627, reflecting a 1% price increase over the past 24 hours, while its trading volume has surged by 9%.

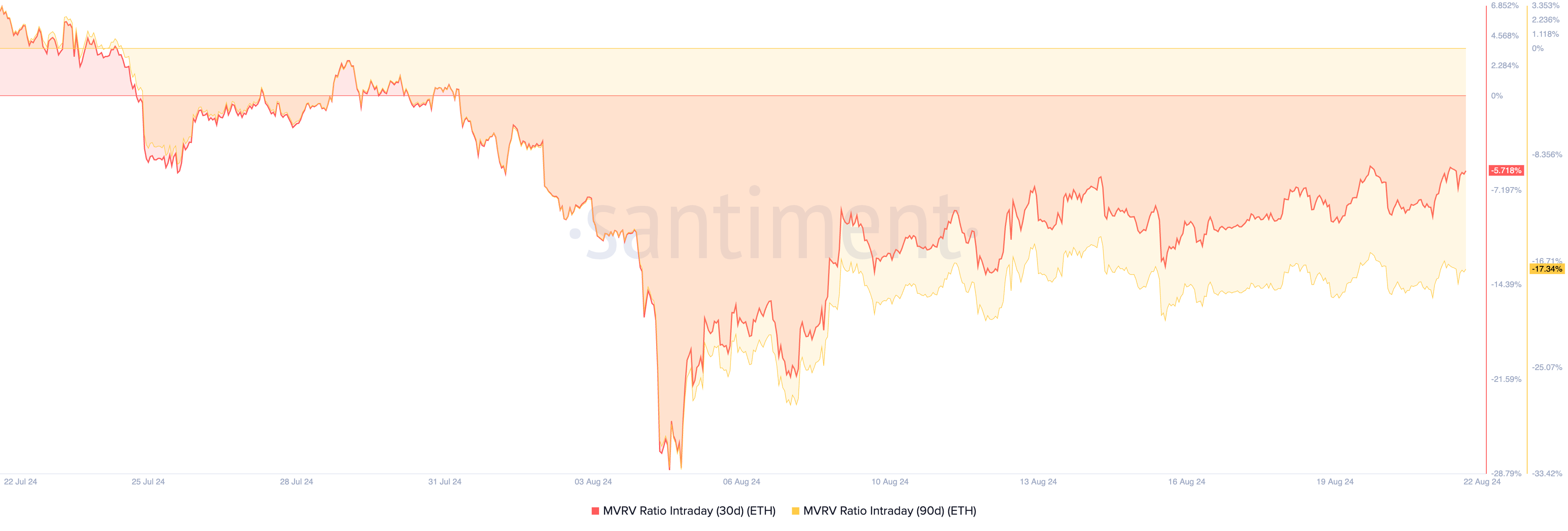

ETH’s struggle to stabilize above the $3,000 mark presents a potential buying opportunity, indicated by its negative market value to realized value (MVRV) ratio. According to Santiment, the token’s 30-day and 90-day MVRV ratios stand at -5.71% and -17.34%, respectively, suggesting the asset may be undervalued.

The MVRV ratio measures whether an asset is overvalued, undervalued, or fairly valued. When the ratio is below one, it indicates the asset’s market value is less than its realized value, suggesting it may be undervalued. This creates a buying opportunity for traders looking to capitalize on the “dip.”

If ETH begins an uptrend, buyers who enter at the current market value could realize gains as the price climbs toward $2,868.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, they risk being put “under the money” if a downtrend occurs and the price drops to $2,579. An investor is “under the money” when the asset’s market value falls below the acquisition price, leading to potential losses.