The unexpected price decline of Stellar (XLM) in October boosted demand, even though the token has not yet recovered its previous losses. On-chain data and the project’s latest updates reflect confidence among certain investors, while overall market sentiment remains pessimistic.

Investor accumulation of XLM throughout October indicates long-term conviction rather than short-term price chasing. The following factors provide a clearer explanation.

Exchange Reserves Plunge While TVL Hits Record High

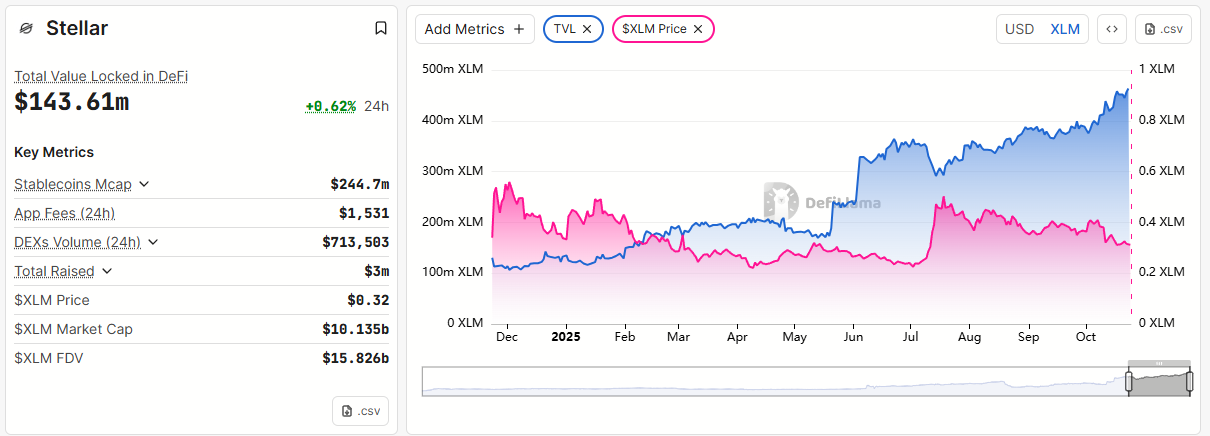

According to DeFiLlama, the total value locked (TVL) on the Stellar chain, measured in XLM, has surged to an all-time high of over 456 million XLM locked across various DeFi protocols.

Comparing XLM’s price performance with its TVL since last December highlights investors’ faith in the network’s ecosystem.

Specifically, since December, XLM’s price has dropped by 50%, but the amount of XLM locked in DeFi protocols has increased more than fourfold.

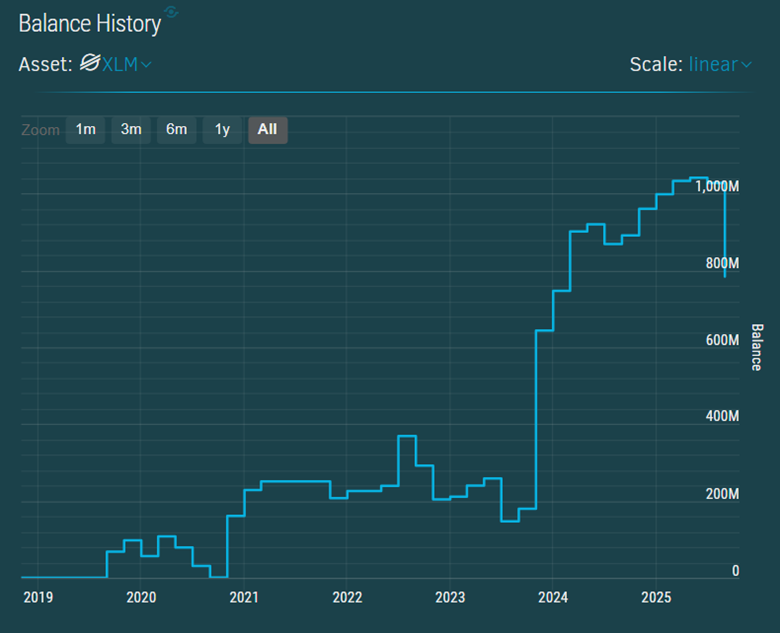

Another positive sign comes from Binance wallet data. The exchange’s official XLM address (GBA…GPA) recorded over 240 million XLM withdrawn from the exchange over the past two months, the largest outflow since 2024.

Combining these two data points suggests that many XLM investors were heavily accumulating during October. They may have moved tokens off exchanges for long-term storage or to deploy them in DeFi.

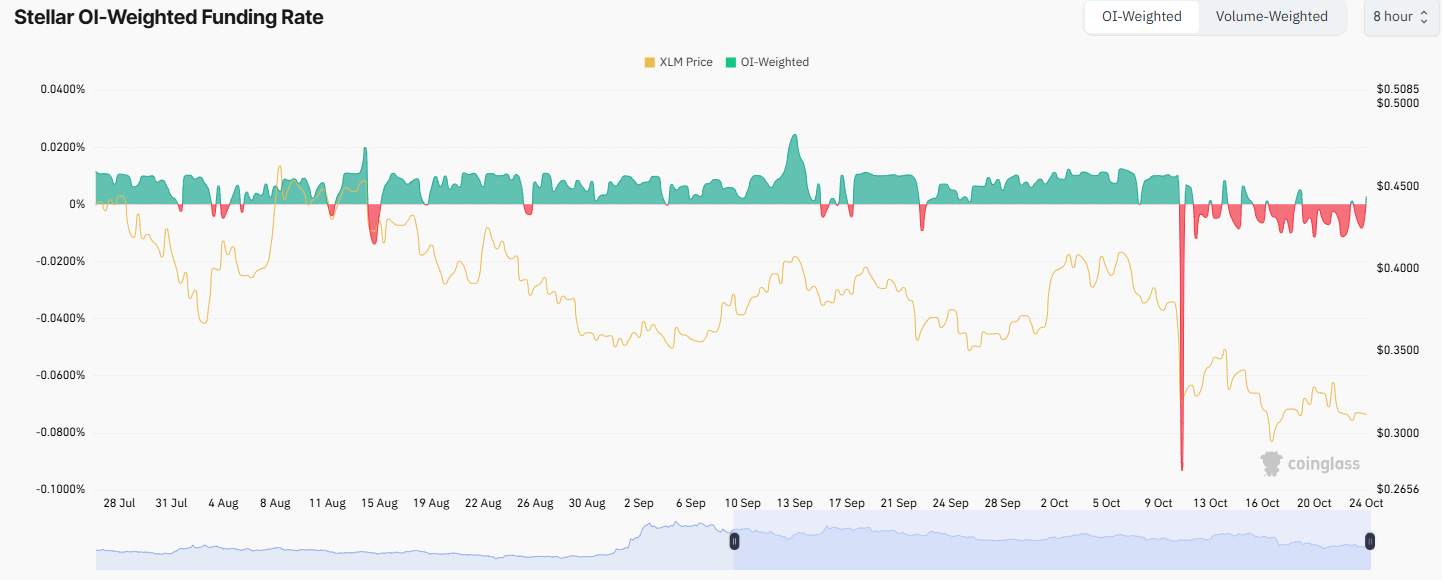

However, the overall picture is not entirely optimistic. Data from CoinGlass shows that the funding rate for XLM futures contracts has remained negative for the past two weeks, reflecting ongoing bearish sentiment among traders.

The OI-weighted funding rate has fluctuated below zero since October 11, indicating that traders are paying to maintain short positions. The drop below $0.20 has made market sentiment even more pessimistic.

While the TVL and exchange reserve data suggest long-term optimism, the negative funding rate reveals short-term selling pressure on exchanges. As a result, XLM’s price could continue to fall. Yet, for some investors, that weakness presents an opportunity.

Several investors believe that XLM below $0.20 represents an attractive entry point before a potential bull run similar to 2017.

“What’s coming next? The mass adoption rally — it’s written all over this chart. Two clean accumulation phases. Buy zone holding. The breakout won’t warn you,” investor X Finance Bull predicted.

Finally, Stellar’s vitality stems from its core upgrades and real-world use cases.

Validators on the Stellar network recently voted to upgrade the Stellar Mainnet to Protocol 24, fixing a bug in the state storage feature. At the same time, the value of real-world assets (RWA) on Stellar rose by 26.3% over the past month, reaching $638 million.