Injective blockchain has unveiled a novel tokenized index for BlackRock’s USD Institutional Digital Liquidity (BUIDL) Fund. This index enables traders to access the fund through on-chain financial instruments, marking a leap in asset tokenization.

The index introduces a perpetual market that tracks the supply of the BUIDL fund rather than its price. This approach caters to a growing demand for transparency in fund flows and provides insights into institutional crypto engagement.

Injective (INJ) Price Soars After BlackRock BUIDL Fund Announcement

Eric Chen, co-founder and CEO of Injective Labs, emphasized the index’s significance.

“For the first time, institutions and retail users alike can gain direct access to a novel RWA offering that tracks the actual fund spearheaded by BlackRock,” Eric Chen, CEO of Injective Labs, said.

The introduction of the BUIDL index has also positively influenced Injective’s native token, INJ, which immediately surged 14% after the index’s launch. As of writing, the INJ price is up by around 10.80%, trading at $17.18.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

The BUIDL index operates on Injective’s decentralized exchanges, such as Helix, where traders can use leverage to take long or short positions on the index. Its price is adjusted based on changes in the supply of BUIDL tokens, using a 1-hour time-weighted average price (TWAP) to reduce volatility from significant token movements.

This development expands the accessibility of the BUIDL fund. Earlier, it was an institutional investment product, which required a minimum of $5 million. As a result, only 18 BUIDL token-holders exist, with the largest owning more than 33% of the fund, valued at about $178 million.

However, now, a broader audience can access the BUIDL index with entry points as low as $1. This shift aims to democratize access to tokenized assets, potentially reshaping retail investor engagement.

As of early September, the BUIDL fund boasts a market capitalization of over $517 million. Complementing this, the fund recorded a $2.1 million dividend payout in July, marking a record monthly high.

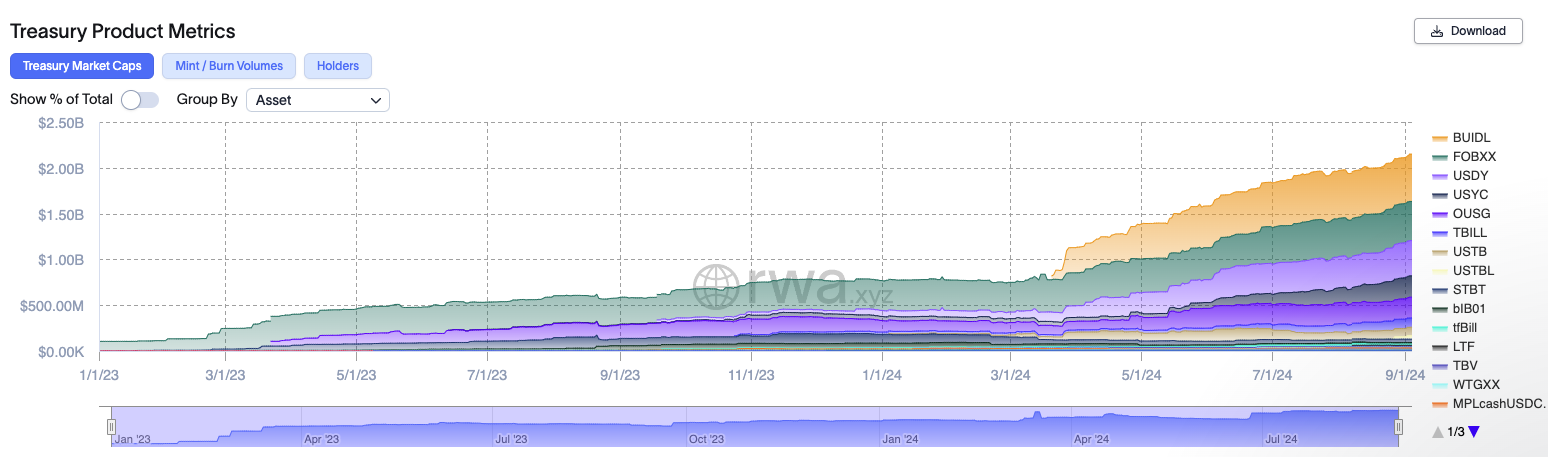

Asset tokenization, particularly of US treasuries through platforms like BlackRock’s BUIDL and Franklin Templeton’s FOBXX, contributes significantly to the market, amassing a combined value of $2.15 billion.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

This trend indicates a strong interest in real-world asset markets and positions the BUIDL fund as a crucial indicator of institutional sentiment toward cryptocurrencies.