The crypto industry needs friends in high places. Including government, banks, corporations, and, not least, Big Law. It also needs more clout with regard to rulemaking. A prominent lawyer working in the trenches of the digital asset markets thinks that, when it comes to regulation, people who understand how crypto works should be in the driver’s seat. The reaction to recent scandals is also misinformed, the lawyer believes. There is an acute need for smarter, not more, regulation.

Claire Cummings is the managing partner of Cummings Pepperdine, a London law firm active at the intersection of law and finance. Her firm deals often with rulemaking coming from the Financial Conduct Authority (FCA)—the UK’s regulator of financial markets. Even today, Cummings Pepperdine is one of the few law firms in the nation, or the world, specializing in crypto and decentralized finance (DeFi). BeInCrypto interviewed Cummings to get her thoughts on crypto regulation, best practices, the fall of FTX, and how to keep digital assets safe.

Industry Wants Crypto Regulation

Cummings and her colleagues work on the front lines, helping crypto firms deal with complex FCA rules from day to day. Compliance is no easy feat. Earlier this year, the UK Treasury revealed that only 15% of crypto firms adhered to the country’s anti-money laundering and terrorist financing rules. A total of 73% of applications were withdrawn or failed on the first attempt, and only 5% passed the first time around.

Here were the lowest rates on record. Shortly after, Harriet Baldwin, chair of the Treasury Select Committee, called the industry a “Wild West.”

Unsurprisingly, Cummings believes that regulation is the toughest part of operating in the industry.

“There is no one in the crypto arena who is a grown-up and doesn’t want regulation,” she tells BeInCrypto. “But what we also want, and more importantly what the end investor needs, is regulation that works with the best interests of the end investor in mind and also provides clarity.”

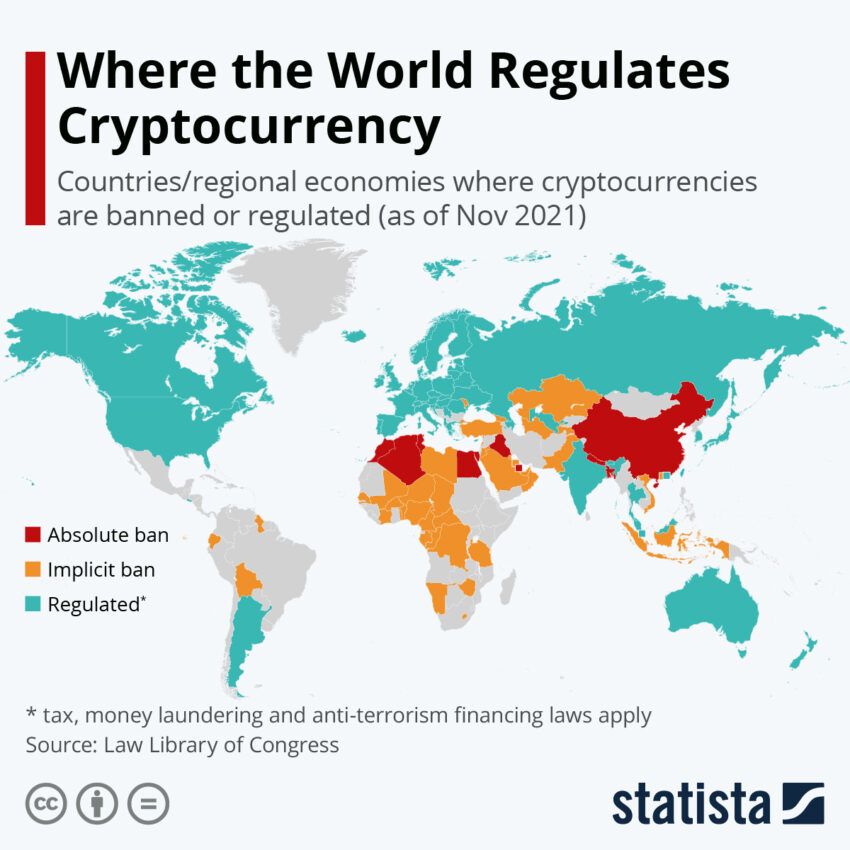

Looking across the pond, she acknowledges that the UK isn’t the only jurisdiction where it can be tough to maneuver.

“Your readers in the US will be well aware of the trying issues with the SEC,” she said. Referring to the months and years of vindictiveness under Chair Gary Gensler. On his watch, the SEC’s war on crypto has steadily escalated. This week, Gensler’s agency sued the world’s biggest crypto exchange, Binance, and its CEO.

Put the Investor First

Speaking more broadly about the approach to global regulation, Cummings said:

“What I would really like to see is a swift and meaningful international dialogue and solution in which those in the industry, both investors and providers, have the loudest voice. We’re the ones who can explain how crypto works day-to-day, in real life. So we’re the ones who are so perfectly placed to guide.”

Cummings does not hold a purist’s view. She acknowledges that the financial system does not necessarily require strict decentralization for everything. “I would urge for both centralized and de-centralized financial systems,” she said. “With both having robust regulatory cover that puts the end investor at their heart.”

Here, the reply that some will make is predictable. Surely an industry enveloped in such scandal can’t seriously hope to lead the way in its own regulation? However, Cummings is of the opinion that the outcry about the industry is “in some ways misinformed.”

“In every industry, there are bad actors,” she acknowledges. “And these latest shenanigans are shaking these baddies out of the industry.”

The recent scandals, involving the likes of FTX and Genesis, further demonstrate the need for smart regulation, she argued.

“Regulation which enables growth, job creation, and personal wealth and at the same time has the end-user’s interest in mind. In fact, I would say that you can’t have regulation [that] achieves any good without it being predicated on what the end user wants and needs. So all in all, while paying great heed to the pain caused to many people, I would say that there is room for good news,” Cummings said.

The IOSCO Report

Cummings went on to address the recent report from the International Organization of Securities Commissions (IOSCO). A global association of securities regulators of which the UK’s FCA and America’s SEC are a part. Its section on Policy Recommendations for Crypto and Digital Asset Markets Consultation Report offers 16 recommendations for the digital assets sector. Including on organizational governance and cooperating with regulators.

“I applaud IOSCO’s recommendation that there is real and meaningful cooperation between regulators across all borders,” said Cummings. “We can all play our part by liaising with IOSCO and feeding in our thoughts and ideas.”

“My starting point here is that every single person should be able to hold and control their own assets with safety,” Cummings continued. “And this must extend to their personal financial data. With this at the heart of any proposals and used as the principle against which to test every rule and regulation, we’re likely to get to the right place.”

Staying Safe Requires Cynicism

According to the Chainalysis 2023 Crypto Crime Report, crime committed with or involving cryptocurrencies and other digital assets has never been more common. However, it continues to decline as a share of on-chain activity. In a technological frontier which is notoriously complex, how do users and consumers stay safe?

“This is such a tricky one as the fraudsters are so unimaginably smart and sophisticated,” said Cummings.

“Not just that, but they seem to have a real grasp on people and how they tick. They pick up on needs, worries and vulnerabilities and offer what seems to be a clear way out,” she added.

For investors and consumers, the key here is as old as finance itself. Do your due diligence as much as you can, Cummings stressed.

“So I would say, if you’re someone who’s thinking of making an investment, talk to a lawyer or an accountant. Or the police or other crime agency. A financial advisor, your bank manager, or even someone else you know who is removed and knows what to look for, and also has a very strong dollop of cynicism.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.