India’s Yes Bank has integrated unified payments interface (UPI) compatibility on the Reserve Bank of India (RBI) Central Bank Digital Currency (CBDC) app.

“This move is set to significantly expand the reach of the Digital Rupee and underscores the Bank’s commitment towards propelling digital innovations,” it stated.

Yes Bank Strives to Achieve Seamless Digital Rupee Transactions

According to the statement, users will be able to scan any UPI QR code through the bank’s Digital Rupee app to execute transactions.

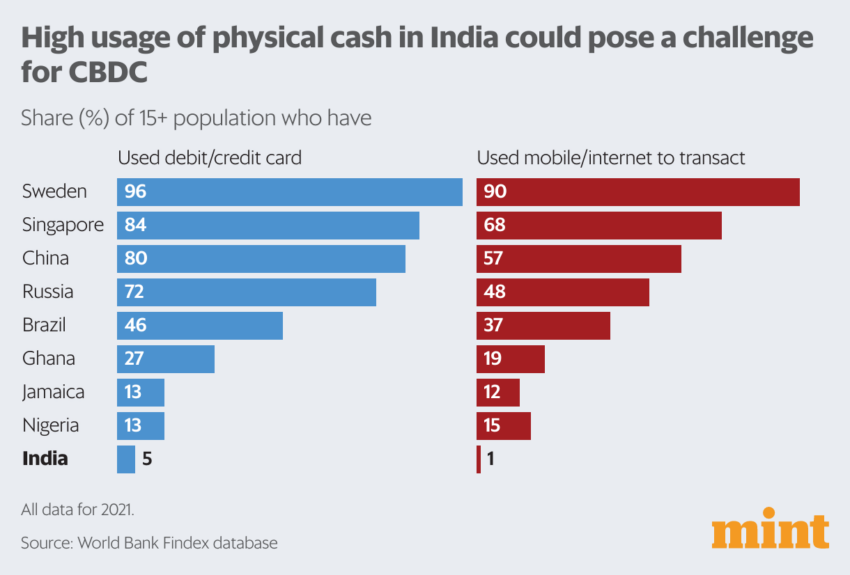

UPI transactions are extremely popular in India. A recent report from The Economic Times revealed that more than 260 million Indians have utilized the technology for payments. UPI transactions are bank-to-bank transactions. When a user opts to use UPI, it doesn’t instantly transfer money like physical cash. Instead, banks move the funds periodically through settlements.

On the other hand, the digital rupee, just like physical cash, guarantees settlement and is a government-issued legal tender. Digital currency removes the necessity for intermediary banks in transactions.

According to Yes Bank’s website, there are various ways to use digital rupee, similar to traditional fiat currency. Users can send digital rupee to another individual through a virtual payment address (VPA) or a registered phone number. They can also generate QR codes of a specified amount and share them with another individual as a “collect request.”

Yes Bank anticipates that the integration will further boost its already rapid adoption in India:

“By integrating CBDC with UPI QR codes, the e₹ gains a broader platform with the goal of becoming a staple in daily transactions.”

Ajay Rajan, Yes Bank’s Country Head of Digital and Transaction Banking, aims to make their services as straightforward as handling physical cash for users. “Our aim is to ensure that the e₹ transcends its role as just another type of currency,” Rajan stated.

The RBI launched the first retail pilot of the digital rupee in December 2022. According to the RBI, the e-rupee provides,

“Features of physical cash like trust, safety, and settlement finality. It will earn any interest, just like physical cash.”

To learn more about the Digital Rupee, read BeInCrypto’s guide: Digital Rupee (e-Rupee): A Comprehensive Guide to India’s CBDC

India’s Push For Global Crypto Rules

Recently, the Indian government has been advocating for international consensus on cryptocurrency regulations.

Ahead of the upcoming G20 Summit in Delhi, Indian Prime Minister Narendra Modi has stressed the importance of establishing consistent regulations for cryptocurrencies, drawing a parallel to global aviation standards.

Over the past year, India has conducted workshops aimed at gaining a deeper insight into the workings of cryptocurrencies. The focus has shifted from merely assessing crypto’s impact on financial stability to a broader consideration of the global economy.

Modi acknowledges that the varying international regulations in different countries pose a challenge to the global economy:

“We haven’t stopped at ideating on how we should move ahead. We have also come up with tangible details on the way ahead and how quickly we need to move. So, our road map is detailed and action-oriented.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.