A highly leveraged trader on Hyperliquid, Qwatio, found himself facing 8 consecutive liquidations after betting against the market rally.

This happened as the cryptocurrency market surged by 1.78% over the past 24 hours, fueled by a US-Vietnam trade deal. As Bitcoin (BTC) and Ethereum (ETH) rallied, Qwatio’s shorts took a hit, marking a rough day for his strategy.

Hyperliquid Trader Hit with Liquidations Amid Market Surge

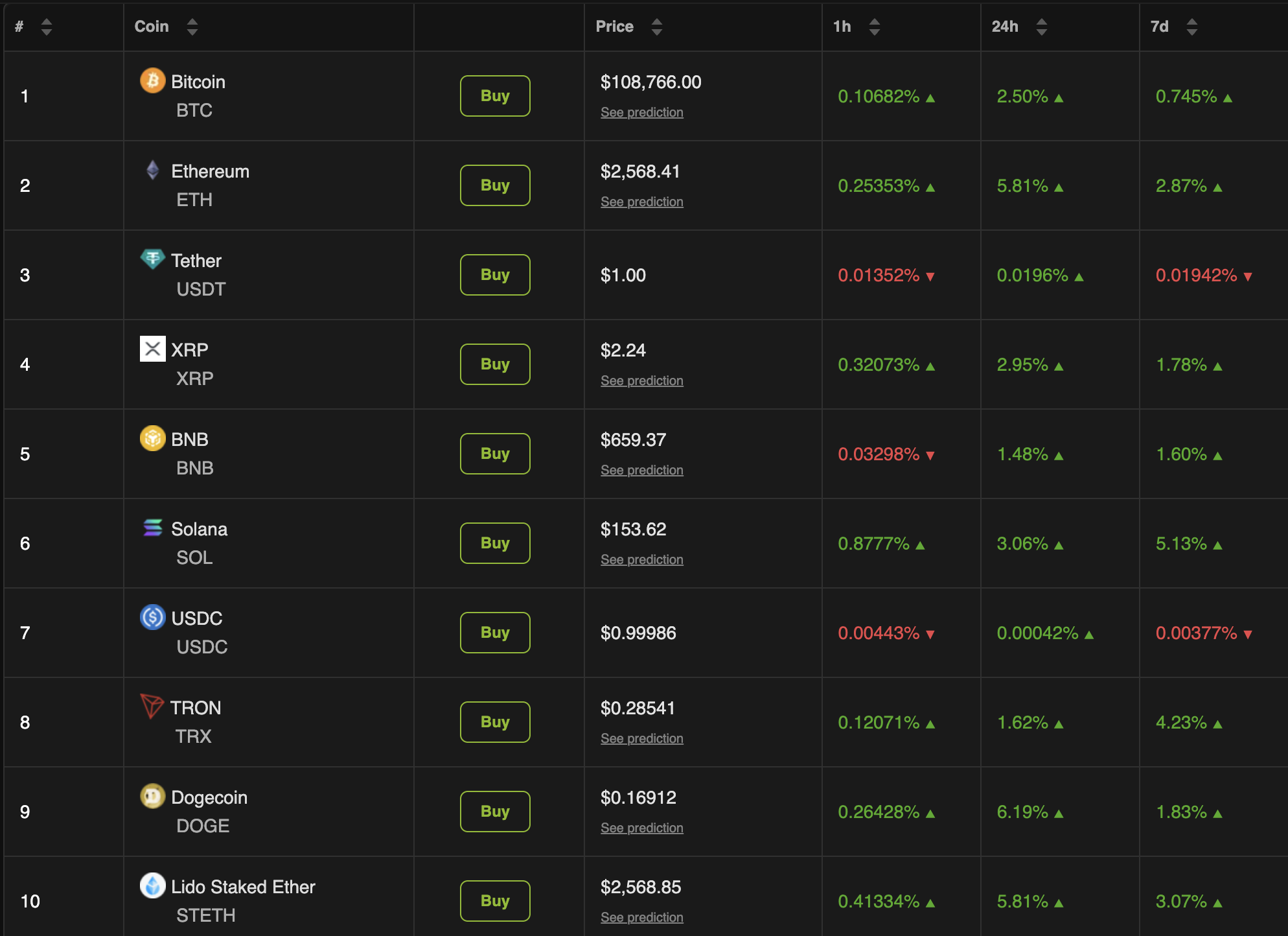

According to the latest data from BeInCrypto, the market turned green following a rally sparked by eased tariffs on Vietnamese exports. Bitcoin rose 2.5%, reaching $108,766 at press time. Ethereum saw an even bigger jump, climbing 5.8% to trade at $2,568.

However, this market surge didn’t bode well for short sellers. Qwatio failed to anticipate the rebound amid his high-leverage bets. This led to cascading liquidations that wiped out significant holdings.

Lookonchain data revealed that the trader’s leveraged positions were liquidated 8 separate times within a five-hour period. Over the past 10 days, Qwatio’s total losses have reached over $15 million.

“Gambler Qwatio caught in a savage liquidation storm! He was liquidated 8 times in 5 hours, with a total of 1,177 BTC($128.3 million) and 34,466 ETH($86.82 million) liquidated,” Lookonchain posted.

The blockchain analytics firm added that the trader uses a high-leverage strategy to bet against the market (shorts) when prices drop. However, when the market rises, his positions get liquidated.

This isn’t the first time the trader has faced massive losses. BeInCrypto has previously reported on his recurring struggles on Hyperliquid. Overall, Qwatio has faced 15 liquidations with Bitcoin and 8 with Ethereum.

Meanwhile, Qwatio wasn’t the only one facing setbacks. Lookonchain reported that another trader, 0xFa5D, experienced a significant blow, losing over $6.8 million. Yesterday, he took a long position on ETH, which cost him $3.55 million.

“But he wasn’t ready to walk away with a loss — determined to make it back. Just 2 hours later, he came back with the 15.66 million USDC and flipped short on ETH with 10x leverage,” Lookonchain added.

However, this strategy backfired. Instead of recovering his losses, the trader ended up losing an additional $3.28 million.

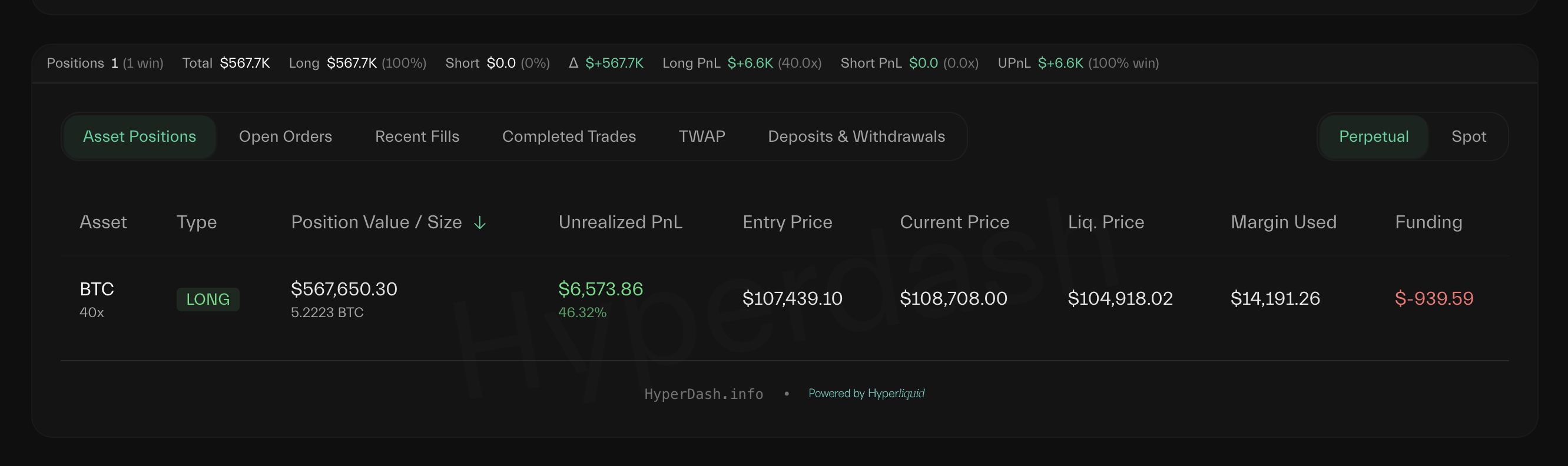

These incidents highlight the risks associated with high-leverage trading, a challenge that another Hyperliquid whale, James Wynn, knows all too well. Wynn has suffered losses exceeding $100 million. Despite this, Hyperdash data reveals that he continues to open new positions.

His latest long BTC position shows a modest unrealized profit of $6,573.8, a sharp contrast to his earlier $87 million profit, which he lost entirely.

Nonetheless, some traders have capitalized on the market opportunities. BeInCrypto highlighted a trader who turned $6,800 into $1.5 million, all while avoiding directional bets.