Cardano (ADA) price action offered some respite to holders as the price broke above the bearish trend line.

Cardano price action has been rather dull of late, with ADA trading at $0.3186 at press time, up just 0.74% on the day. But price is down a massive 89.81% from its Sept. 2021 all-time high.

From a technical standpoint, Cardano price had been moving in a bearish trend line for over two weeks. Although at press time, price action was starting to break free.

While ADA price-breaking the bearish trend line offered some short-term respite for holders, it is crucial for the price to establish above the $0.330 resistance level and then flip it into support.

Older ADA on the Move

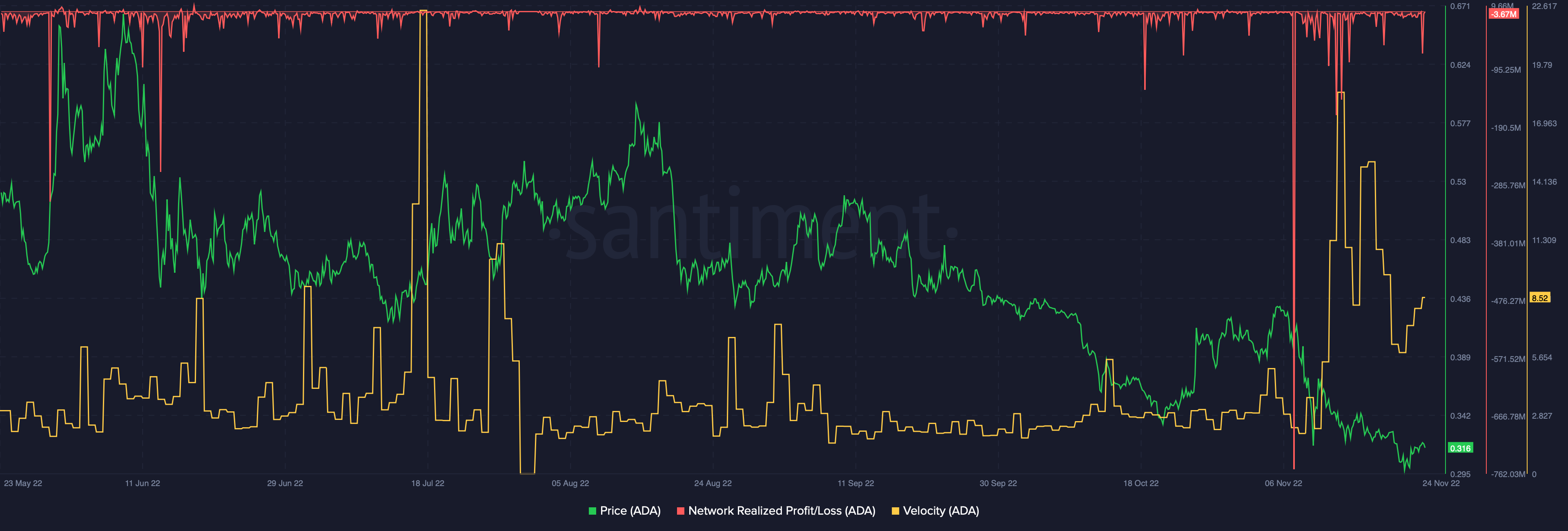

The recent short-term volatility in Cardano price seemed to put some old coins back in circulation. The Age Consumed metric for ADA highlighted that after the price action turned bearish, a notable amount of old ADA was moved.

Nov. 24 saw over 38.58 billion ADA being moved on-chain. Spikes in the Age Consumed graph signal a large number of tokens moving after being idle for an extended period of time. This could either point towards redistribution or some sort of selling.

That said, Net Realized Profit/Loss (NRPL) for ADA was largely projecting losses for holders for the most part of the past six months. The metric calculates the net profit or loss for all coins spent over the time frame considered.

Low NRPL values indicated capital outflows. However, a considerable dip in NRPL could lead to an upside reversion if bulls can place prices above the $0.330 level. That said, with velocity showing a consistent rise, it means that the coin was being used in transactions more often in the set time frame.

Cardano NFT and DeFi Space Still Dull

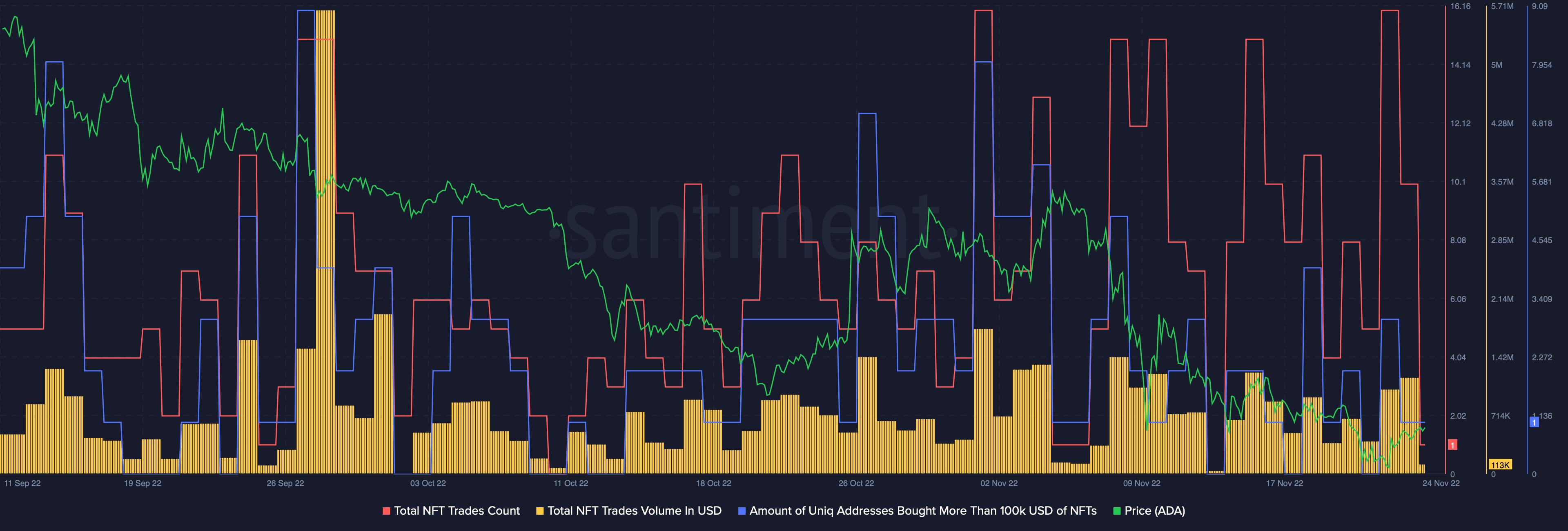

Activity in the NFT space often aids positive price momentum for the blockchain’s native token. A report at the end of Oct., suggested that Cardano was the third-largest non-fungible token (NFT) protocol by trading volume.

During that time, ADA price was appreciating. However, at the time of writing, the NFT landscape appears to have lost its sheen.

The total NFT trade volumes (USD) are much less now than in comparison to June and July 2022. While NFT trade volumes maintained above-average counts, the unique addresses that bought over $100,000 NFTs has been dropping.

Recent updates around the ecosystem, like Cardano launching its algorithmic stablecoin Djed in Jan. 2023, keep investors hooked. However, the coin’s TVL has continued to decline.

Data from DefiLlama suggested that ADA TVL oscillated around the $53.46 million mark. Its TVL was down 83% from all-time highs.

Nonetheless, the mid-short-term on-chain metrics for ADA present a slow price growth. In the case of a short-term bullish action price above $0.33 and then $0.40 would be key for reversal. However, if the ADA price falls further, Cardano could revisit the lower $0.30 mark.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.