The Lebanese economy is on the brink of collapse. Since October 2019, the Lebanese pound has lost 80% of its value.

This depreciation has caused a surge in prices of all products, dramatically reducing the purchasing power of consumers and companies. For a short time, the Lebanese pound fell so low against the dollar that it was worth less than one Satoshi.

Why did this happen? And what does it tell us about the future of cryptocurrency?

Ten years ago, one Lebanese lira was worth 0.67 bitcoin.

Today it's worth 2 satoshis.

— Saifedean Ammous (@saifedean) June 20, 2020

The Risks of Centralized Money

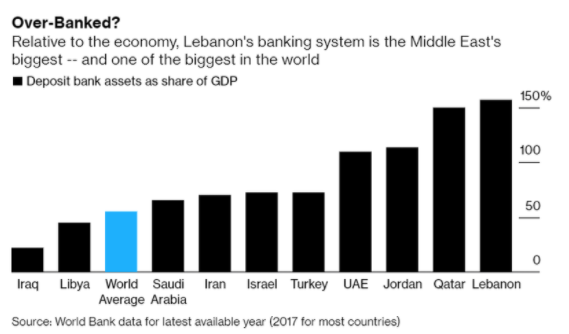

During the last two decades, Lebanon has pegged its exchange to the dollar at a fixed rate of 1507.5 pounds per US$. This allows its banking system to subsidized imports like fuel and vehicles. Artificially cheap imports enabled Lebanese consumers to buy products above their means, and the Lebanese banking system grew disproportionately.

It has become the biggest banking sector in the Middle East relative to its economy, and one of the biggest in the world. This system has decimated domestic production over the years, as local products can’t compete with bulk cheap imports.

Also consider the de facto corruption, which is not illegal according to Lebanese law. Local and foreign debts have increased to new highs, and the country sports one of the highest debt-to-gross domestic product ratios in the world: 166% at the end of Q1 2020.

In October 2019, the Lebanese central bank stopped providing dollars for most non-essential imports, excluding wheat, fuel, drugs, and medical equipment. The sudden cut of cash inflows made numerous consumers and companies turn to the black market, creating a perfect environment for a currency crisis.

A National “Ponzi Scheme”

Since October, protestors took to the streets, demanding a change in the political leadership of the country and stricter regulation against corruption. One of their targets is Prime Minister, Saad Hariri, who is in the spotlight after a plaintiff filed a lawsuit against his personal bank requesting the return of one billion dollars.

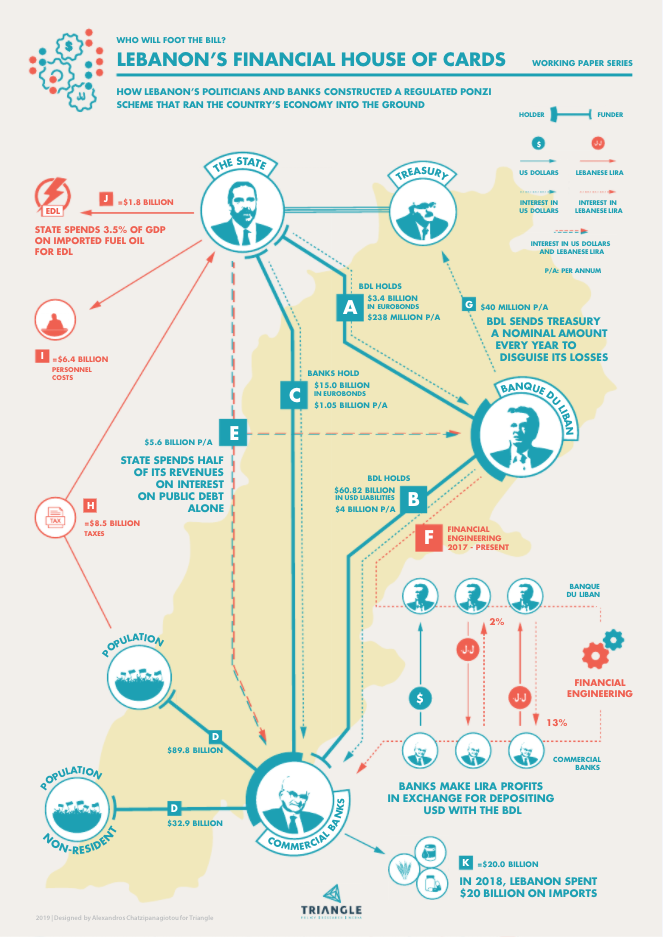

Lebanese think tank “Triangle” has accused the Lebanon central bank, Banque Du Liban (BDL), led by Riad Salameh since 1993, of implementing a regulated, nationwide Ponzi scheme. Salameh implemented a high-interest rate policy after the end of the civil war.

The core of this alleged Ponzi was to offer attractive interest rates to Lebanese banks. The central bank-issued debt in lira, which was pegged to the dollar at a fixed exchange rate. It was then paid for with public spending similar to the payments of taxes and public servant salaries.

By offering good returns on savings, Lebanese commercial banks have been able to receive large deposits of foreign currency from both ex-pats and international investors. They used the deposits to buy debt issued by the central bank.

As long as new money came into the country, the central bank was able to issue more debt. The influx of new funds fueled a boom in financial and real estate investment. And, of course, the Lebanese commercial banks experienced unprecedented growth.

Post Financial Crisis

After the Financial Crisis of 2008-09, the supply of dollars started to shrink, making it increasingly difficult to maintain the system. Between 2011 and 2016, the Lebanese central bank used a peg between the lira and the dollar. This provided high-interest rates indirectly on the dollar itself, a widely-known practice called “financial engineering.”

Long story short, commercial banks were making lira profits in exchange for depositing dollars with the Lebanese central banks. One of the tricks that make this system possible is the complete lack of records on these deposits. The public can only estimate how many dollars actually exist in the country’s reserves.

This “dollarization of the economy” caused a surge in inflation, which in turn created a wider gap between rich and poor, not to mention the degradation of Lebanon’s international financial rating score. More definitively, it has established a cycle of debt that has taken the real economy hostage.

Notice that the yearly profits of Lebanon’s four largest banks have almost doubled since the 2008 Financial Crisis, reaching $1.4 billion in 2018.

The WhatsApp Tax, Local Uprising, and COVID-19

Instead of implementing progressive taxation and removing financial engineering, which would have made the wealthiest Lebanese share the burden of the monetary crisis, the state tried to put in place regressive taxes.

The most infamous of these measures was the “Whatsapp Tax,” that aimed to tax internet-based phone calls at $0.20 a day. This was one of the igniters of the October 2019 uprising.

The rising dependence on the black market, a climate for local demonstrations, and later the grinding halt that COVID-19 brought to the global economy have all coalesced to create the perfect storm for the country.

The currency crisis has long left the realms of financial engineering and now heavily impacts the population, with small businesses unable to purchase some foreign brands. Even large wholesalers that haven’t been hit by COVID-19 are having trouble collecting enough money from supermarket chains.

According to Bloomberg, only 207 vehicles landed in the Port of Beirut in April 2020, compared with 3,500 in the same month last year. In a desperate measure to control the parallel market, where the lira surged to 6,000 to 1 dollar on June 23rd, the central bank is setting unified rates with the exchange houses every day.

Authorities are restricting international wires and access to dollars, as well as deposit withdrawals. The current COVID-19 crisis has stopped tourism and is decimating domestic consumption. The situation is likely to deteriorate further, especially amidst the uncertainty of second coronavirus waves after summer in the northern hemisphere.

Lebanon, Corruption and the Case for Bitcoin

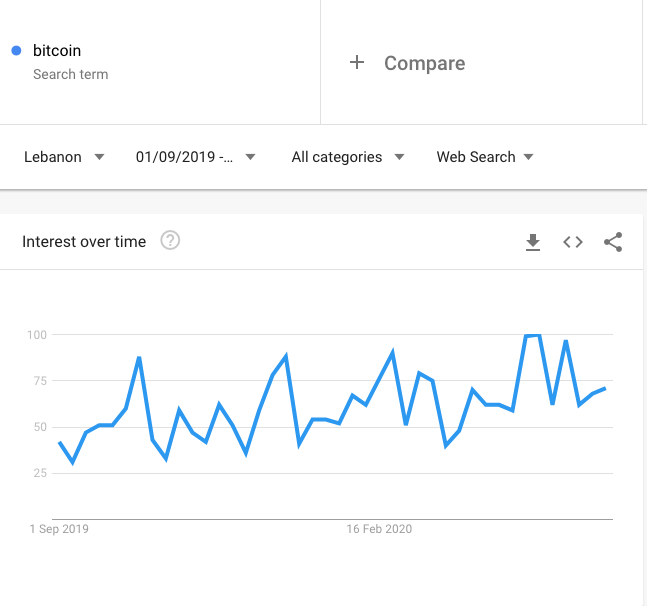

Google Trends shows a steady increase in searches from Lebanon, including “bitcoin.” Google search volume is a classic indicator of the population’s current worries. Citizens are merely trying to protect their wealth against further deterioration of the Lebanese lira.

Lebanon offers an excellent case study for cryptocurrency. A heavily intervened and complex banking system, facing accusations of corruption and mismanagement, and a population willing to gain financial independence.

We have witnessed similar scenarios during the last few years in Venezuela and Zimbabwe, where hyperinflation and monetary restriction caused a surge in cryptocurrency demand.

Bitcoin, with its promise of peer-to-peer electronic cash that belongs to its users, not to a central authority, can play a massive role in the future of Lebanon. The development of the new Decentralized Finance (DeFi) movement also provides alternatives for avoiding the corrupt banking sector.