The crypto dominance race is being commanded by the decentralized finance (DeFi) landscape, as its relative protocols and tokens have outperformed Bitcoin and its brethren so far this year. Ethereum is the foundation of this new financial landscape, and it has been pulling more and more BTC into the mix.

DeFi markets have instantly rebounded from what appeared to be the genesis of a correction. In terms of total value locked, numbers are back at an all-time high of $1.7 billion according to DeFi Pulse. The yield farming FOMO that began a couple of weeks ago has driven investors and speculators to DeFi protocols where they have been stashing their crypto collateral.

There is a good reason for this. Traditional crypto storage locations such as wallets or exchanges offer nothing in return, whereas a DeFi platform can offer impressive interest rates from around 4-6% on stablecoins and over 15% on various altcoins.

Add to that the incentive of earning tokens such as COMP or BAL, and it’s no wonder that over $750 million has flooded the space over the past month. A few other interesting developments, like the rise of tokenized Bitcoin on the Ethereum network, are constantly shifting and propelling the DeFi scene.

Bitcoin Flowing into DeFi

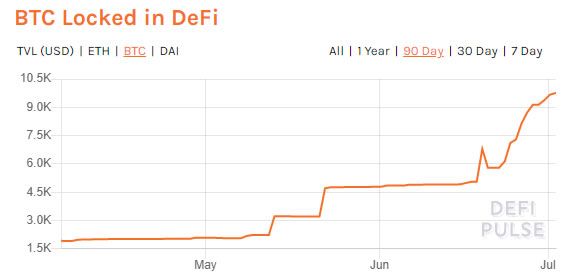

The DeFi boom over the past month has not just attracted Ethereum to the ecosystem, but the amount of Bitcoin locked up in various protocols has also skyrocketed. Over the past fortnight, the total value locked in BTC on DeFi has doubled.

The current amount of Bitcoin locked is just under 10,000 BTC which is an increase of 575% since the beginning of this year. Comparatively, the amount of ETH locked into DeFi has returned to 3 million, which is on par with what was seen at the beginning of 2020.

In her latest Defiant newsletter, industry expert Camila Russo delved deeper into this rising trend of linking Bitcoin with ERC-20 tokens for holders to access decentralized finance. With over $100 million in BTC circulating on the Ethereum network, the two assets have never been more closely tied. Although there is still a lot of tribalism in the crypto world, Russo aptly pointed out that;

Ethereum acts as a gravity well for global financial assets. And Bitcoin is the first victim.

The explosive growth on DeFi platforms offering financial incentives for providing crypto liquidity has attracted Bitcoin holders to this new digital honeypot. Simply HODLing BTC is not enough any longer, and savvy investors are looking for further gains by migrating their Bitcoin onto Ethereum to capitalize on the ever-increasing earning opportunities in DeFi.

This is achieved by depositing BTC in return for ERC-20 tokens that are effectively pegged to the underlying asset. Wrapped BTC (wBTC) is one method of tokenizing the king of crypto. Simply put, it is an ERC-20 token that is equivalent to one BTC. Being an ERC-20 token makes the transfer of wBTC faster than normal Bitcoin, with the added advantage that it can be integrated into the world of Ethereum wallets, dApps, smart contracts, and in this case, DeFi.

There are other tokenized versions of Bitcoin such as renBTC which went live on the Ethereum network in late-May this year. It works using a versatile, decentralized, trustless, and permissionless custodian through a protocol called RenVM. The project medium explains the operation in more detail:

You give BTC to RenVM, it holds that BTC, and it mints that BTC as an ERC20 (a.k.a. renBTC) on Ethereum with 1:1 ratio to ensure your renBTC is always backed by the same amount of BTC.

Ethereum’s Gravity Well

The trend has been termed an ‘Ethereum gravity well,’ and Compound Finance has attracted the most Bitcoin in recent weeks. This has been largely catalyzed by the launch of the COMP token distribution which began on June 15. Within two days, COMP became the first DeFi unicorn with a $1B+ market capitalization.

According to DeFi Pulse, BTC started entering the Compound protocol on June 18, when levels were at a paltry 173 BTC locked. Today, that figure is 2,578 BTC representing a gain of almost 1,400%.

The original catalyst for Bitcoin on Ethereum was MakerDAO, which added wBTC as collateral in May. The Defiant added that the amount locked in Maker flatlined as wBTC reached its debt ceiling of 10 million circulating DAI.

Balancer has provided another boost to Bitcoin collateral in the DeFi ecosystem. Another token distribution mechanism created more liquidity farming options which drew in more crypto collateral, propelling the platform up the charts in terms of total value locked.

DeFi Pulse has found that the amount of BTC locked into Balancer surged from around 25 at the beginning to June, to 1,657 BTC today.

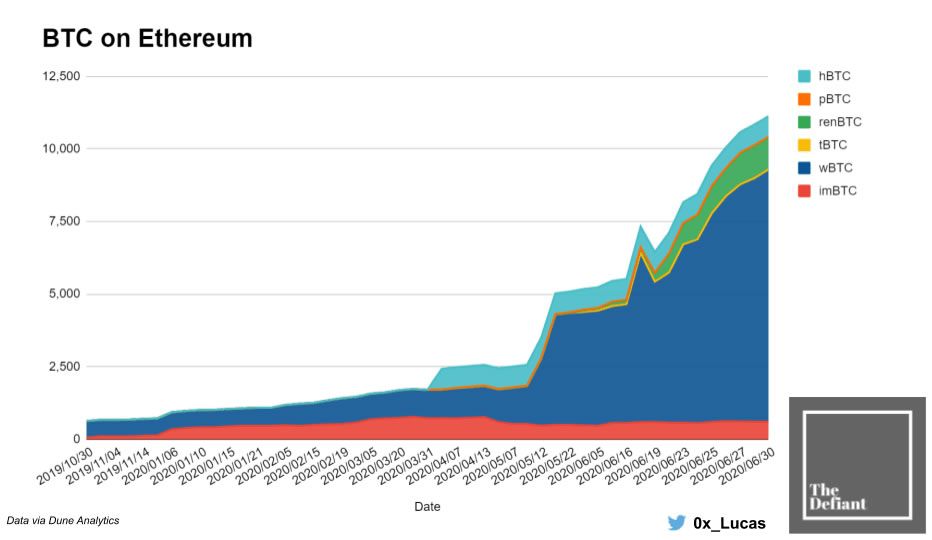

Lucas Campbell [@0x_Lucas] included this chart depicting the amount of Bitcoin that is now tokenized in various formats on the Ethereum network:

There are several flavors of tokenized Bitcoin as illustrated above. In addition to wBTC, the dominant player with around 78% of all BTC on Ethereum, and renBTC, is sBTC, Synthetix’s version of BTC collateralized by SNX.

The research concluded that the common theme for this trend has been liquidity farming:

People simply can’t resist using their otherwise idle BTC to earn the astronomical rewards that typically range between 30% – 100% APY.

The potential for BTC in DeFi is enormous and we’ve only just scratched the surface. The amount of Bitcoin on Ethereum has surged in the past month, and if DeFi continues with this growth momentum, that quantity is likely to increase. This is ultimately bullish for Ethereum as the foundation of this embryonic financial landscape.

Unfortunately at the moment, Ethereum is still in the digital doldrums in terms of price. ETH prices are lulling at around $230 today, down over 7% since the same time last month. Ethereum prices have been range-bound since the end of May and, aside from a little spurt in mid-February, have done very little in 2020.