On April 9, 2025, the US Senate confirmed Paul Atkins as the new Chair of the SEC with a majority 52–44 vote. This marked a new chapter for the crypto industry in the US.

The crypto community welcomed the news enthusiastically. Atkins is widely seen as someone who will bring transparency and support innovation—unlike the heavy-handed approach of his predecessor, Gary Gensler.

SponsoredPaul Atkins Will Bring Clarity and New Direction to the US Crypto Industry

In Wednesday’s episode of the Crypto in America podcast, Republican Congressman Tom Emmer—House Majority Whip and Co-Chair of the Congressional Crypto Caucus—shared his optimistic expectations for Atkins’ role in reshaping crypto policy.

Emmer expressed strong confidence that Paul Atkins will steer the SEC back to its core mission: ensuring that all Americans have access to the world’s greatest financial markets, including digital assets.

“I think Paul Atkins will bring the clarity and certainty that we need. I’ve been saying for over nine years, we need to understand what is currency, what is security, and what is a commodity. I’m sick and tired of hearing about the case law and that, oh well, you know, the attorneys, the courts—why are we doing that? We’re Congress. Why don’t we act? And I think it’ll start with the new SEC Chair, but he will give us direction much like Trump is doing with executive orders.” Emmer said.

This statement reflects the long-standing demand from the crypto industry for a clear legal framework.

Paul Atkins is well-acquainted with the SEC and the financial sector. He served as an SEC Commissioner from 2002 to 2008 under President George W. Bush. During that time, Atkins gained recognition for his pro-free market stance and efforts to reduce regulatory burdens.

After his tenure at the SEC, Atkins founded Patomak Global Partners, a consulting firm that helps crypto companies navigate complex regulatory frameworks.

Notably, since 2017, he has served as Co-Chair of the Token Alliance, an initiative of the Digital Chamber of Commerce, where he has led efforts to develop best practices for the issuance and trading of digital assets.

Sponsored SponsoredAtkins’ career demonstrates a deep understanding of the intersection between technology and finance. Emmer expects him to adopt a “light-touch” approach—one that focuses on supporting innovation rather than stifling it.

“I think he’s gonna make sure that that’s the SEC that we believe it should be. Gary Gensler took it off mission. What it’s supposed to do is make sure that every single American has access to the greatest financial markets on the face of the planet. And what Gary Gensler was doing was saying, well, if you’re traditional finance, you can have access. But if you’re this new digital stuff, this is bad. We’re gonna make sure that we stop you from doing anything.” Emmer said.

Emmer added that this shift in leadership could pave the way for critical legislation like the FIT 21 Act, which passed the House in May 2024 to provide clear rules for digital assets.

With support from Atkins and the Trump administration—who had pledged to make America the “crypto capital of the world”—Emmer believes Congress can soon codify these reforms into law, creating a lasting impact on the market.

SponsoredCriticism of Gary Gensler: A Legacy of Obstruction

In contrast to his optimism about Atkins, Emmer did not hesitate to criticize Gary Gensler, saying that he had set “a pretty low bar” for the SEC.

“We need to have clarity and certainty in the system so investors, entrepreneurs, can, you know, take risk and innovate. And what was Gary Gensler doing? He was stopping all of that. He was telling people, my door is open. Bring any idea you got, we’re happy to talk to you about it. Well, if you were naive enough to do that, he usually sued you, or he sent you a letter that you’re under investigation afterward.” Emmer criticized.

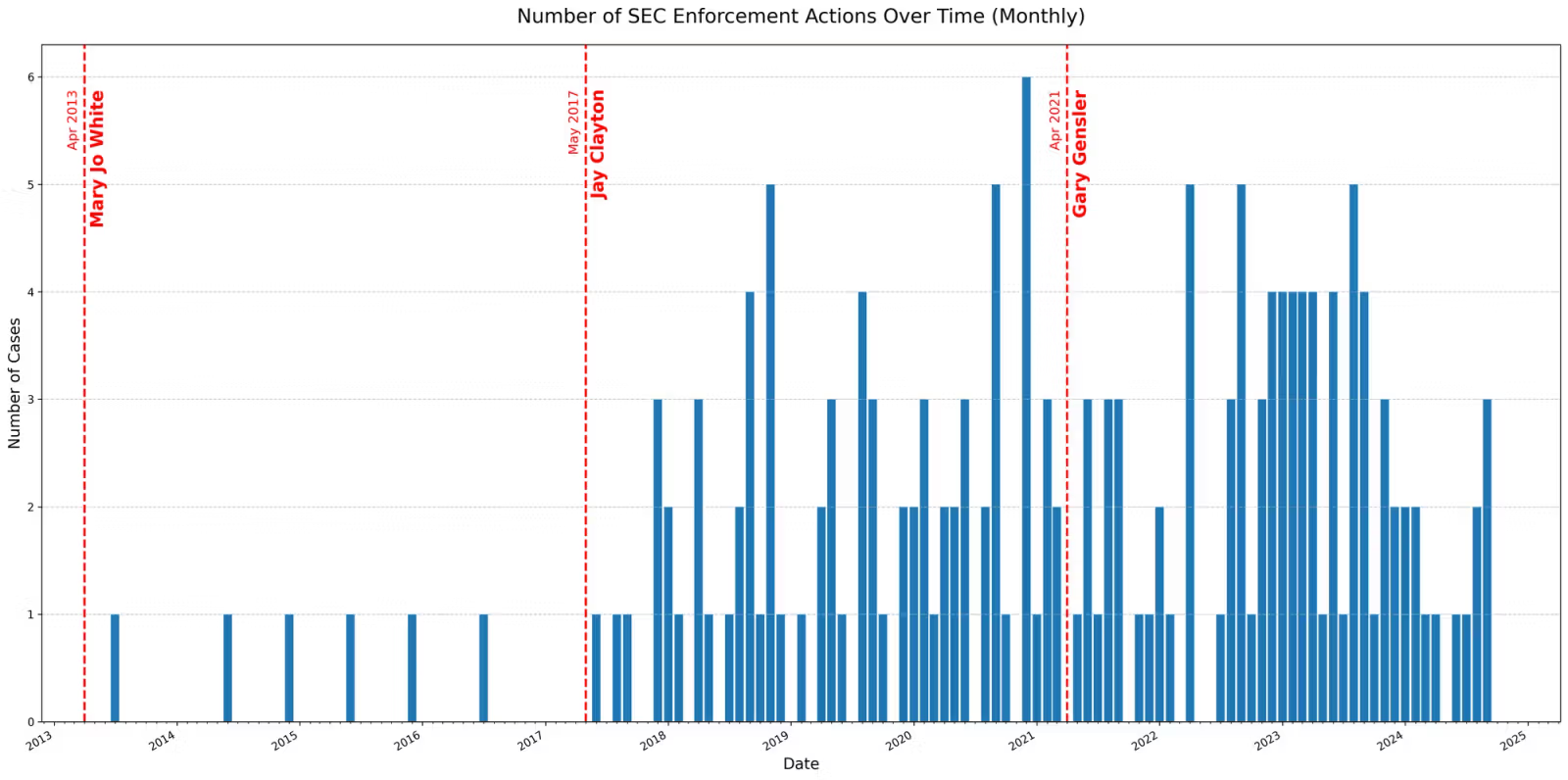

According to a report by Paradigm, since the SEC’s first crypto-related enforcement in 2015, the agency has taken action against 171 projects and individuals.

These actions spanned three presidential terms and three confirmed SEC chairs. Nearly half of them—88 cases—occurred under Gensler’s leadership.

Emmer also pointed out a striking contradiction in Gensler’s approach to meme coins, often criticized as vehicles for fraud.

Sponsored Sponsored“I heard a lot of complaints about meme coins yesterday during the hearing… But you realize Gary Gensler is the one that said, this is what we could use meme coins for. He’s the one that actually empowered the creation of meme coins the way we see it right now… If you don’t like it, stop complaining about it, and let’s figure out how we can put some guardrails on that.” Emmer revealed.

His remarks emphasized Gensler’s failure to provide guidance—instead choosing to criticize and punish. With Atkins, Emmer hopes to reverse that trend. He envisions an SEC that doesn’t just enforce but enables the crypto industry to grow within the United States.

A New Era for Crypto Policy

According to Tom Emmer, Paul Atkins’ appointment is more than a change in leadership. It’s an opportunity to reset crypto policy in America. Atkins could be the catalyst for Congress to turn reforms into reality—and, more importantly, to keep crypto businesses in the US rather than driving them overseas.

With a clear and supportive approach, Atkins could transform the SEC into an agency that champions the digital financial future rather than blocking it.

If successful, the crypto industry may be entering a new era of unprecedented growth under his leadership.