In this article, we will take a look at the BTC.D rate and attempt to determine where it will head to next.$BTC Dominance

— BillGK (@BillGK_Crypto) April 15, 2020

Consolidating below key W/D3 area after bearish retest.

Overall structure since high remains bearish (bullish $alts) but considering $BTC spot, continue conservative sizing.

Reclaim D3 level marked = risk off immediate term. Nice confluence w/ $ETH atm too pic.twitter.com/Lms5VYQDBY

Long-Term Outlook

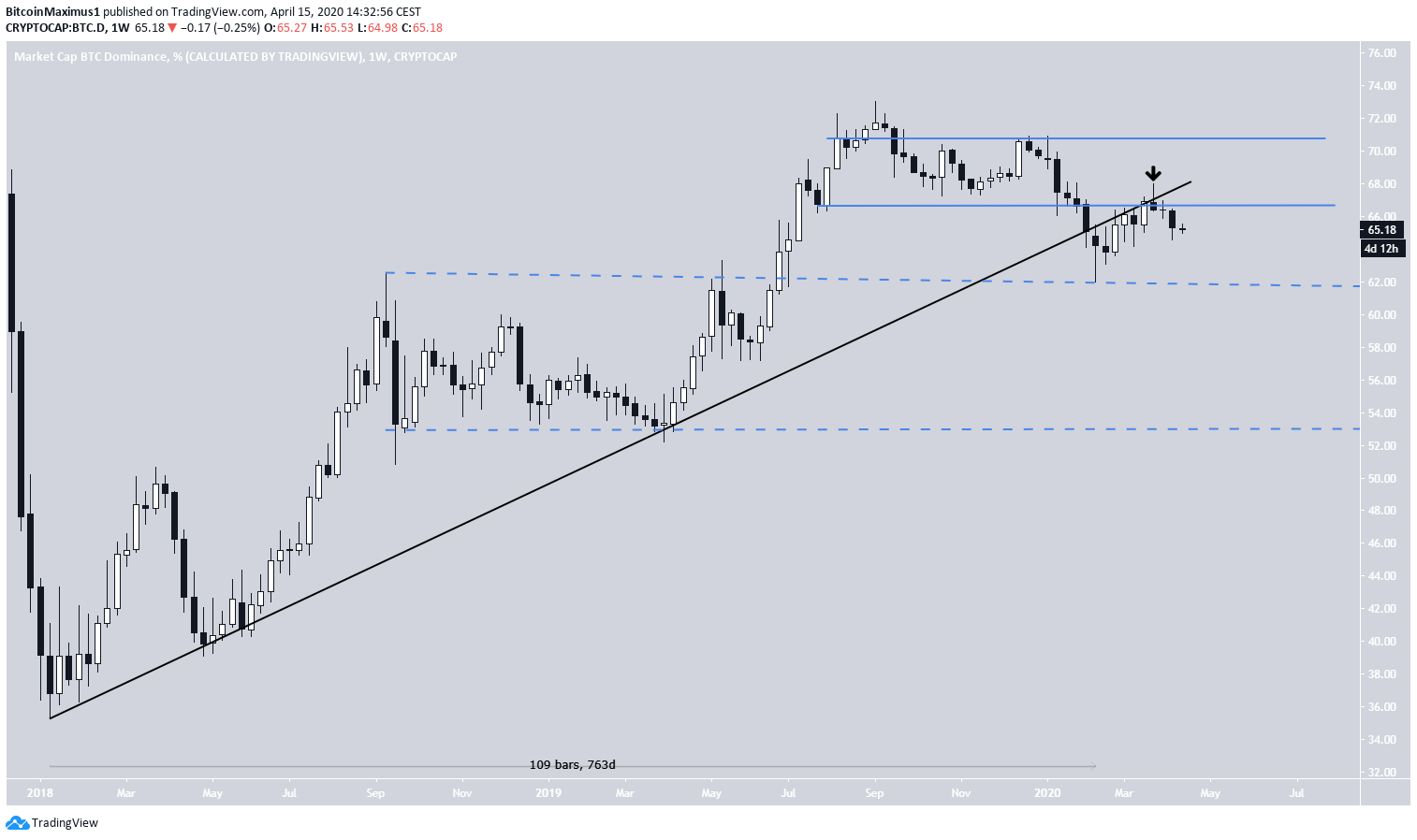

During the second week of January, the Bitcoin dominance rate broke down from an ascending support line that previously had been in place for 763 days. This occurred during the second week of January. Afterwards, the price validated the line as resistance before decreasing once more. Using the closing prices in the weekly time-frame, two main trading ranges are revealed. The upper range has support and resistance at 67.7% and 70.7%, respectively, while the lower one, which is much bigger, has a range between 53% to 62%. At the time of writing, the price was stuck in a limbo between these two ranges, having been rejected on its attempt to enter the upper one. If it were to decrease below the resistance of the lower range at 62%, it could indicate that it is back in its old trading range and continue its descent towards 53%.

Recent Rejection

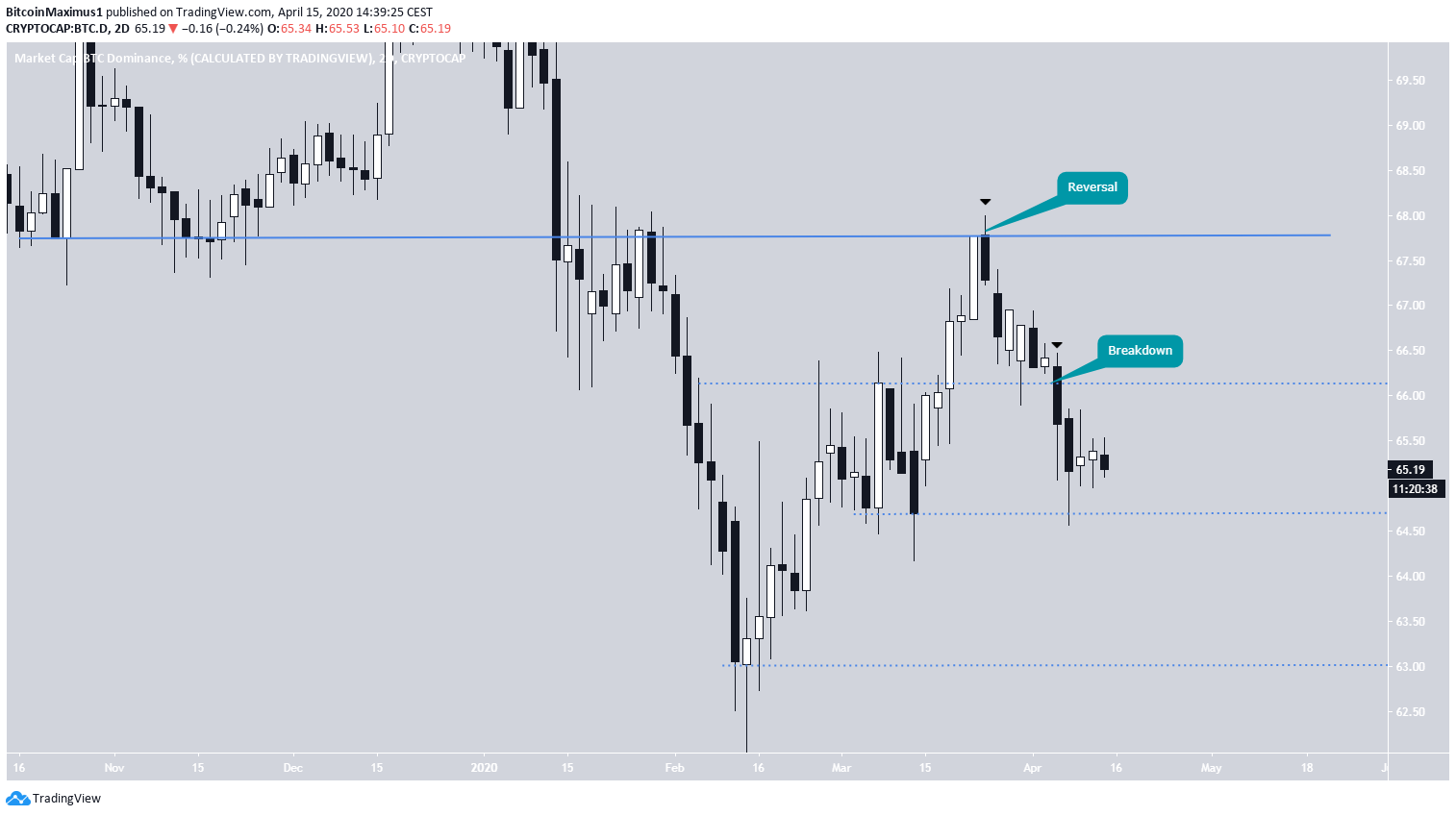

In the daily level, we can see different support and resistance levels. The price is now trading inside a range between 63% and 66.5%, currently being very close to its midpoint. When attempting to determine the direction of the trend, there are two dates that stand out as more significant than the others: First, the March 25 rejection was a catalyst for a trend reversal. Secondly, the April 6 breakdown that caused the price to fall back within the range.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.