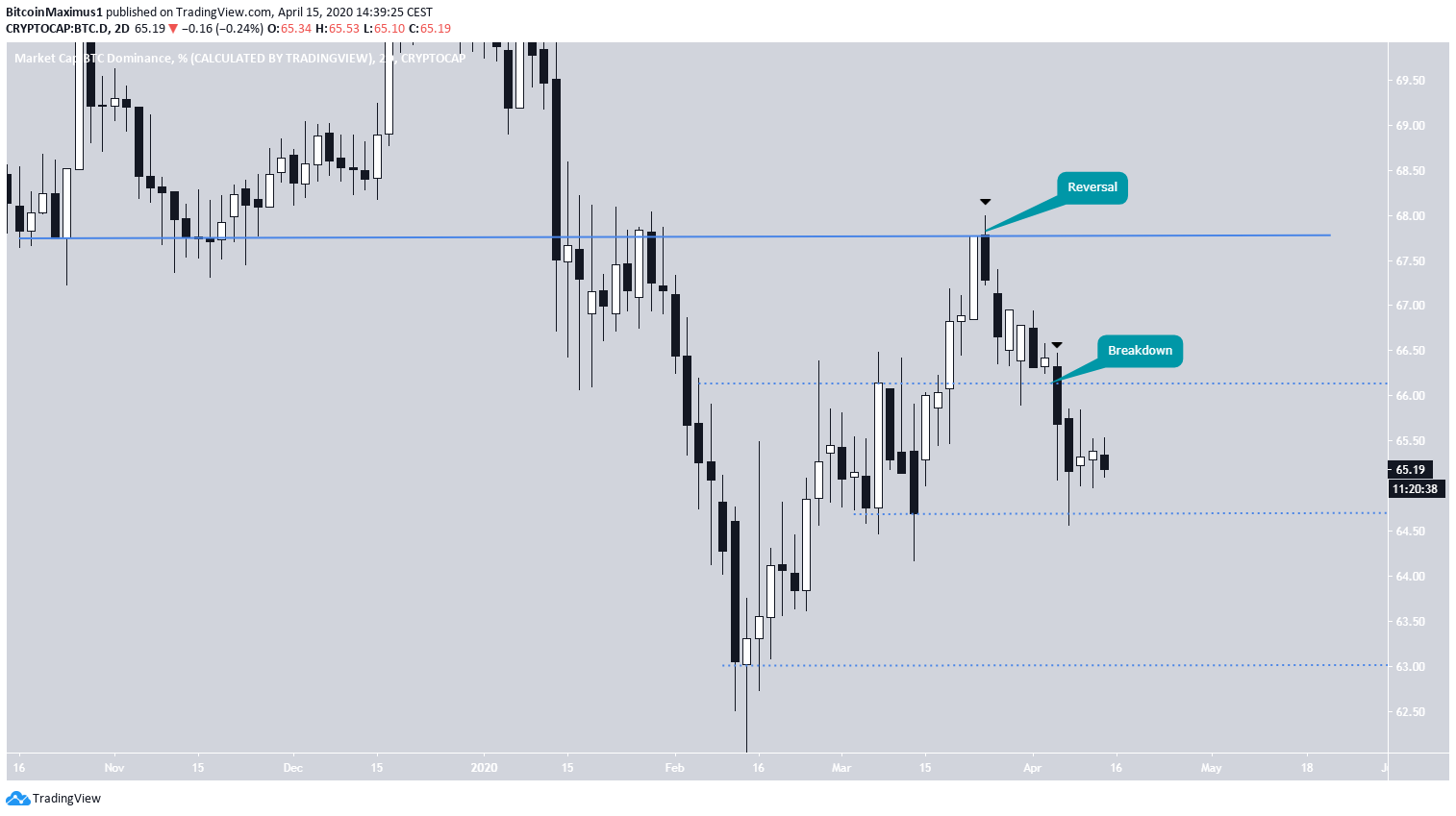

On March 25, the Bitcoin dominance rate reached a high of 67.99%. It has been decreasing ever since. Interestingly, the ETH/BTC pair reached a low on the same date and has been increasing ever since.

Bitcoin and altcoin trader @BillGK_Crypto tweeted a BTC dominance chart (BTC.D) that shows the price having fallen below an important support level. Until it reclaims it, he believes altcoins will go up and has used the price of Ethereum as an example to show what happens when there is a decrease in the BTC.D rate.

$BTC Dominance

Consolidating below key W/D3 area after bearish retest.

Overall structure since high remains bearish (bullish $alts) but considering $BTC spot, continue conservative sizing.

Reclaim D3 level marked = risk off immediate term. Nice confluence w/ $ETH atm too pic.twitter.com/Lms5VYQDBY

— BillGK (@TraderBGK) April 15, 2020

In this article, we will take a look at the BTC.D rate and attempt to determine where it will head to next.

Long-Term Outlook

During the second week of January, the Bitcoin dominance rate broke down from an ascending support line that previously had been in place for 763 days. This occurred during the second week of January. Afterwards, the price validated the line as resistance before decreasing once more.

Using the closing prices in the weekly time-frame, two main trading ranges are revealed.

The upper range has support and resistance at 67.7% and 70.7%, respectively, while the lower one, which is much bigger, has a range between 53% to 62%.

At the time of writing, the price was stuck in a limbo between these two ranges, having been rejected on its attempt to enter the upper one. If it were to decrease below the resistance of the lower range at 62%, it could indicate that it is back in its old trading range and continue its descent towards 53%.

Recent Rejection

In the daily level, we can see different support and resistance levels. The price is now trading inside a range between 63% and 66.5%, currently being very close to its midpoint.

When attempting to determine the direction of the trend, there are two dates that stand out as more significant than the others:

First, the March 25 rejection was a catalyst for a trend reversal. Secondly, the April 6 breakdown that caused the price to fall back within the range.

We can see clearly an identical effect but in the opposite direction in the price of Ethereum.

On March 26, the price reversed its trend and began a gradual increase, which intensified on April 6 when the price broke out above the main resistance area, the opposite of what happened with the BTC dominance rate.

This makes sense since Ethereum is the largest altcoin ranked by its market capitalization, and an increase in its price that is larger than the increase in the price of Bitcoin is bound to have a significant effect on its dominance rate.

To conclude, the Bitcoin dominance rate has broken down below an important long-term ascending support line. While it is currently in a neutral zone, a breakdown below 62% could trigger a rapid decrease.