Cardano has experienced considerable gains in recent weeks. What catalysts could prompt a surge in the price?

A deep dive into the underlying on-chain data shows how the ongoing spike in whale activity could spur ADA into higher price levels.

DJED Stablecoin Launch Attracts Whales to the Cardano Ecosystem

ADA, the governance coin for the Cardano ecosystem, has benefited from renewed investor interest in the crypto market. On-chain data shows a spike in whale transactions while flashing green signals in other relevant metrics.

The upswing appeared to have begun on Feb.1, a day after the announcement of Cardano’s crypto-backed Djed stablecoin.

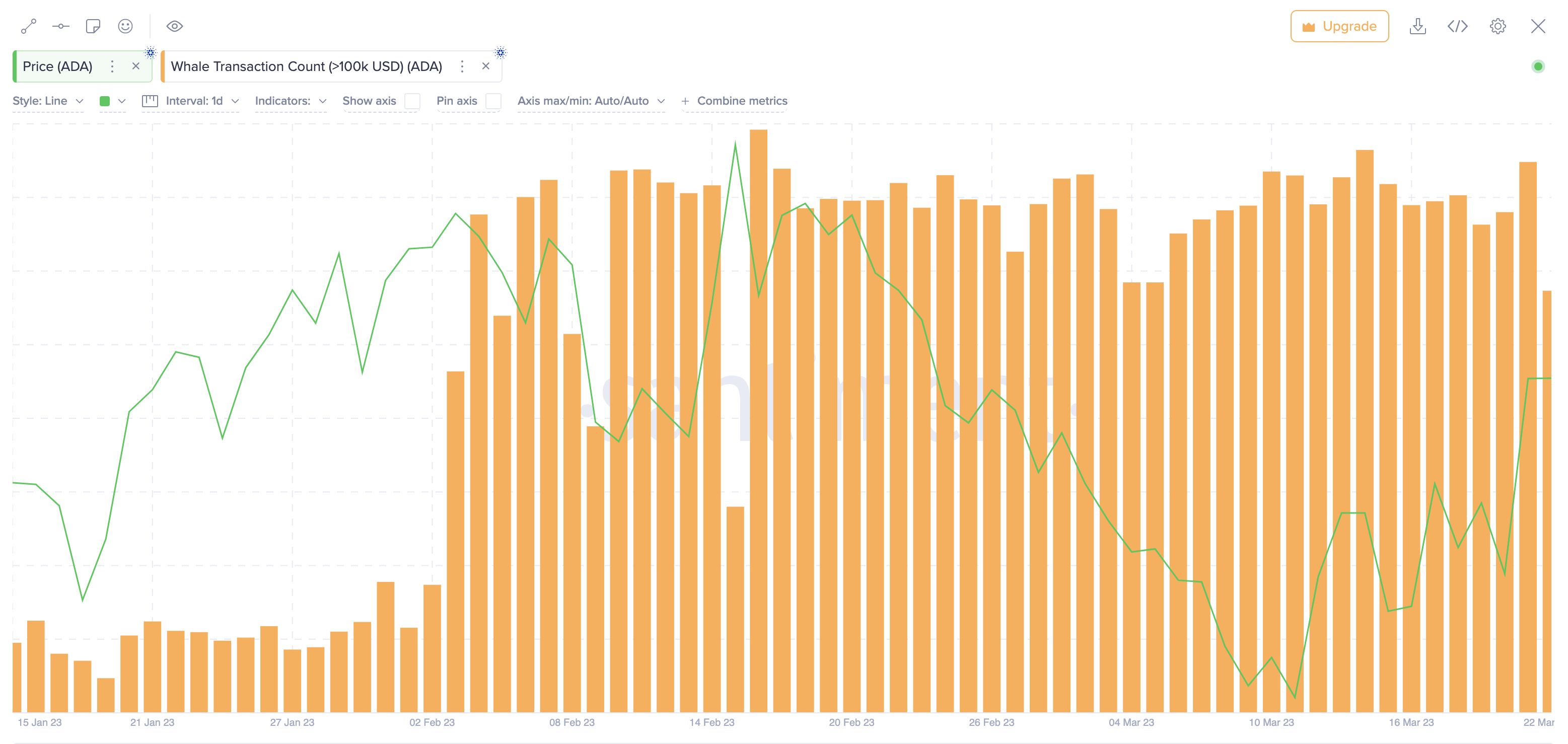

On-chain data from Santiment shows whale activity on the Cardano network has surged since the recent launch of the Djed stablecoin. The 2,117 whale transactions recorded on Mar. 21, are considerably higher than the 327 transactions reported on Feb 1.

Whale transactions measure the daily transactions surpassing the $100,000 threshold. A closer look at the previous market cycles shows how an uptrend in whale transactions has often preceded ADA price upswings.

If this condition holds, this could signal more gains for ADA holders.

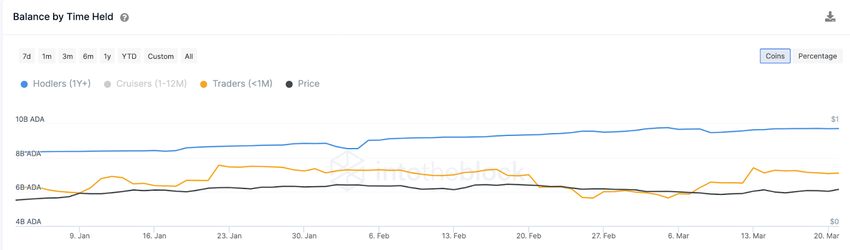

Similarly, the share of coins held by Cardano long-term holders has increased compared to short-term traders in recent weeks. IntoTheBlock reveals the wallet balance of long-term holders has increased, while the balances held by short-term traders have reduced marginally.

Between Feb. 3 and Mar. 22, the balance on long-term holders’ wallets has increased from 8.5 billion ADA to 9.7 billion ADA. During the same period, the coins held by short-term traders were reduced by nearly 200 million ADA.

An increase in the balance of long-term holders’ wallets can be considered a bullish signal because it suggests a strong conviction among crypto investors that the asset has long-term value and growth potential.

ADA Price Prediction: Eyes on $0.50

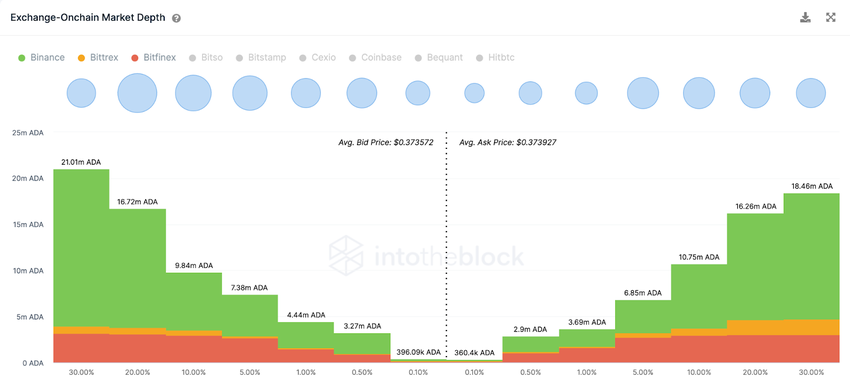

IntoTheBlock’s Exchange Market Depth chart shows that ADA could soon break above $0.40. The Market Depth spread is a segregated chart of limit orders placed by ADA traders across top exchanges. It depicts critical support and resistance points based on the current prices.

Based on the Market Depth model, Cardano will likely face minimal resistance until it reaches $0.40, where 1.6 billion ADA are up for sale. Still, if Cardano beats this resistance, it could make a 30% rally toward $0.50 where another 1 billion ADA sell-orders are open.

To invalidate this bullish stance, the price of Cardano must slip below the buy wall of 4.7 billion ADA, or around $0.30. If this support caves, the ADA price may again fall closer to $0.25.