We all want to find new crypto projects that post incredible gains – but how? Here we look at the token metrics for newly listed coins and how to search for a specific price movement after listing.

A thread by well-known trader @MacnBTC has been trending on Twitter. The thread explains in detail his strategy on finding lesser-known coins before they begin their bullish cycles and post gains of at least 100x.

Newly listed coins

The first step in finding coins that give such massive gains is to look at cryptos that are newly listed on Binance. There are three main reasons for this:

- Newly listed coins have fresh charts. So, there is no overhead resistance once they break out above their original listing price.

- Newly listed coins often have vested unlock schedules. This means that at least for the first few months of trading, early investors still have their tokens locked, in turn greatly decreasing the circulating supply.

- New narratives can easily be crafted with newly listed coins, which then greatly assist in the ensuing price increase.

So, the first step at picking a crypto project that will increase a hundredfold is to look for newly listed coins.

Crypto token metrics

The second step in finding such winners is an analysis of token metrics, which in these cases consist of:

- Seed/private round unlock schedule

- As outlined in the first section, coins with locked vesting schedules typically post significant increases due to the lack of selling pressure. This was especially visible in GMT, since all the coins of the seed/private rounds, advisors, and teams were locked for nearly a year.

- Price per token during seed/private rounds

- A large difference between the price at the initial seeding rounds and the listing price is a negative phenomenon, especially if a significant portion of the supply is unlocked. The reason for this is that if the listing price is several times higher than the early seed rounds price and investors have their tokens unlocked, it is likely that they will realize their gains and provide sell pressure.

- Investors/advisors/team

- Finally, the team behind the project and investors also play a significant role in the future price movement. It is always desirable to invest in projects which have other investors that are known to be long-term holders.

Chart readings

Finally, the price movement after the listing is extremely important. Ideally, the chart should have

- A gradual choppy decrease after listing

- Bullish cross in short-term moving averages (MAs) shortly afterwards

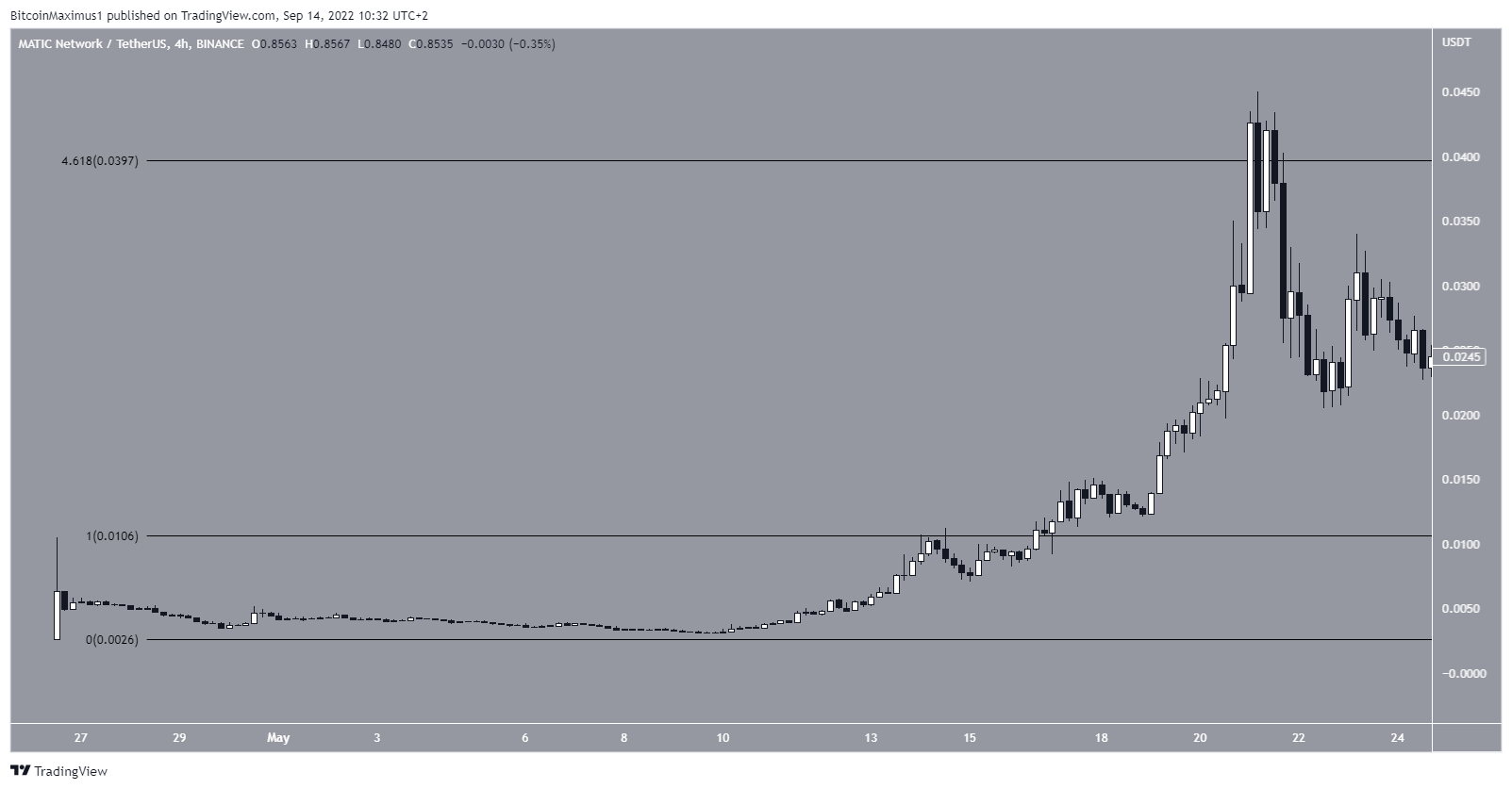

Both of these were visible in MATIC. After its listing, MATIC fell for a period of roughly 20 hours. Then, the price initiated a massive increase once the short- (red) and long-term (black) MAs made a bullish cross (green icon).

Since there is no resistance overhead once the listing price is clear, Fibonacci levels are used to determine the future resistance levels.

In the case of MATIC, the 4.61 Fib extension of the original upward movement predicted the ensuing top nearly perfectly. Therefore, it could have been used as an ideal take profit target for the first portion of the upward movement.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.