Bitcoin made a big move today, briefly hitting five figures again and breaking key technical resistances. The gains may well be halving hype-driven, but the chart setup looks good for further increases.

BTC finally broke through resistance and tapped an eleven-week high of $10,060 during today’s Asian trading session. The move added 7.5% to Bitcoin prices since yesterday’s open, further bolstering the strong bullish momentum that has lifted crypto markets this week.

The Perfect Bitcoin Set Up

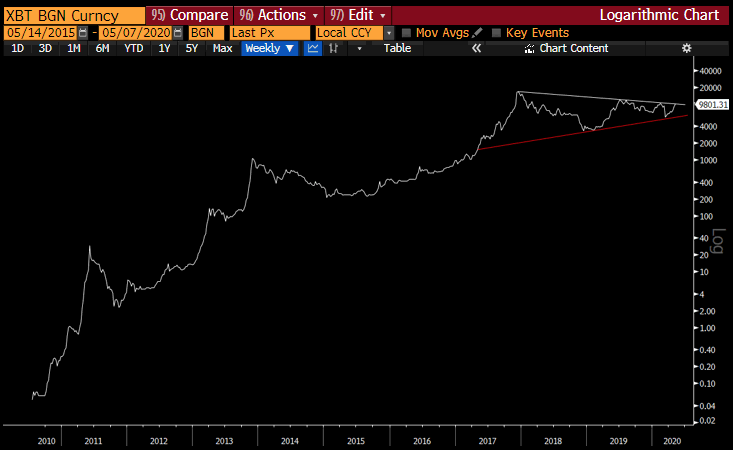

Founder and CEO of Global Macro Investor and Real Vision Group, Raoul Pal [@RaoulGMI], has been delving into some longer time frame charts in a tweet entitled ‘Bitcoin Porn and The Perfect Set-Up.’ The first chart, labeled ‘the perfect wedge,’ depicts the triangle formation from the 2017 peak to today’s levels. Following that is the same wedge shown on the logarithmic chart since Bitcoin’s inception. Pal stated;If you use classic charting techniques, it gives you a price target of around $40,000,

Well, that gives you a price object for this run potentially (key word – potentially) of $1m.

This is the one of the best set ups in any asset class I’ve ever witnessed…technical, fundamental, flow of funds and plumbing. All. Now.As a caveat, Pal concluded that horrific volatility should be expected and huge returns cannot be expected without large drawdowns.

Halving Pump or Dump?

In the short term, BTC signals such as the Relative Strength Index are flashing overbought so the correction could begin soon after the halving next week. Additionally, analysts have noted that there is still a lot of resistance at $10,500, which was also the last peak BTC made in February this year. For the uptrend to be confirmed, a higher-high above this level needs to be closed soon. Be sure to check out BeInCrypto’s in-depth video guide on everything you need to know about Bitcoin’s upcoming halving:Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored