Bitcoin’s network activity and on-chain metrics are looking healthy as the first and foremost cryptocurrency’s third block-reward halving approaches. Activity on the BTC network is also nearing its all-time high, according to industry statistics.

Bitcoin prices are battling against resistance levels following a week of consolidation. BTC’s much-anticipated block-reward halving event is now less than five days away — and both network activity and on-chain metrics are looking healthy.

According to industry metrics provider glassnode, the number of unique entities that were active either as a sender or receiver on the Bitcoin network has risen sharply. @glassnode tweeted:

“The number of active entities on the #Bitcoin network is the highest it’s been since the 2017 $BTC bull run.”

Healthy Fundamentals

The industry metric provider describes ‘entities’ as a cluster of addresses that are controlled by the same network entity — estimating them “through advanced heuristics and proprietary clustering algorithms.” The metric is essentially a measure of activity on the network, which is very loosely correlated with its price. Currently, the number of active entities has surpassed the 2019 peak — when Bitcoin prices approached $14,000 — and it is moving towards the next all-time high, which occurred in December 2017. The transaction count chart is very similar and can almost be overlaid onto this one, with glassnode reporting the current number of transactions at 316,656. This number, however, is still quite a ways off the peak number of 406,953 in December 2017. The number of active addresses has also shot up recently and is currently 937,904, according to the glassnode’s figures. It too peaked along with price two years ago at 1,190,302 active addresses.Bitcoin Hodlers & Hash Rate Growing

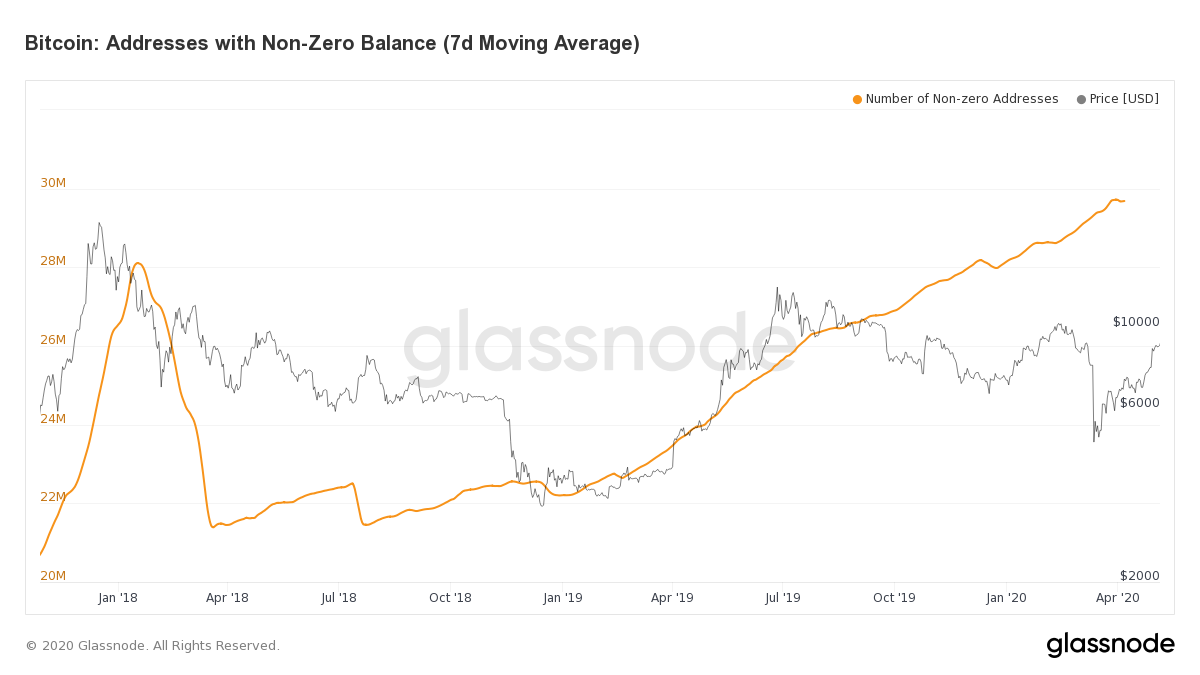

One interesting Bitcoin-specific chart is the number of addresses with a non-zero balance. This has steadily increased over the past two years, despite a prolonged bear market.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored