Bitcoin made a big move today, briefly hitting five figures again and breaking key technical resistances. The gains may well be halving hype-driven, but the chart setup looks good for further increases.

BTC finally broke through resistance and tapped an eleven-week high of $10,060 during today’s Asian trading session. The move added 7.5% to Bitcoin prices since yesterday’s open, further bolstering the strong bullish momentum that has lifted crypto markets this week.

The Perfect Bitcoin Set Up

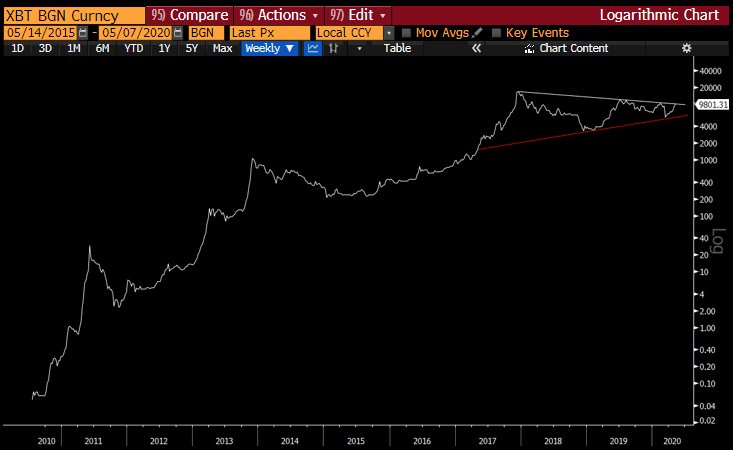

Founder and CEO of Global Macro Investor and Real Vision Group, Raoul Pal [@RaoulGMI], has been delving into some longer time frame charts in a tweet entitled ‘Bitcoin Porn and The Perfect Set-Up.’

The first chart, labeled ‘the perfect wedge,’ depicts the triangle formation from the 2017 peak to today’s levels. Following that is the same wedge shown on the logarithmic chart since Bitcoin’s inception. Pal stated;

If you use classic charting techniques, it gives you a price target of around $40,000,

Before adding on the second chart;

Well, that gives you a price object for this run potentially (key word – potentially) of $1m.

A third chart was presented with a regression channel and even greater potential gains with standard deviations.

Pal also added that today’s key break of technical resistance has vastly increased the probability of much higher prices. The stock-to-flow model backs up this prediction as the break has occurred just before the halving.

Earlier this week, Beincrypto reported that the S2F model was also recently cited by Pantera Capital CEO Dan Morehead in his prediction of $115k BTC by August of next year.

Pal continued with his narrative, adding that unprecedented global fiscal stimulus packages, quantitative easing, and mass money printing by central banks will result in fiat failing — which is what Bitcoin was ultimately designed for.

This is the one of the best set ups in any asset class I’ve ever witnessed…technical, fundamental, flow of funds and plumbing. All. Now.

As a caveat, Pal concluded that horrific volatility should be expected and huge returns cannot be expected without large drawdowns.

Halving Pump or Dump?

In the short term, BTC signals such as the Relative Strength Index are flashing overbought so the correction could begin soon after the halving next week.

Additionally, analysts have noted that there is still a lot of resistance at $10,500, which was also the last peak BTC made in February this year. For the uptrend to be confirmed, a higher-high above this level needs to be closed soon.

Be sure to check out BeInCrypto’s in-depth video guide on everything you need to know about Bitcoin’s upcoming halving: