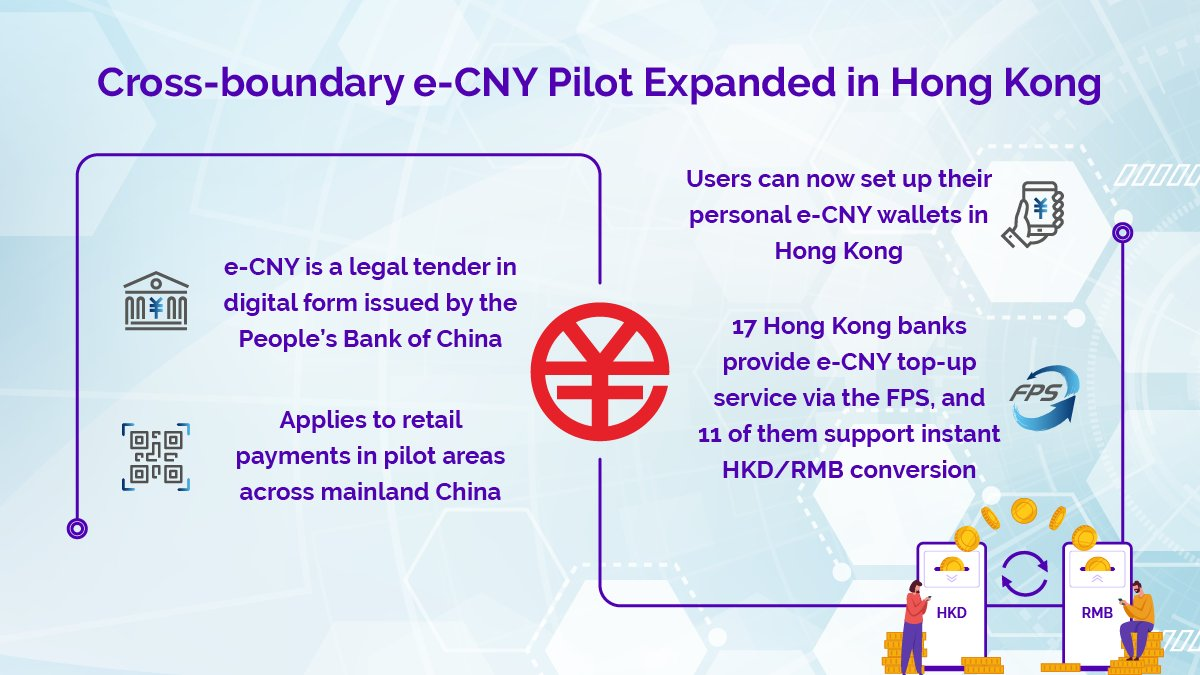

The Hong Kong Monetary Authority (HKMA) announced the acceptance of China’s digital yuan, the e-CNY, for retail transactions within Hong Kong. This initiative, backed by the Central Bank of China, marks a crucial step in integrating digital currency into everyday commerce.

Residents of Hong Kong and mainland China can now use the digital yuan for purchases at physical retail stores and select online merchants in Hong Kong. A mobile application developed by China’s central bank enables users to manage their digital yuan wallets seamlessl

Hong Kong Allows Yuan Only in Local Commerce

Despite enthusiasm for digital integration, the program maintains control over circulation by restricting cross-border transactions and peer-to-peer transfers. In Hong Kong, the operational framework for the e-CNY sets a maximum wallet balance of 10,000 yuan, with individual transactions and daily spending capped at 2,000 yuan and 5,000 yuan, respectively. These limits aim to moderate the currency’s use and prevent financial disruptions.

Expanding the digital yuan into Hong Kong aligns with broader efforts to internationalize the currency amid geopolitical tensions and competitive global financial markets. By June 2023, transactions with e-CNY reached 1.8 trillion yuan, indicating rapid adoption among the Chinese populace.

“By expanding the e-CNY pilot in Hong Kong.. users may now top up their wallets anytime, anywhere without having to open a mainland bank account, thereby facilitating merchant payments in the mainland by Hong Kong residents,” HKMA Chief Eddie Yue said.

Read more: What Is Fiat Currency? How Does It Differ From Cryptocurrency?

Currently, over 10 million merchants in 17 provinces and cities in mainland China accept the digital yuan. That demonstrates its growing acceptance of digital currencies in the region.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

While the yuan’s use in global finance is modest, its adoption in international markets reflects China’s strategic financial objectives. The HKMA, in collaboration with the People’s Bank of China, continues to explore the potential for cross-boundary e-CNY payments. This highlights its commitment to improving the digital currency’s usefulness and interoperability with existing payment systems.