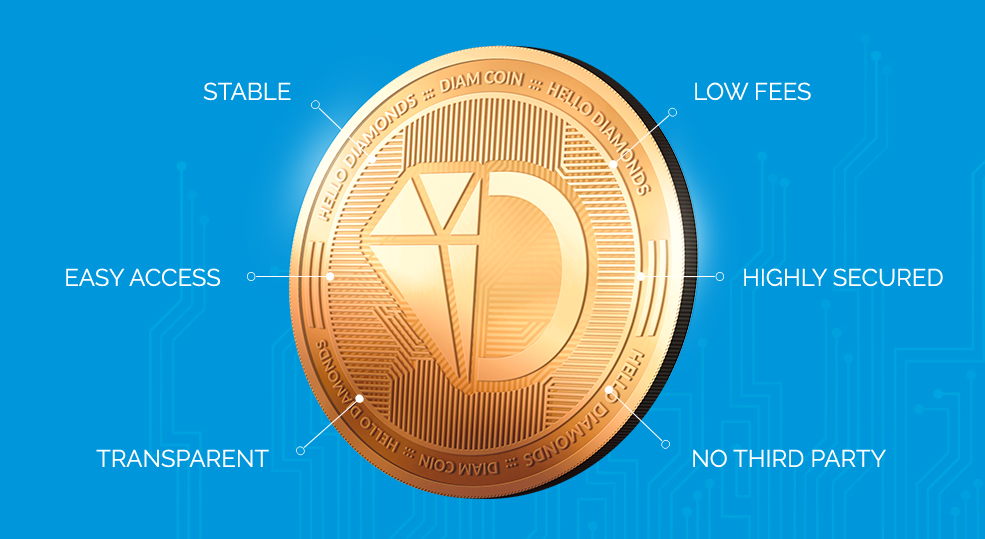

BeInCrypto recently caught up with Jeremy Dahan, CEO of Hello Diamonds, as he prepares to officially launch the platform’s Initial Exchange Offering (IEO). Hello Diamonds is currently working on issuing DiamCoin, the first cryptocurrency to be 100 percent backed by real, physical diamonds. Jeremy told us about the use cases of stablecoins, their importance for attracting new investors, and backing up cryptocurrencies with traditional assets. Here’s what he had to say!

What makes a stablecoin useful?

A stablecoin is a tool for society. It is a tool designed to transfer and store value. We might think of a stablecoin as just a crypto asset but, in fact, stablecoins are used on a daily basis around the world in the shape of national currencies — the most common one being the dollar. For the dollar, there are now many digital representations in the blockchain space, such as Tether, Paxos and GeminiUSD. Needless to say, as it happens with cryptocurrencies, governments issue their currencies with the best intentions for stability… which doesn’t always happen. I personally believe that the full potential of cryptographic stablecoins hasn’t been exploited. Stablecoins can be useful for things like buying bread, paying rent or paying employees. Companies don’t tend to use crypto for these everyday transactions since even the most famous coins tend to be speculative. Try not having a hard time paying your employees in Bitcoin and then going down 30 percent!

Can stablecoins help drive new users to the crypto market?

Major businesses will start to accept stablecoins because they are simply faster and have lower transaction fees. Then, people will also have more incentives to hold stablecoins and not go through the hassle of selling their crypto assets for traditional fiat to be held in bank accounts. The advantages of using stablecoins (such as greater speed and lower transaction costs) will inevitably change how the game is played now and drive new users to the crypto market.

How does backing a coin with assets make a difference?

Using an asset as collateral to a coin assures people of the value of that coin, as it is related to the assets stored. If the crypto market crashes, the value of the assets held does not crash with the crypto market, but they hold their value as their asset class may not be crashing at that moment. This is why it is important to select a suitable asset that is stable so that you can create a robust stablecoin.Would ‘traditional’ cryptos, such as Bitcoin, Ethereum and others, perform better if they were backed by assets?

No, speculative assets and stable assets are two different asset classes that have different purposes entirely. Bitcoin wouldn’t be what it is today, for better or worst, if it wasn’t for volatility.

If your currency is backed by diamonds, why does it remain pegged to the price of a dollar?

This is so that we can simplify the experience for our users. We want them to be able to use DiamCoin as a safe store of value, without them having to get confused or worried about what the price of one carat of a diamond is today — even if it doesn’t vary that much. Also, determining what the price of one carat of diamond is right now is not as straightforward as for an ounce of gold, since there are many factors that come at play when determining the value of every individual diamond. At Hello Diamonds, we have extensive experience in dealing with diamonds, so we can use these assets to ensure the value of our token to keep the 1:1 proportion. The benefit of such a system is that, in the case of a financial crisis, diamonds are one of the most crisis resistant-assets.

What should people know in order to trust an asset-backed coin issuer?

They should familiarize themselves with the audit process, the valuation process, and the auditing companies’ procedures. For us, as it should be for every investor, using reputable third parties and operating in a transparent manner is essential. The greatest marketing, at the end of the day, is fulfilling people’s expectations.How can DiamCoin offer more stability within the volatile crypto market than other existing stablecoins?

I think speculative assets are designed to be volatile, while stable assets are designed to be stable. They each serve different purposes but can work well in parallel. When people feel like investing, they move their value to speculative assets, if they feel like not investing and preserving the value of their finances until they do feel like investing, the can hold DiamCoin. DiamCoin can also be used for payments, therefore attracting a new market segment to crypto, as well as competition to provide payment solutions that are both stable and reliable. What do you think about stablecoins and DiamCoin? Let us know your thoughts in the comments below!Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored