Be[in]Crypto takes a look at the five cryptocurrencies that decreased the most last week, more specifically, from Aug 19 to 26.

These cryptocurrencies are:

- Gnosis (GNO) : – 10.65%

- Flow (FLOW): -9.81%

- OKB (OKB): -9.65%

- Filecoin (FIL): -7.87%

- Helium (HNT): -7.04%

GNO

GNO had been increasing alongside an ascending support line since July 14. This upward movement led to a high of $205.50 on Aug 18. However, the price was rejected by the $195 horizontal area and has been decreasing since. On Aug 20, it broke down from the ascending support line.

If the downward movement continues, the closest support area would be at $140, created by a horizontal level and the resistance line of the previous ascending parallel channel.

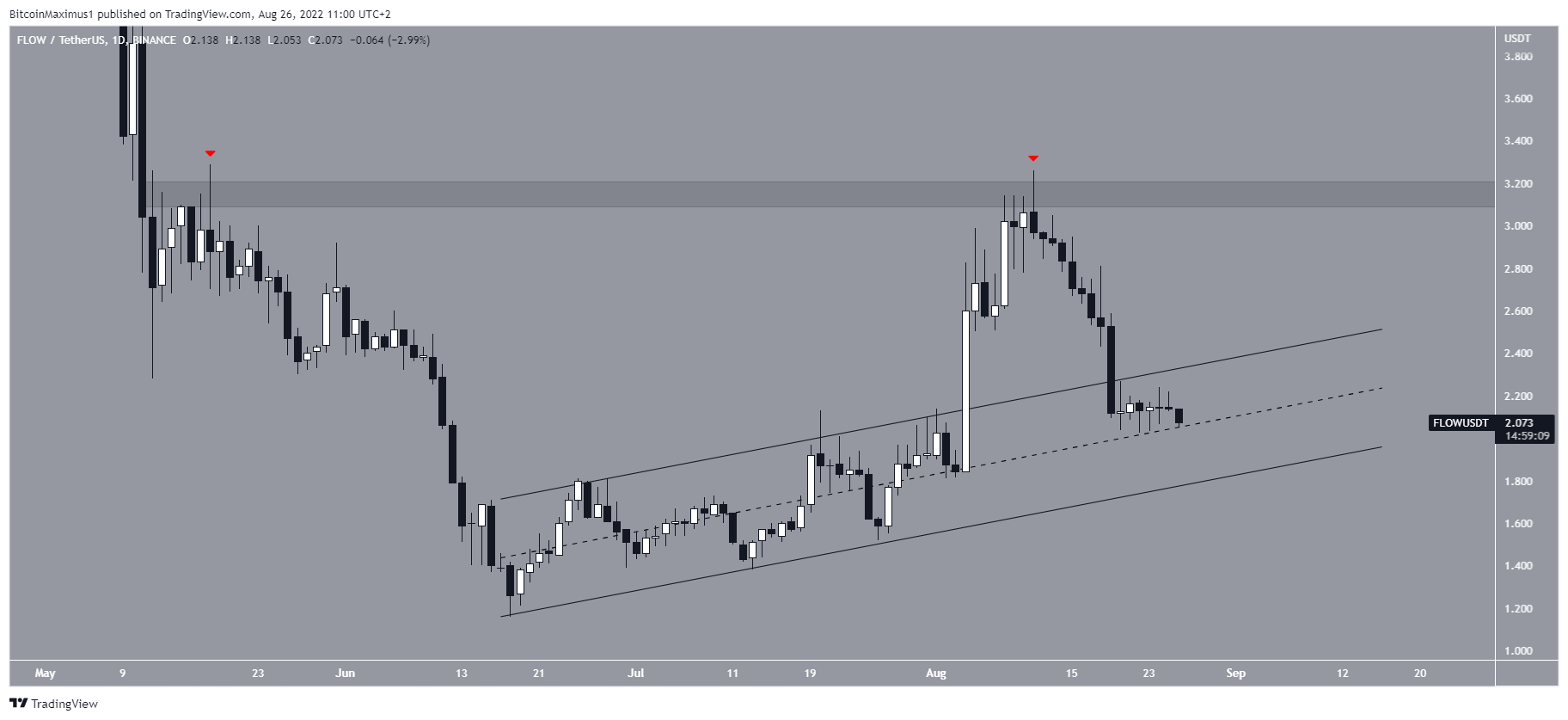

FLOW

FLOW had been increasing inside an ascending parallel channel since June 18. On Aug 4, it broke out from the channel and proceeded to reach a high of $3.25. However, it was rejected by the $3.20 horizontal resistance area (red icon) and has been falling since.

Currently, it is back in the middle of the previous channel. It is possible that the decrease is part of a fourth-wave pullback. In order for this to hold true, FLOW has to continue trading above the middle of this channel.

Conversely, a breakdown from this channel would be expected to lead to lower prices.

OKB

OKB has been moving upward since June 18. The increase resembles a five-wave upward movement and led to a high of $23 on Aug 14. OKB has been moving downward since.

It is possible that OKB has begun an A-B-C corrective structure. If so, the 0.5-0.618 Fib retracement support area at $14.75 to $16.30 would be expected to act as the bottom.

FIL

FIL has been falling since Aug 1, when it was rejected by the $11.20 horizontal resistance area (red icon). The rejection and ensuing decrease created a very long upper wick, which is considered a sign of selling pressure.

FIL has now returned to the $6.05 horizontal support area. A breakdown from this area would be expected to take the price below its June lows.

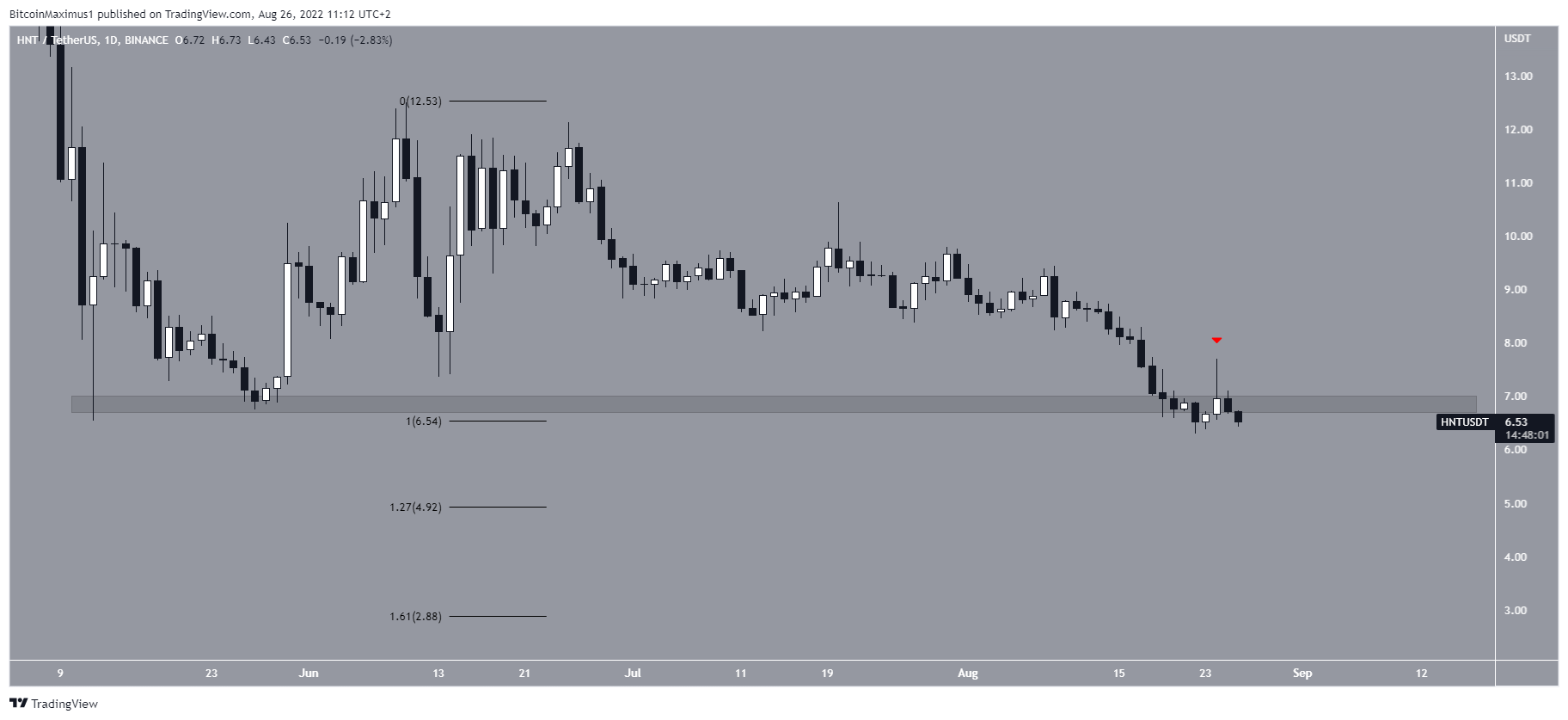

HNT

HNT has been falling since reaching a high of $12.50 on June 10.

On Aug 22, HNT fell to a new yearly low of $6.30. While it made an attempt at moving upward, it was rejected by the $6.80 resistance area (red icon) and has been falling since.

If the downward movement continues, the two closest support levels would be at $4.92 and $2.88. These levels are created by the 1.27 and 1.61 external Fib retracements of the most recent bounce.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.