Hedera (HBAR) is down 37% in the last 30 days, with its price trading below $0.30 for almost a month now. Technical indicators continue to show a bearish outlook, with the DMI revealing a lack of clear direction and weak trend strength.

The Ichimoku Cloud also points to continued downward pressure as HBAR struggles to break above key resistance levels. With its EMA lines maintaining a bearish alignment, HBAR could face further declines unless buying momentum returns.

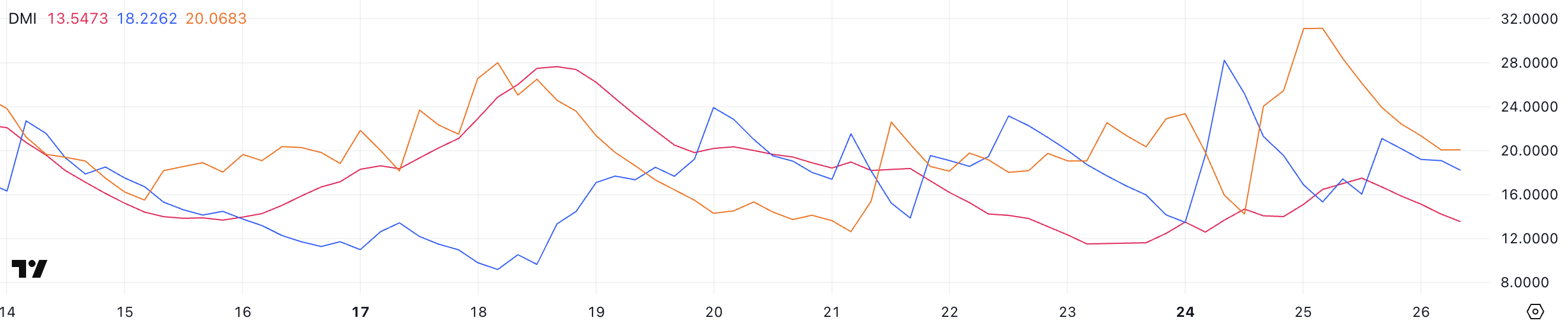

Hedera DMI Shows the Lack of Clear Direction

HBAR’s Directional Movement Index (DMI) shows its ADX currently at 13.5, down from 17.4 yesterday. The Average Directional Index (ADX) measures the strength of a trend, regardless of direction, with values below 20 typically indicating a weak or non-trending market.

In this case, Hedera declining ADX suggests that its downtrend is losing momentum. This could indicate a period of consolidation or sideways movement, as the trend lacks the strength to continue downward aggressively.

Meanwhile, the +DI is at 18.2, down from 28.2 two days ago, while the -DI is at 20, down from 31 one day ago. The +DI measures upward momentum, and the -DI measures downward momentum. Both indicators declining suggests that selling pressure is decreasing, but buying interest remains weak.

Since -DI is still above +DI, Hedera remains in a downtrend, although the diminishing gap between the two could indicate that selling pressure is easing.

If +DI begins to rise above -DI in the coming days, it could signal the start of a reversal or at least a pause in the current downtrend. However, until that happens, HBAR price action is likely to remain bearish or range-bound.

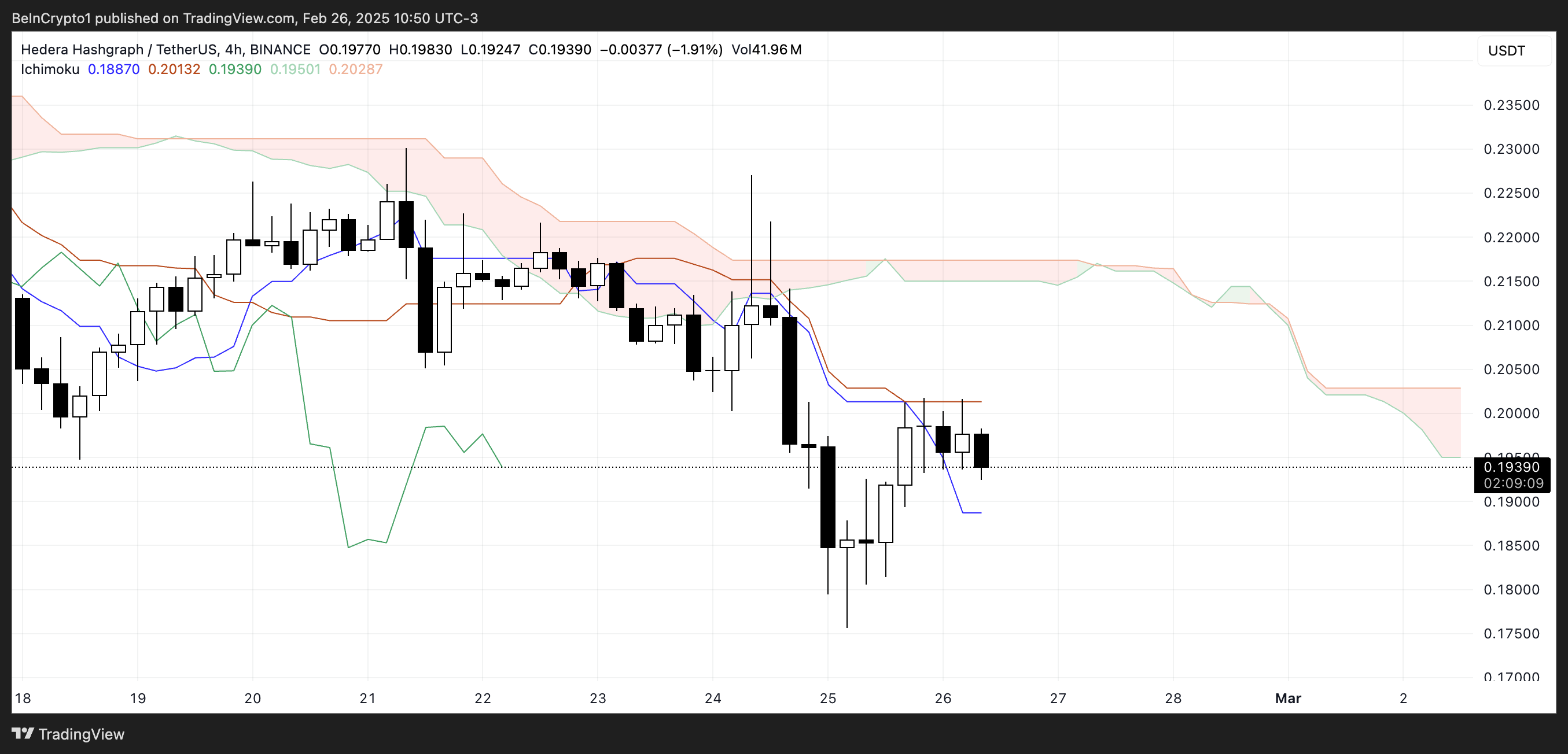

HBAR Ichimoku Cloud Paints a Negative Picture

HBAR’s Ichimoku Cloud chart currently shows a bearish outlook. The price is trading below the red cloud (Kumo), indicating a continuation of the downtrend.

The Tenkan-sen (blue line) is below the Kijun-sen (red line), reinforcing the bearish sentiment. Additionally, the price is struggling to break above the Kijun-sen, which is acting as resistance, suggesting that buying momentum remains weak.

The Senkou Span A (leading green line) is below the Senkou Span B (leading red line), projecting a bearish cloud ahead. This indicates that downward pressure is likely to persist in the near future.

Furthermore, the distance between the current price and the cloud shows that Hedera remains in a strong downtrend. Unless the price can break above the Kijun-sen and move towards the cloud, the bearish outlook is likely to continue.

Will Hedera Drop to $0.12 Soon?

HBAR’s EMA lines are currently signaling a bearish trend, with short-term EMAs positioned below the long-term ones. This alignment indicates that downward momentum is prevailing, and selling pressure remains dominant.

Recently, HBAR tested the support at $0.177, and although this level held, the risk of a retest persists. If the support at $0.177 is tested again and fails to hold, HBAR could drop further to $0.125, marking a continuation of the bearish trend.

The current EMA positioning suggests that a downtrend remains the more likely scenario unless buying interest picks up significantly.

However, if the bearish momentum fades and the trend reverses, HBAR could rise to test the resistance at $0.24. Breaking above this level would indicate a shift in sentiment, potentially pushing the price to $0.32.

If the uptrend gains even more strength, Hedera could rally to $0.40, a level not seen since 2021. For this bullish scenario to materialize, short-term EMAs would need to cross above long-term ones, signaling a reversal.

Until that happens, HBAR’s price action is likely to remain under pressure, with the $0.177 support level being crucial for determining the next directional move.