Hedera Hashgraph (HBAR) has broken out from a year-long resistance line and returned to validate it as support.

HBAR is expected to continue increasing toward the closest resistance area at $0.06.

Hedera Hashgraph Breaks Out

HBAR had been following a descending resistance line since reaching an all-time high of $0.084 on Feb. 12, 2020.

After three unsuccessful attempts, HBAR finally broke out over resistance last week on Jan. 6. It moved rapidly and reached a high of $0.071 two days later. After reaching the $0.071 high, HBAR returned to validate the descending line as support and has been increasing since.

The main support and resistance levels are found at $0.04 and $0.06 respectively.

Cryptocurrency trader @Crediblecrypto outlined an HBAR chart, stating that the price will likely consolidate before bouncing higher.

Since the tweet, HBAR has returned to validate the breakout level as support and began the current upward movement. The continuation of this move is supported by readings from technical indicators.

Both the MACD and Stochastic oscillator are increasing. While the RSI has fallen below 70, it has generated a considerable hidden bullish divergence — a strong sign of continuation. This suggests that HBAR will at least make one more attempt at breaking out above $0.06.

Future Movement

The two-hour time-frame shows that HBAR has also broken out from a short-term descending resistance line (dashed) and is currently in the process of moving above the 0.5 Fib retracement level at $0.52.

If HBAR can reclaim this level, it’s likely to move upwards at an accelerated rate. Short-term indicators also support this upward movement.

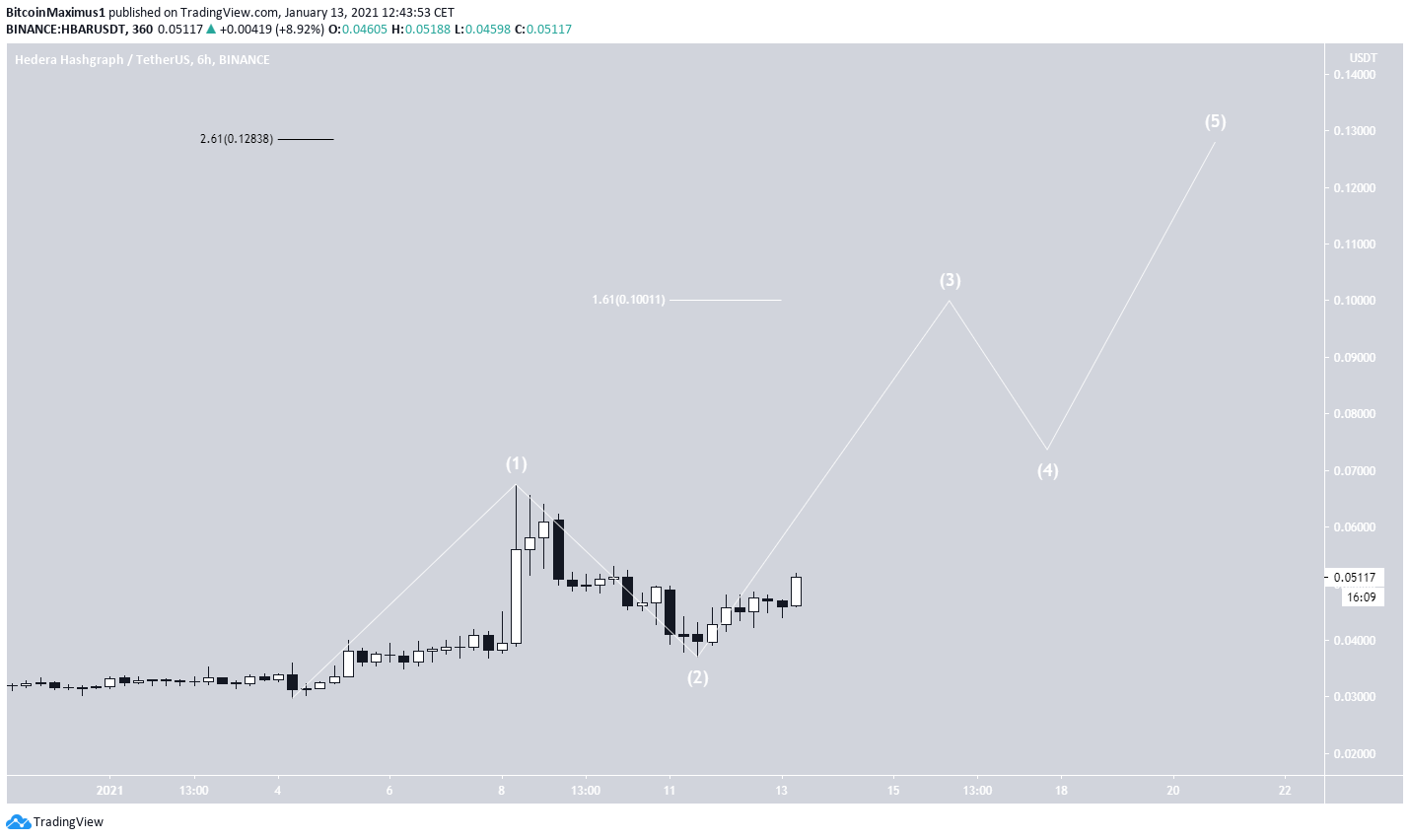

The wave count suggests that HBAR is in a long-term wave 3 (shown in white below).

A preliminary target for the top of wave 3 is found at $0.10. This target would give waves 1:3 a 1:1.61 ratio. A preliminary target for the top of the entire upward move is found at $0.128, the 2.61 Fib extension of wave 1.

Nevertheless, the targets will become more clear as the move develops.

A decrease below the wave 2 low of $0.037 would invalidate this particular wave count.

Conclusion

Hedera Hashgraph (HBAR) is expected to continue increasing towards the $0.06 resistance area and could potentially go to $0.10.

If it can reclaim the $0.052 level, the rate of increase is expected to accelerate.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.