Hedera (HBAR) price has joined the broader crypto rally, gaining over 5% on Friday. While most assets are reacting to optimism around potential September rate cuts, two key signals suggest that HBAR could outperform peers in the days ahead.

One group’s accumulation pattern and a bullish technical sign are flashing supportive signs.

SponsoredWhale Accumulation Strengthens Outlook

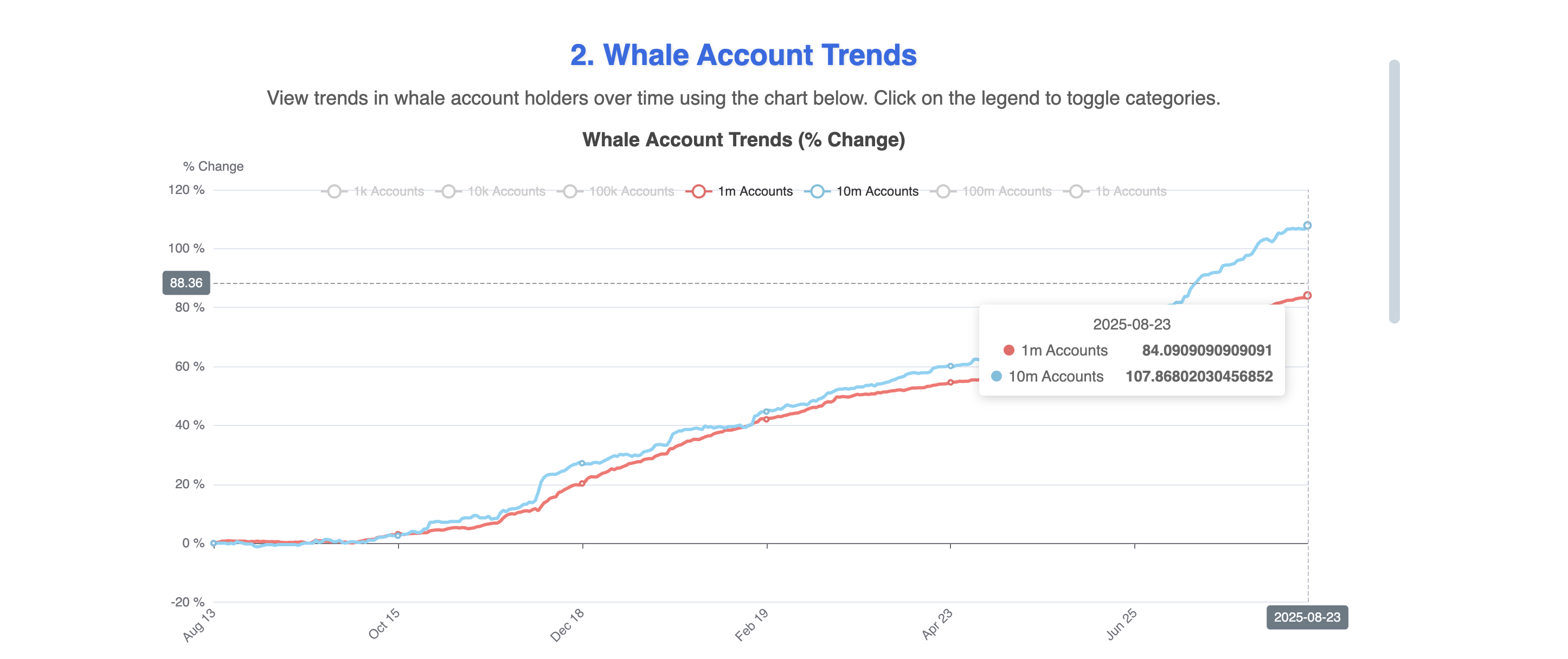

Over the past week, large HBAR holders have expanded their positions. Accounts holding at least 1 million tokens grew from 82.41 on August 16 to 84.09 on August 23. Similarly, the 10 million token band rose from 106.59 to 107.86 during the same period.

At the current HBAR price of $0.25, this increase represents a minimum addition of 1.68 million tokens ($420,000) in the 1 million band and 1.27 million tokens ($317,500) in the 10 million band.

The steady build-up highlights quiet confidence among whales, hinting at expectations of further upside.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

SponsoredRSI Divergence Adds Another Bullish Layer

The whale accumulation is now being echoed by momentum signals. Between August 19 and August 22, HBAR’s price slipped from $0.23 to $0.22, marking a lower low on the chart.

Yet during the same stretch, the Relative Strength Index (RSI) — a momentum indicator that tracks the balance of buying and selling pressure — climbed from 43 to 51 on the lower end.

This bullish divergence suggests that while price action hinted at weakness, underlying demand was actually strengthening. In other words, buyers were quietly absorbing supply even as spot prices dipped, reinforcing the steady accumulation already seen among whale cohorts.

The combination of rising whale holdings and an improving RSI points to growing conviction in the market, hinting that the recent pause may be less a sign of fading momentum and more a base for the next move higher.

HBAR Price Action And Key Levels

The HBAR price is currently trading near $0.25, holding above immediate support. For a stronger rally, it needs to clear resistance at $0.27. A successful breakout could push the price toward $0.30 and beyond, potentially outperforming the broader market.

On the flip side, failure to hold support could trigger downside risks. A drop below $0.22 may expose the price to further declines, with little technical support until $0.15.