According to Seeking Alpha‘s opinion leader, Hans Hauge, the bottom for Bitcoin is near.

Hauge bases this conclusion on an analysis of the number of unique bitcoin addresses, the hash rate, the total transactions, and the current price per coin.

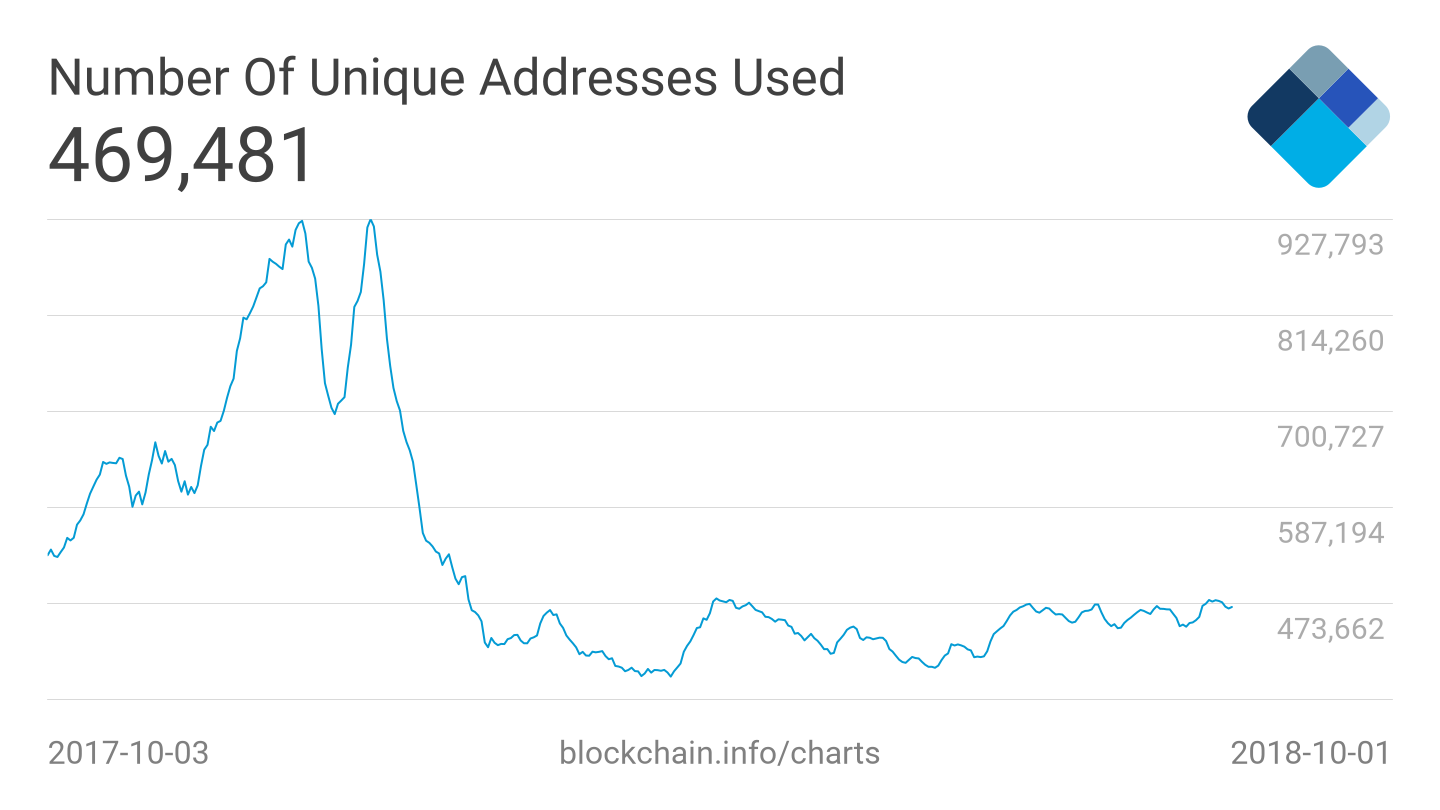

Unique Addresses Are Increasing

Bitcoin’s network grown since hitting a low in April of this year, which is a positive sign for the cryptocurrency market leader.

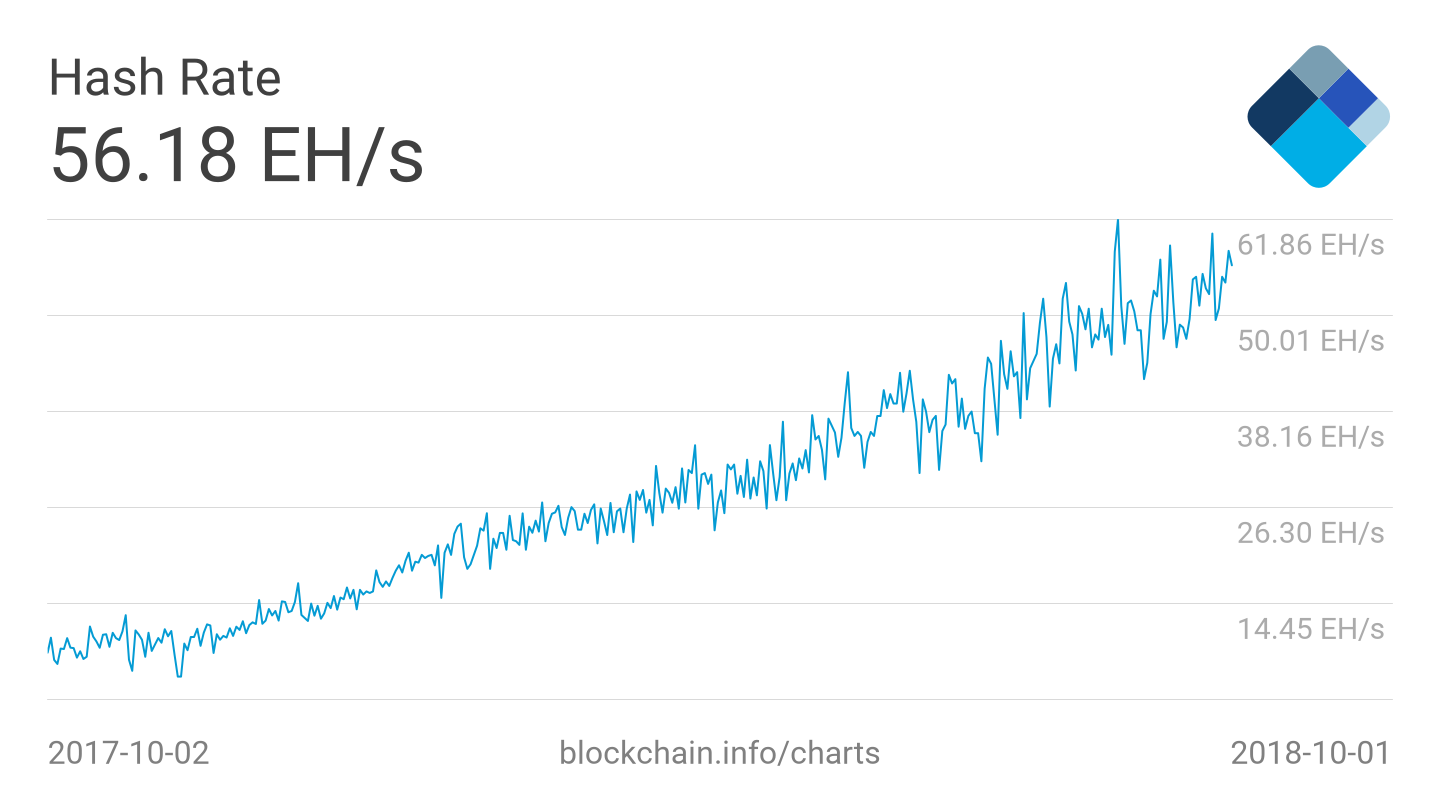

Hash Rate is Rising

Roughly one month ago, BeInCrypto reported on Bitcoin’s hashrate hitting a new all-time high — which is very bullish when talking about the leading cryptocurrency’s intrinsic value.

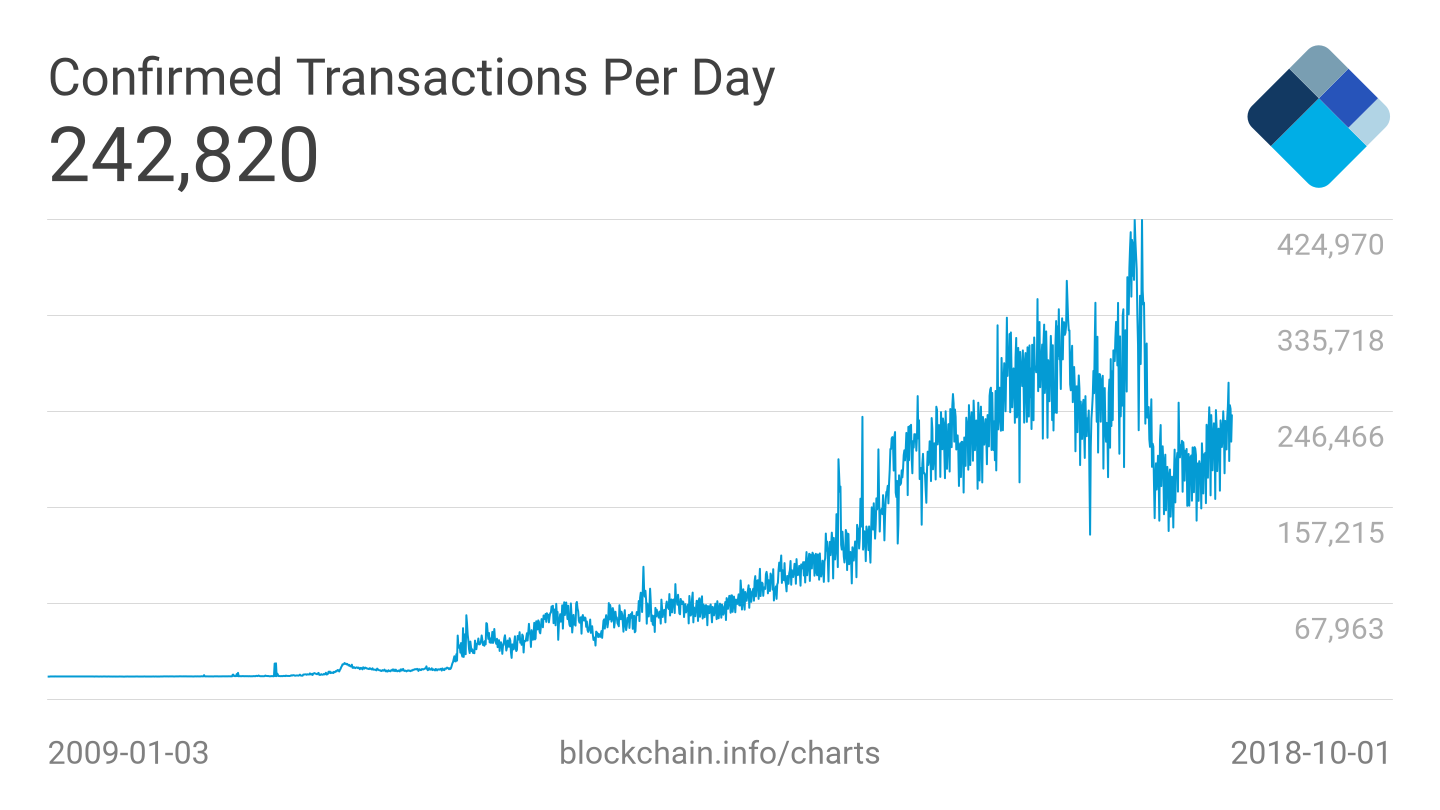

Monthly Transactions Are Trending Upwards

Bitcoin has also experienced a trend increase in daily transactions over the past half year — a sign that the network is continuing to grow and mature following December’s bubble.

The Takeaway

When taking a look at the big technical picture, it’s easy to see how the first and foremost cryptocurrency’s price could plummet further. However, the fundamental picture is as bullish as ever — meaning the bottom might just actually be in. (If it’s not, it’s probably close.) What do you think about the price of Bitcoin and the market leader’s fundamentals? Let us know in the comments below!

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Dani P

Dani Polo is the co-founder of BeInCrypto, one of the most-read crypto media platforms globally. With a background in fintech and digital strategy, he has led its global expansion and business innovation. Recognized with multiple international awards, Dani combines technology, content, and automation to scale audiences in emerging financial markets.

Dani Polo is the co-founder of BeInCrypto, one of the most-read crypto media platforms globally. With a background in fintech and digital strategy, he has led its global expansion and business innovation. Recognized with multiple international awards, Dani combines technology, content, and automation to scale audiences in emerging financial markets.

READ FULL BIO

Sponsored

Sponsored