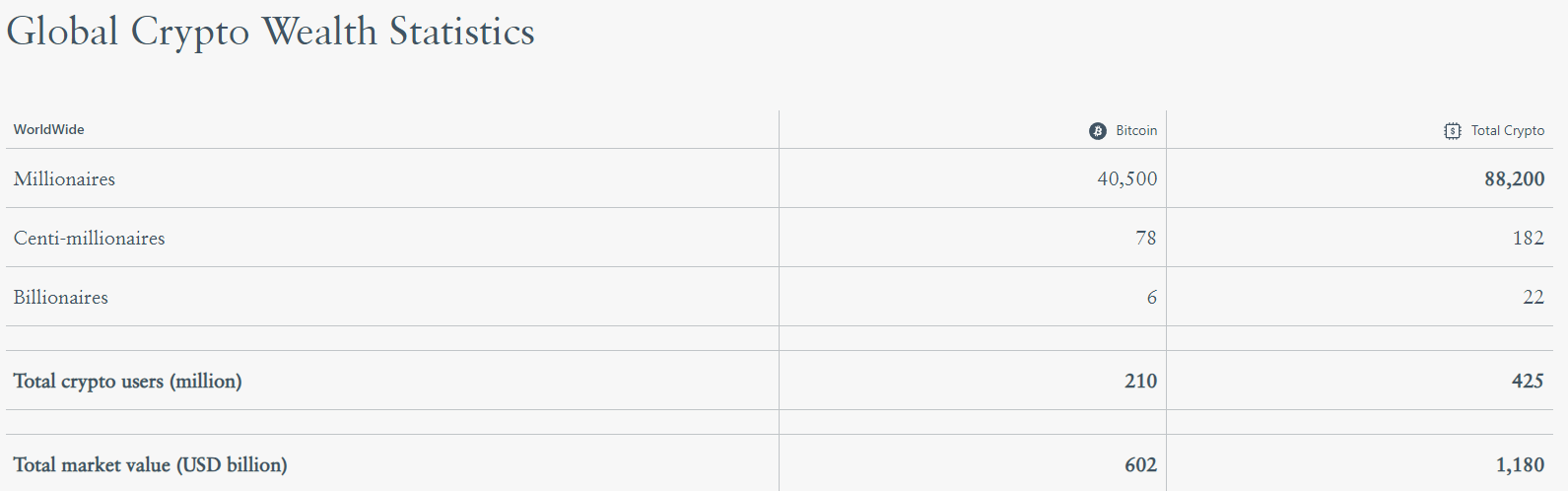

According to a recent report by Henley & Partners, a leading international wealth and investment migration specialist, nearly half of the world’s 88,200 crypto millionaires hold their fortunes in Bitcoin.

This trend underscores the enduring allure of the world’s first cryptocurrency despite the rise of numerous competitors.

Crypto Millionaires Big on Bitcoin

The Crypto Wealth Report, a first-of-its-kind, provides exclusive insights into the wealth of crypto investors. It reveals that of the 182 crypto centi-millionaires (individuals with crypto holdings of $100 million or more), 78 are Bitcoin investors.

Moreover, six of the world’s 22 crypto billionaires have amassed their fortunes from trading Bitcoin.

The global market value of crypto stands at an astounding $1.18 trillion. This demonstrates the significant financial impact of this digital asset class. With 425 million individuals worldwide owning cryptocurrencies, it’s clear that this isn’t a passing trend but a seismic shift in investment behavior.

Read more: How To Trade Bitcoin Futures and Options Like a Pro

Bitcoin’s dominance among crypto millionaires can be attributed to its pioneering role in the crypto space. Since its birth in 2009, Bitcoin has been seen as a promising investment opportunity, likened to the early internet hype.

Jeff D. Opdyke, a leading personal finance and investment expert, notes the current bear market represents a golden opportunity to buy Bitcoin at a low price. He believes that BTC is unlikely to see these prices again in the future. Opdyke said,

“Crypto today, in the wake of a bear market, is a replay of 1999 to 2001 — in other words, a fantastic opportunity to buy when blood stains the streets because we’re not likely to ever see these prices again.”

High Risk, High Reward

However, the crypto industry isn’t without its risks. Associate Professor Dr. Mete Tevetoğlu, a blockchain law specialist, warns of the “severe legal consequences” of assuming that there are no laws governing blockchain technology and crypto assets.

Cyber-security specialist Ali Khan also highlighted the importance of jurisdictions understanding the legitimate nature of crypto wealth and creating mechanisms for secure storage. Khan stated,

“The leadership of an increasing number of jurisdictions understand the legitimate nature of that wealth and have produced mechanisms for it to be stored securely, with soft infrastructure that renders it treated in the same manner as almost any other tangible or intangible asset class. But there are still a number of jurisdictions that are yet to bite.”

In an effort to safeguard their interests, crypto investors are exploring investment migration strategies.

Read more: Bitcoin Halving Cycles And Investment Strategies: What To Know

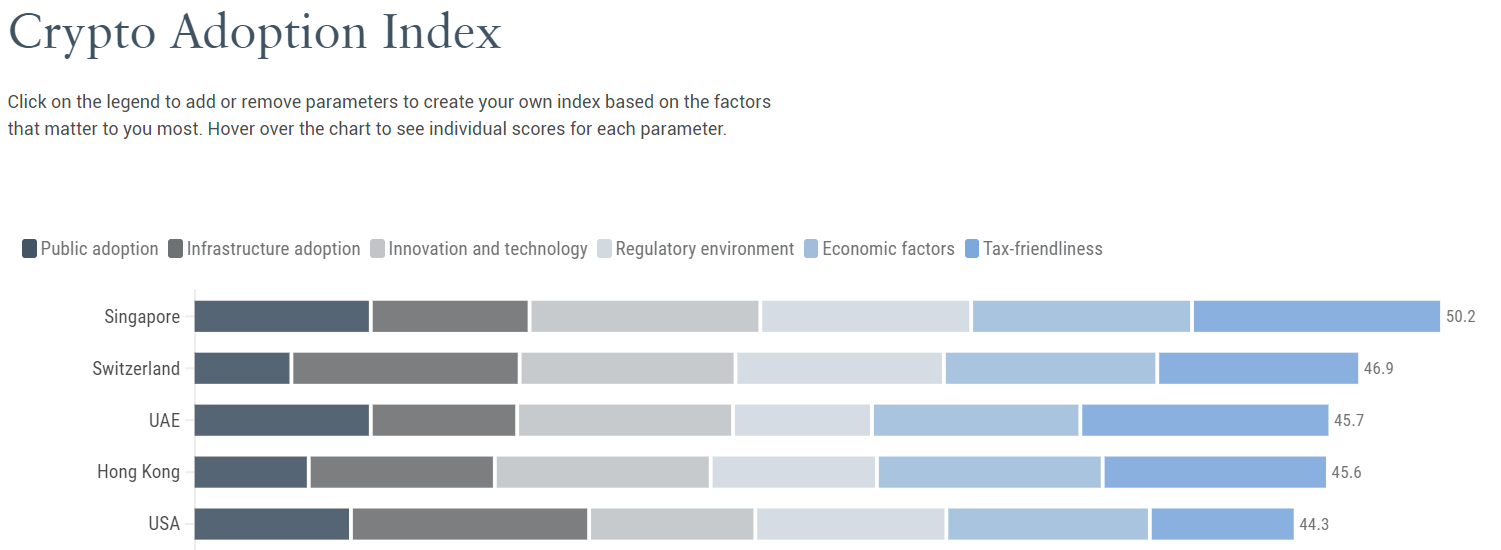

Henley & Partners’ Crypto Adoption Index, featured in the report, compares the best residence and citizenship by investment programs for crypto investors.

With its innovative ecosystem and supportive community, Singapore leads the pack as the top crypto hub. It’s closely followed by Switzerland and the UAE, both of which offer robust crypto infrastructures and favorable tax policies.

The report reads,

“The government [of Singapore] cooperates closely with all actors — banks, businesses, and the public — for the optimal development of the national crypto sector, and the city-state’s crypto taxes are beneficial to individuals and investors alike, with no capital gains taxes.”

Despite the volatility and regulatory challenges associated with cryptocurrencies, the report suggests that crypto investments aren’t going anywhere.