Grayscale Investments is a crypto firm that does things by the book. As a result, it continues to win over regulators, most recently with its Grayscale Ethereum Trust.

Grayscale announced that its Ethereum Trust (ETHE) became an SEC reporting company on the heels of a filing from Oct. 2. Grayscale’s Bitcoin Trust achieved the same status in early 2020.

The ETH price has been higher in celebration, gaining nearly 6% to $394 amid a rally in the broader cryptocurrency market. Now that the Ethereum Trust has the SEC reporting status, its shares become registered under the Securities Exchange Act of 1934. And now that it’s official, the Grayscale Ethereum Trust will be making regular filings with the SEC, including quarterly and annual reports, all of which bodes well for institutional investor interest.

https://twitter.com/barrysilbert/status/1315640460690456579

Early Liquidity

Now that the Grayscale Ethereum Trust has gained this regulatory status, it could serve as a catalyst for institutional capital. As an SEC reporting company, the trust is no longer subject to lengthy lockup periods, which previously tied up investor capital for 12 months. This could get in the way of hedge fund trading strategies as sophisticated traders look to access liquidity and move in and out of assets more easily. That lockup period has now been reduced to six months, giving investors what Grayscale described as an “earlier liquidity opportunity.”

Pricing Pressure?

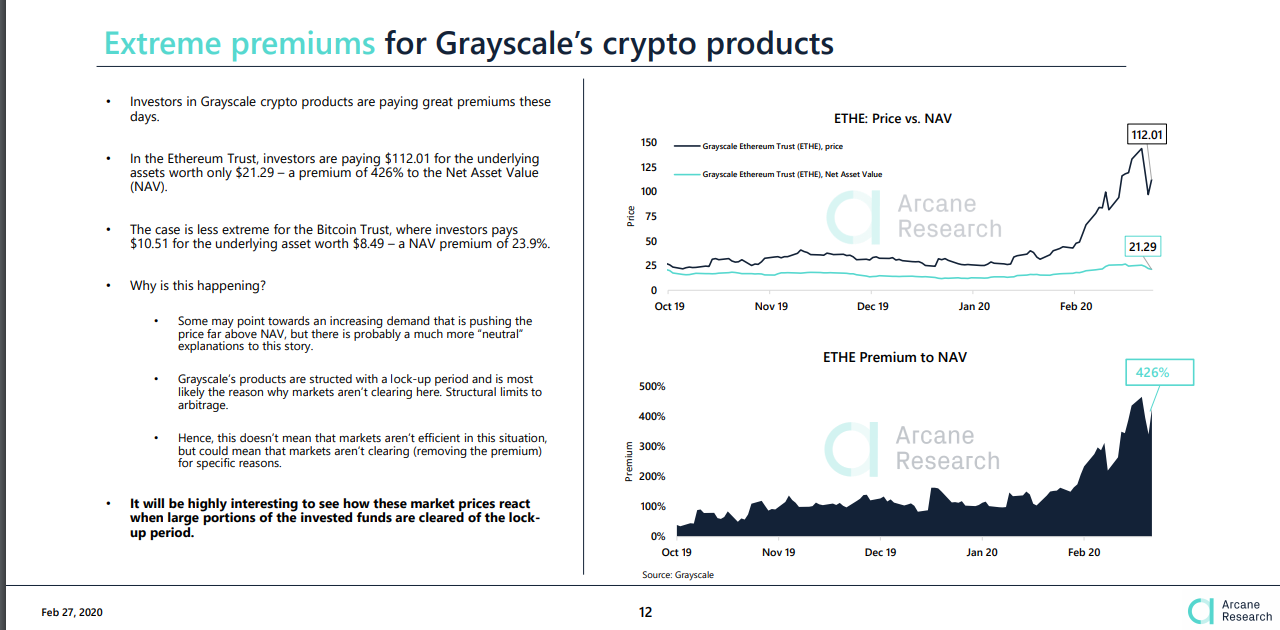

The shorter lockup periods could be a double-edged sword for the ETH price. On the one hand, it can draw in more hedge fund money and attract other big investors who need shorter-term liquidity. On the other hand, however, now that the lock-up period has been slashed in half, investors can also exit sooner. How this might affect the ETH price has yet to be seen, a question that Arcane Research posed back in February 2020 when the Ethereum Trust’s holding period was still 12 months.

ETH Price

The ETH price has gained close to 12% over the past seven days, which outperforms bitcoin’s 8.5% gains over the same period, according to CoinMarketCap data. ETH bulls are hopeful that the second-biggest cryptocurrency is just getting started in this cycle, which would be just fine for retired MMA fighter Ben Askren, who is a bitcoin bull and also owns “plenty” of Ethereum.

The broader cryptocurrency market’s gains come in lockstep with a rally in the S&P 500 on Oct. 12, fueling the argument that there is a close correlation between bitcoin and equities.