Both Grayscale and BlackRock have made notable strides in their Bitcoin (BTC) exchange-traded fund (ETF) products, according to recent announcements.

BlackRock seems to have taken a step closer to listing its product on the Nasdaq stock exchange. Meanwhile, the US Court of Appeals has mandated a review of Grayscale’s Bitcoin ETF proposal.

Positive Bitcoin ETF News for BlackRock and Grayscale

In two separate announcements, the two investment firms saw positive developments for their Bitcoin ETF proposals.

According to Bloomberg analyst, Erin Balchusas, BlackRock’s iShares Bitcoin Trust is making progress towards launching a Bitcoin ETF with an important listing:

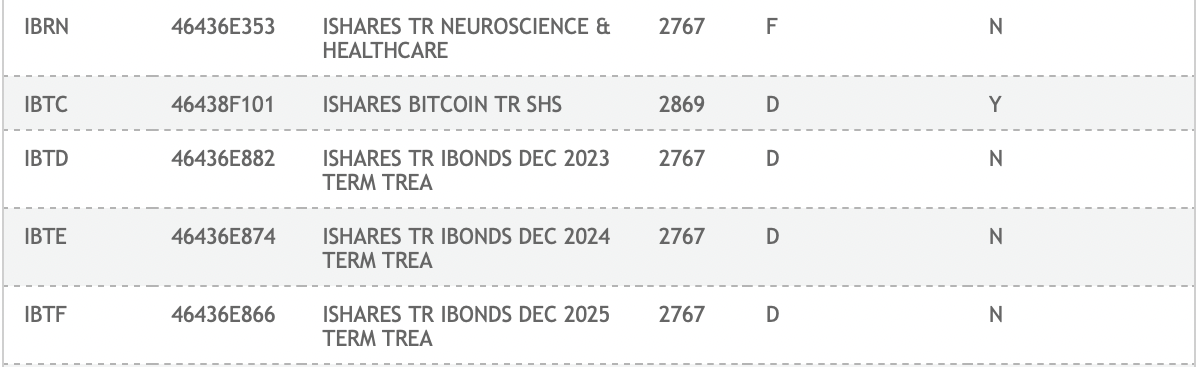

“The iShares Bitcoin Trust has been listed on the DTCC (Depository Trust and Clearing Corporation, which clears NASDAQ trades). And the ticker will be $IBTC. Again all part of the process of bringing ETF to market.”

Balchusas explained that the choice of name for the ticker is a fairly bland choice, describing it as “zzzzz.” However, he notes, it is important to do so to attract more traditional investors to Bitcoin.

“$IBTC is def a zzzzz ticker considering the options, but it fits BLK brand (they more straight up the middle) and arguably better than something like $HODL if goal is to make it into client accounts of rich boomers who use wealth managers.”

At the time of publication, Bitcoin’s price is $33,333.

Meanwhile, the US Court of Appeals mandated that the US Securities and Exchange Commission (SEC) must re-examine Grayscale’s application for a spot Bitcoin ETF.

In a court filing on Oct. 23, a judge ruled that the document constitutes the “formal mandate” of the US Court of Appeals.

Read more: How To Buy Bitcoin With PayPal: A Step-by-Step Guide

On October 14, BeInCrypto reported that the SEC chose not to challenge the initial court’s order. The court ordered the SEC to re-evaluate Grayscale’s proposal for converting its Bitcoin trust into an ETF.

Mounting Speculation Surrounding Bitcoin ETF

Furthermore, this follows the court’s decision in favor of Grayscale. The court chose to support its claim that the SEC’s initial rejection of its application constituted “unfair discrimination.”

More recently, BeInCrypto reported that investors are considering the period from the end of 2023 to the first half of 2024 as a possible timeframe for approving Bitcoin ETFs.

Read more: Bitcoin Pizza Day Explained: The Story of the First BTC Transaction

Meanwhile, SEC Commissioner Hester Pierce emphasized that the SEC’s efficiency in making decisions regarding Bitcoin and other cryptos has been lacking:

“I really can’t speak to what we’re going to do on the Bitcoin exchange-traded products. I can say that generally, the agency has not been very good when it comes to anything related to Bitcoin or other crypto assets. And, look, I hope that they’ll wake up, and they’ll think… we need to take a more productive approach. That hasn’t happened yet.”