Prominent digital asset manager Grayscale recently adjusted the weightings of key products within its portfolio. Notably, changes were made to the Grayscale Digital Large Cap Fund, Grayscale DeFi Fund, and Grayscale Smart Contract Platform Ex-Ethereum Fund.

The firm incorporated two major cryptocurrencies into its Digital Large Cap Fund, including Ripple’s XRP and Avalanche’s AVAX.

Why Grayscale Added XRP and AVAX

The rationale behind Grayscale’s decision stems from CoinDesk’s recent rebalancing of its Large Cap Select Index (DLSC) on January 3. This index serves as the foundation for assets within the Grayscale Fund. As the index provider included XRP and AVAX in its rebalance, Grayscale mirrored this adjustment to maintain alignment with the updated composition.

Grayscale has restructured its portfolio, selling off parts of its current assets according to their respective weightings. The proceeds from these sales were used to acquire AVAX and XRP. It is important to note that MATIC, belonging to Polygon, was entirely eliminated from the Fund.

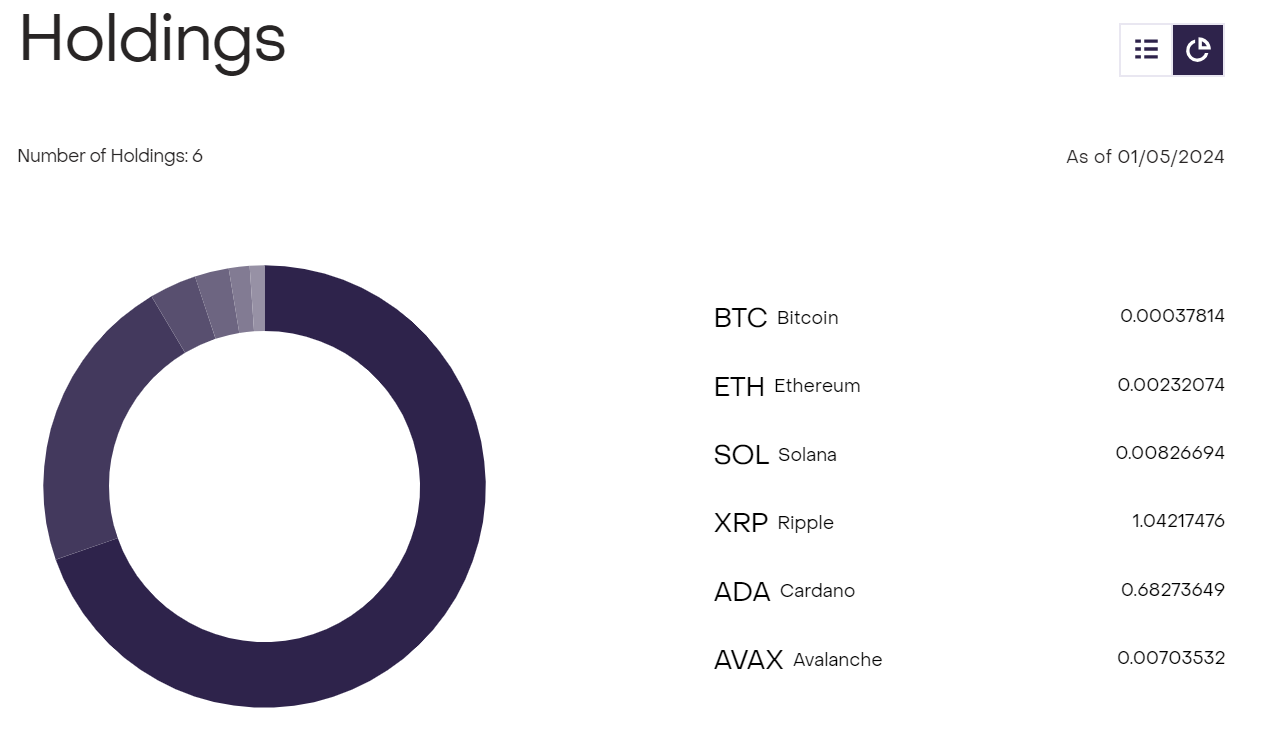

The Digital Large Cap Fund now encompasses 69.15% BTC, 21.90% ETH, 3.68% SOL, 1.62% ADA, 2.54% XRP, and 1.14% AVAX.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

Members of the XRP community immediately hailed the move, with some urging the asset manager to launch an XRP-focused fund.

“It’s great that Grayscale is adding XRP back into their crypto index, but they have had it there for years, more often than not, & we see what the overall effect has been on price,” WrathofKahnemand said.

The Digital Large Cap Fund is Grayscale’s crypto portfolio that exposes investors to large-cap cryptocurrencies. The firm said the product has not met its investment objective and has not reflected the value of its digital assets.

The Price of XRP and AVAX Struggle

Grayscale’s move has yet to translate into a positive price performance for XRP and AVAX. These assets’ values fell by 9% and 11%, respectively, during the past week.

A closer look showed that the negative trend has persisted for around a month for XRP. Its price has fallen by more than 10% to its lowest value in the last three months at $0.567.

Read more: How To Make Money With Cryptocurrency: Top 4 Ways In 2024

The downward trend has led to a substantial reduction in XRP’s market cap, currently standing at $30 billion, a stark $7 billion drop from a month ago. Consequently, it has slipped from the top five crypto assets, now occupying the sixth position, trailing Solana by approximately $10 billion, which boasts a market cap of $41 billion.

On the other hand, AVAX was one of the few digital assets that finished last year strongly, up by around 33% in the last 30 days to $34. The blockchain is also enjoying renewed attention thanks to its thriving ecosystem.