If it seems like more investors are jumping on the bitcoin train with the price now trading above $13,000, it’s probably because they are. The BTC price touched a new high for the year at $13,500 on Oct. 27, and the fundamentals appear only to be getting stronger.

Digital currency asset manager Grayscale Investments published its 2020 survey on bitcoin sentiment, and the results are bullish. Grayscale, via 8 Acre Perspective, canvassed 1,000 consumers across the United States between 25 and 64.

According to Grayscale, investor interest in Bitcoin has been piqued, with more than half, or 55% of those polled expressing a desire to invest in the leading cryptocurrency. This compares to slightly over one-third of respondents in the 2019 survey.

Our new study shows that 55% of U.S. investor survey respondents are interested in investing in #Bitcoin in 2020, which marks a significant increase from the 36% of investors who said they were interested in 2019. Read our study here. $BTC https://t.co/9fyRIxJXfD pic.twitter.com/DXYzav8qYx

— Grayscale (@Grayscale) October 27, 2020

Bitcoin also has momentum on its side, as more than 80% of survey respondents said they added exposure to bitcoin within the last year. More than one-third of that subset invested in the past four months alone.

Grayscale also acknowledged the headwinds that prevent people from taking the plunge into digital assets. Some of the biggest hurdles include a “need to access investment income” for retirement, volatility, and risk.

As fate would have it, the risk pendulum could be beginning to swing in the opposite direction. Even JPMorgan has come full circle, reportedly saying in a recent report that bitcoin offers “considerable upside” as an alternative investment to gold.

Follow the Signs

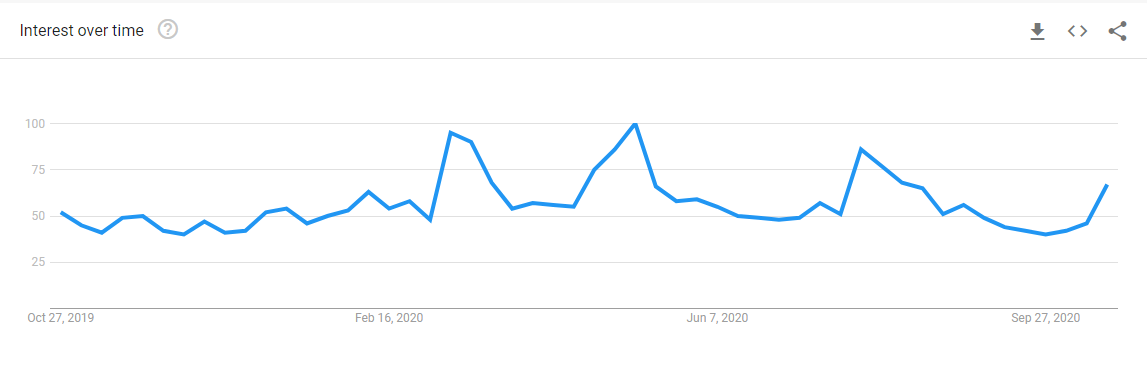

In addition to Grayscale, there are other signs that bitcoin interest is on the rise. According to Google Trends, there has been an upswing in searches for the term “bitcoin” in recent weeks though searches remain below their peak for the year, which occurred in May.

Bitcoin Less Risky

It could also be because bitcoin as an asset class is getting more mature. Mike Novogratz, CEO of Galaxy Digital, seems to think so, saying in a tweet that bitcoin on a risk-adjusted basis “is an easier bet today than it has ever been,” adding that it is “being de-risked daily.”

Raoul Pal, economist, co-founder, and CEO of Real Vision Group, couldn’t agree more.

Trader Luke Martin also cheered this dynamic, saying that with investing, there will be ups and downs while explaining,

“The floor is higher for Bitcoin than it’s ever been.”

Crypto market leaders have also been touting the fact the bitcoin has been trading independently from stocks of late, with Gemini’s Cameron Winklevoss saying “the decoupling is upon us.” This theory appears to be happening in fits and starts.