GOAT price has been riding a strong uptrend, recently reaching a new all-time high. This rapid ascent, however, might face turbulence, as the coin saw a sharp 24% dip, raising concerns about a potential drawdown.

The recent price drop has investors questioning whether the bullish momentum can be sustained or if a deeper decline lies ahead.

GOAT Is Losing Ground

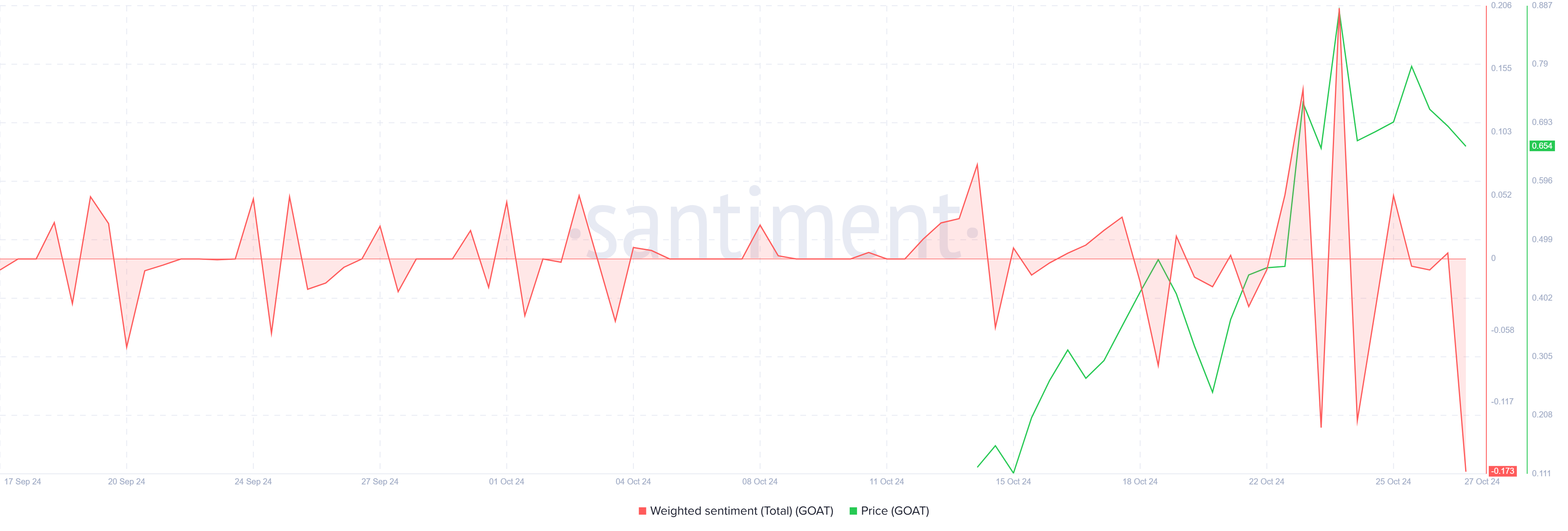

Investor sentiment surrounding GOAT is shifting from optimism to caution. Indicators of bearish sentiment have emerged, with Santiment data showing spikes below the neutral line, signaling a dip in confidence. This shift reflects the uncertainty among investors who had been banking on continued growth.

Uncertainty often fuels volatility, particularly in meme coin markets. As GOAT’s recent price drop erodes confidence, traders may become more inclined to exit positions to avoid further losses. This heightened caution could trigger a negative feedback loop, placing additional pressure on the coin’s price.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

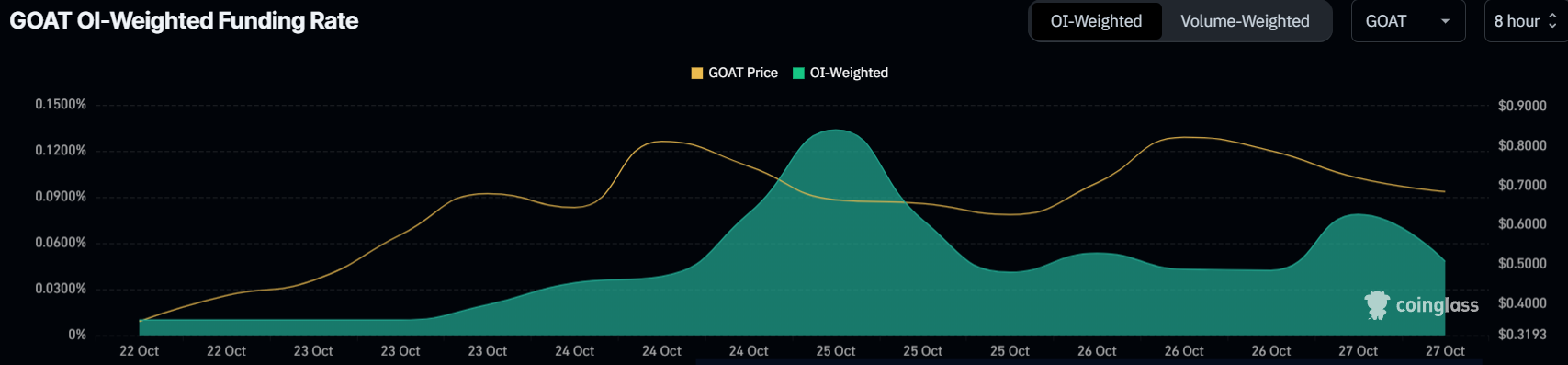

GOAT’s macro momentum also shows signs of weakening, primarily reflected in the coin’s funding rate. Although the funding rate remains positive, it has been gradually declining, an indicator that some traders are hedging their positions by opening short contracts. Rising open interest (OI) paired with a dropping funding rate suggests traders are beginning to anticipate a potential price fall.

Short contracts allow traders to profit from declining prices, adding an element of bearish expectation to GOAT’s outlook. As more short positions are opened, downward pressure on GOAT’s price could intensify, potentially accelerating any ongoing downtrend.

GOAT Price Prediction: Bearing the Brunt of a Drop

GOAT recently saw a 24% dip from yesterday’s intraday high, falling short of its effort to establish a new all-time high (ATH). This decline raises concerns about whether the meme coin’s bullish run can be sustained or if a continued drawdown might follow.

If the downtrend persists, GOAT is at risk of breaching the $0.64 support level. A dip below this threshold could open the path to $0.46, amplifying investor losses and weakening short-term market sentiment. Such a drop would signal a shift toward bearish control, possibly spurring further selling.

Read more: 11 Top Solana Meme Coins to Watch in October 2024

However, if the $0.64 support holds firm, GOAT could have a chance to recover. Stability at this level would keep hopes alive for a rebound, giving the coin another shot at surpassing its current ATH of $0.90.