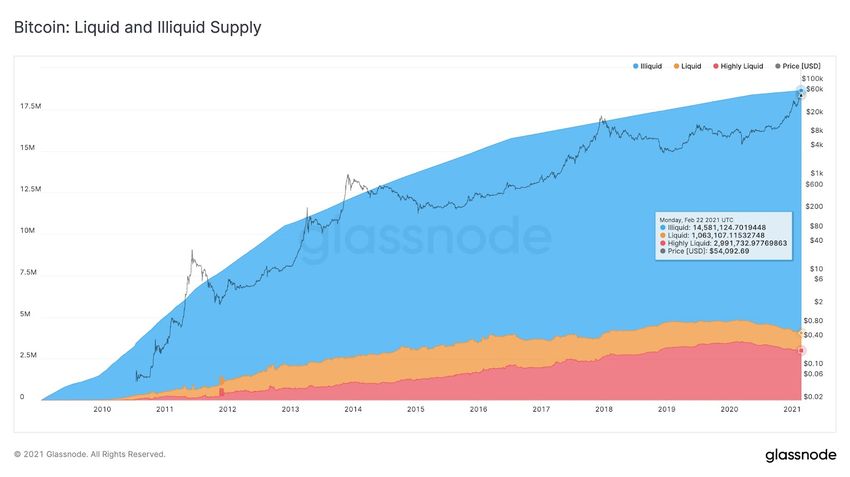

The latest on-chain data from glassnode reveals that the illiquid bitcons supply has soared past its circulating supply for the first time in three years.

Glassnode co-founder and on-chain analyst Rafael Schultze-Kraft considers this is a bullish sign ahead of Bitcoin.

On the Verge of BTC Consolidation?

Currently, there are more than 14,5 million BTC termed to be illiquid, according to glassnode. Meanwhile, liquid supply sees a sharp decrease, down to 4 million BTC worth around $189,5 billion at press time.

Illiquid supply indicates that more market participants choose to accumulate bitcoin, as they believe that BTC will keep growing. Although bitcoin crashed over 7.5% along with the entire market on Bloody Monday (Feb 22), investors believe this is just one of potential corrections which precede the flagship cryptocurrency hitting much more astronomical heights.

Other glassnode cofounders Jan & Yann share this stance, saying this Bitcoin rally is more than likely to continue. In the following thread they also noted miners are joining the long-term holders club while exchange deposits are becoming fewer.

Time will tell, whether the ongoing situation is actually bullish for bitcoin. Currently, it sits at slightly above $46,900 price level, more than 9% daily drop, according to CoinGecko. However, bitcoin billionaire Tyler Winklewoss sees the price area from at least $45,000 is the one that “smells of opportunity,” probably hinting that it’s a good time to buy the dip.

Massive BTC Purchases in Full Swing

Schultze-Kraft highlighted that the increasing illiquid BTC supply is credited to recent purchasing activity from mainstream investors and companies.

Moreover, Tesla, Microstrategy and Square managed to capitalize on the BTC price dip. Since Elon Musk’s electric car producer had started to acquire bitcoin en masse, these three companies saw their own stocks booming. While MicroStrategy is yet in the middle of swallowing billions of BTC making its price fight $50,000, Square is growing its BTC stash with another $170 million in bitcoin.

Strong institutional purchases have also been witnessed on the leading cryptocurrency exchanges. On Feb 24, Coinbase Pro registered Bitcoin outflow of over 13,000 BTC. CryptoQuant CEO Ki-Young Ju explained that big players keep purchasing BTC in anticipation of the next Bitcoin bull run.