The crypto industry has become synonymous with producing red on Mondays. Consequently, that’s exactly what the market got on Feb 22. Bloody Monday saw bitcoin (BTC) drop over 7.5% as the entire market dipped.

Bitcoin was the story of the day following a dramatic drop that saw as much as a 15.8% loss on the Binance exchange. There were varying degrees of price drops depending on the exchange.

The mini flash crash saw the entire market follow suit. All major cap coins saw multiple figure drops as BTC tumbled to its lowest level in a week.

While the drop might not seem that dramatic following a steady two-week price increase, the sharp correction clearly took traders by storm. The crash saw over $4 billion in leveraged positions liquidated.

The unprecedented number of liquidations proves that margin trading is on the rise, regardless of whether traders actually know how to use it successfully.

Ethereum (ETH) Under $2,000 Again

Following much respite, ethereum recently managed to break the $2,000 resistance line. The joy was short-lived as it has quickly dropped below $2,000 again.

On Monday, Feb 22, ETH looked like it might test $2,000 for a second time but was quickly halted as the BTC drop saw ETH decline a massive 21.4% before recovering to the mid $1,700s.

Total Market Cap Shows Total Sell-Off Effect

Sunday saw an all-time high in the cryptocurrency market cap. The market cap reached a staggering $1.749 trillion over the weekend.

The new all-time high total market cap, unfortunately, was short-lived following the devastating sell-off on Monday. The recent high was met with a 19.37% decline before seeing some respite.

The majority of altcoins looked similar to that of bitcoin, with a massive dump before a quick recovery.

Biggest Gainer in the Top 100

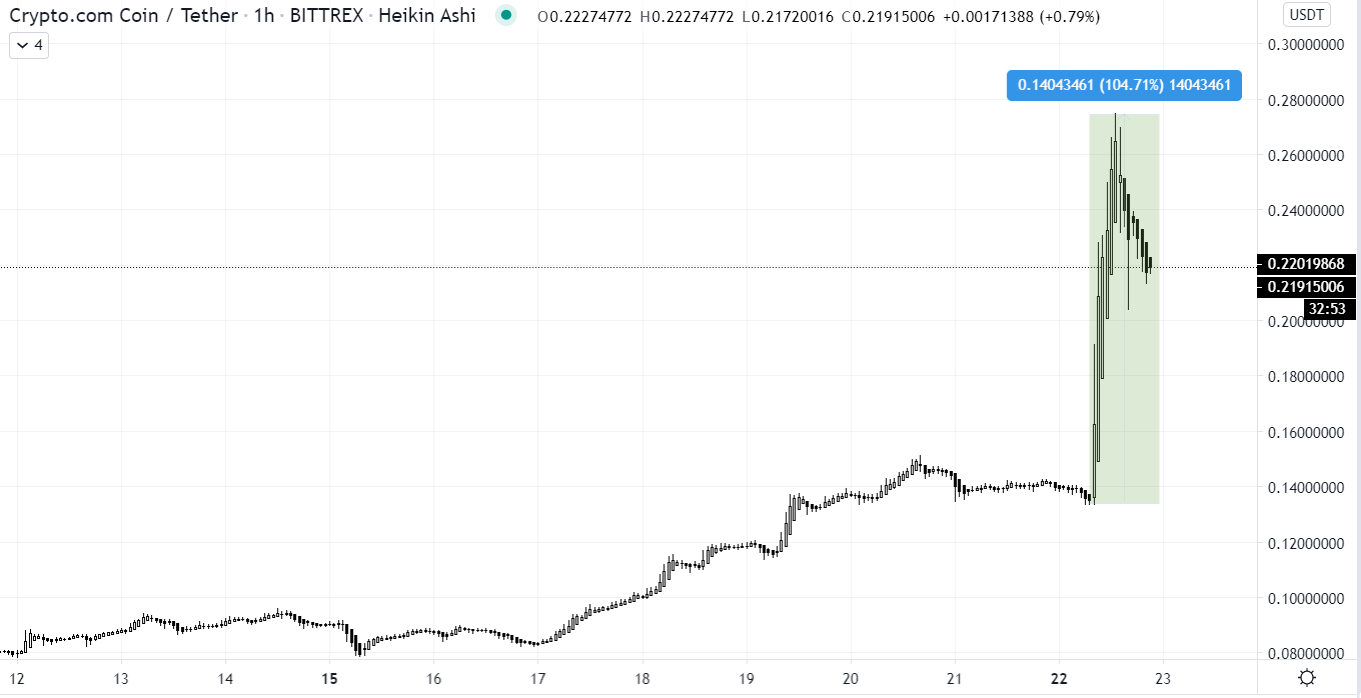

While there was a sea of red on Monday, Crypto.com (CRO) announced some huge updates to the project. The announcements saw the CRO token surge over 100% in value from $0.13 to $0.27 on the day.

The exponential price rise was credited to a large token burn accounting for 70 million CRO tokens.

The news also included the announcement of the project’s Mainnet launch, scheduled for March 25, 2021. CRO chain will now become Crypto.org Chain.

Despite the sea of red, this was similar to last week’s price action. It’s not completely out of the question that the rest of the week brings more gains across the board, something that has been common over the past few weeks. Only time will tell.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.