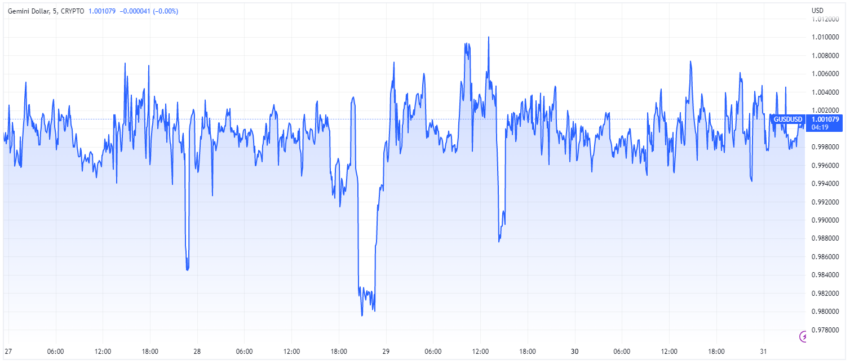

The Gemini Dollar (GUSD) has been experiencing some fluctuations, with the stablecoin losing its peg over the past week. The exchange is currently the center of attention for its Gemini Earn program.

Gemini and the stablecoin market are facing troubles after the Gemini Dollar (GUSD) stablecoin lost its $1 peg over the past 24 hours. The stablecoin has been dropping to as low as $0.98 over the past week, and in the past 24 hours, it has been fluctuating quite wildly. The last time the GUSD token price behaved like this was at the end of 2022.

OKX did not offer any specific reasons why GUSD was listed, rather simply stating the generic rationale of maintaining “a robust spot trading environment, we constantly monitor the performance of all listed projects and review their listing qualifications on a regular basis.”

GUSD was experiencing a drop in usage from around the start of the year. The number of active addresses that used GUSD fell to 2020 levels. This is not good for an asset that is already in a hotly competitive sector in the crypto space.

Gemini Being Investigation Over FDIC Claims

There are several possible reasons for the generally poor health of the Gemini ecosystem. The exchange was in the headlines on several occasions over the past two months, primarily for its spat with Genesis over the Gemini Earn product.

That program has caught the attention of authorities, as the New York State agency that regulates Gemini is investigating the exchange for making claims related to the Federal Deposit Insurance Corporation. Furthermore, Gemini is also under investigation by the United States Securities and Exchange Commission (SEC) for the Earn program.

Then there are investors themselves. Many of them have sued Gemini for their Earn product, claiming they should have registered it as a security.

Stablecoins Looking Good, for the Most Part

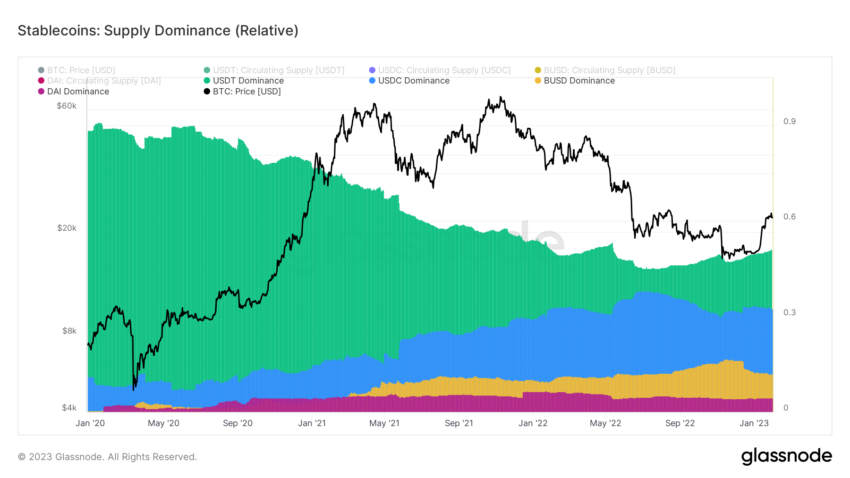

While GUSD is experiencing a tough time, stablecoins generally are doing well. The market caps of USDT, USDC, and DAI have all increased over the past month. This typically indicates a greater demand.

However, one notable drop over the past ten days is BUSD. The Binance stablecoin saw a sudden and sizable drop in market cap a few days ago. So far, it looks like nothing serious, but analysts are keeping an eye on it.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.