French banking giant Societe Generale has unveiled a CBDC-type Euro-pegged stablecoin. However, crypto developers were quick to identify potential issues with its code.

On April 20, Societe Generale (SG) announced the launch of a Euro stablecoin called “CoinVertible.” The asset is based on the Ethereum blockchain and has the ticker EURCV.

However, the new bank-issued stablecoin is only available to instructional clients, according to SG. EURCV is “limited to investors onboarded by Societe Generale group through its existing compliance procedures (KYC/AML-CFT),” it stated.

The bank asserted that it was fully backed with a “secure legal structure guaranteeing (the complete segregation of the collateral assets held to back the value of the stablecoins from the issuer.

Furthermore, the launch comes at the same time as Europe’s MiCA crypto regulations get the final nod from the European parliament.

SG Stablecoin Code Dissected

However, not all is what it seems with the bank’s institutional stablecoin. Being an ERC-20 token means that the underlying smart contract code was available for inspection.

Several crypto developers have already found numerous issues with it, some of which are rather concerning.

DeFi developer “0xfoobar” observed that transfers needed additional centralized transactions for approval.

“Every ERC20 single transfer has to be approved in a separate ETH transaction submitted by a centralized registrar. What a laughingstock, is this your CBDC?”

“What if we made an ERC20 but instead of settling in seconds, you still have to wait for the back-office fax,” he quipped.

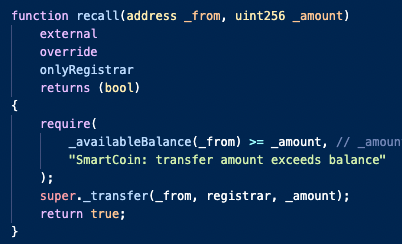

Software engineer “@0xCygaar” found even more insidious clauses buried in the stablecoin code.

“The new Euro-pegged stablecoin from SG-Generale has a function that allows them to take all of your money lol,” he said.

“There’s also a function that allows them to burn your money as well,” the developer noted.

The stablecoin will have severe scaling issues being based on Ethereum using these constraints. However, considering that it is only available to the bank’s institutional clients, it’s unlikely to gain much traction.

A Dangerous CBDC Precedent

Societe Generale has set a dangerous precedent for central bank digital currencies. This demonstrates the bank’s control of the asset. This includes what it allows users to do with it.

Warnings over CBDC deployments have been issued by lawmakers in the United States and globally. Earlier this year, Congressman Tom Emmer introduced the CBDC Anti-Surveillance Act.

The bill provides a provision to prevent the Federal Reserve from using a CBDC to implement monetary policy and control the economy.

Others have cautioned that a CBDC could be used to control people’s spending or enforce carbon-limit restrictions.