The Federal Trade Commission (FTC) has issued a consumer advisory cautioning that scammers are increasingly demanding payment in cryptocurrencies such as Bitcoin (BTC) and Ether (ETH). The agency offered some pointed words of caution about vendors relying on cryptocurrencies for payments.

In its warning, the FTC noted that cryptocurrencies do not have the same legal protections as traditional payment methods. This can make it difficult to recover lost funds when sent to scammers.

“Only Scammers Demand Payment in Crypto,” Says the FTC

The agency pointed to common crypto-related scams, including imposter scams where callers pose as government agents and demand fines be paid in cryptocurrency.

Romance scams are also highlighted, where scammers prey on lonely individuals by asking for cryptocurrency to pay for medical procedures or to cover other sudden emergencies. Fake job offers that require upfront “fees” in crypto are also high on the FTC’s list of things to avoid.

Learn how to keep your digital assets safe with this helpful guide: 15 Most Common Crypto Scams To Look Out For

“Only scammers demand payment in cryptocurrency,” the FTC warning stated plainly. “No legitimate business or government agency is going to demand you pay with cryptocurrency.”

Across the United States, Americans reportedly lost $2.57 billion to crypto scams last year. The problem is pervasive and afflicts communities large and small.

The FTC urges Americans to be wary of any demands for crypto payments. It advises all consumers to report suspicious activity to the FTC’s complaint assistant at ReportFraud.ftc.gov.

Crypto Scams Target Wannabe Investors

The fresh warning comes just as yet another crypto scam hits the headlines. A 40-year-old Wyoming woman lost $8,785 in a cryptocurrency scam, police say. She reported the loss to the Gillette Police Department on August 25.

The woman said a female suspect had recommended that she invest in cryptocurrency through a fraudulent website called Elite Capitals Live. Her money was transferred to a broker, but when she tried to withdraw funds, the scammers asked for more money.

It was only then that the woman realized bad actors were at work. Gillette detectives are now investigating.

Victims of such scams often fall for promises of high and fast returns.

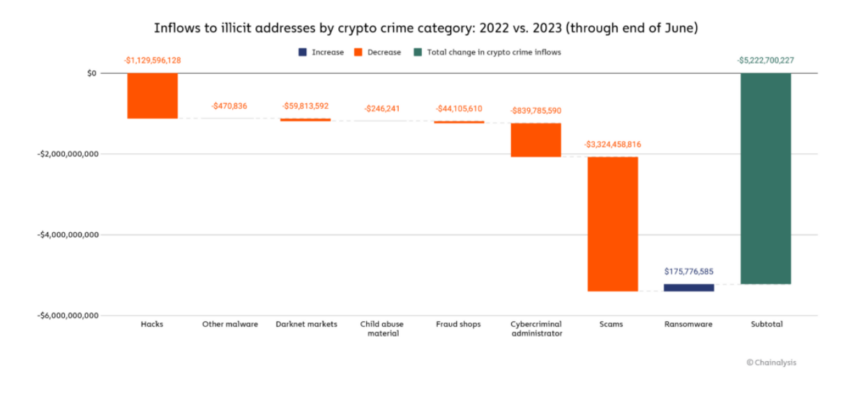

However, even though crypto scams make for good headlines, a lack of consensus does exist on the overall rates of such crimes. Some even think that the problem is easing. Consider, for example, a mid-year report by Chainalysis.

Chainalysis reports that through the end of June, crypto inflows to known illicit bodies have dropped 65% compared to the same time in 2022.

However, Chainalysis’ head of investigations, Elizabeth Bisbee, recently conceded that the company has no proof its software works. An article stating as much was recently retracted by CoinDesk for being written under a pseudonym. It has now been republished by Bitcoin Magazine.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.