Crypto social finance (SocialFi) platform Friend.tech remains in the spotlight after its team decided to relinquish control over its smart contracts, aiming to prevent future modifications. This decision had a negative impact on the platform’s native token, FRIEND, causing its value to plummet.

Following community backlash, the team addressed the concerns in a post early Tuesday, aiming to clarify the situation and calm tensions.

Friend.tech Team Deny Shut Down Concerns

The team denied any plans to shut down the Friend.tech web app. They said they were only sealing the doors for any future smart contract changes on matters fees by transferring the admin and ownership rights of the protocol’s code to a null address.

“We have no plans to shutter or discontinue the Friend.tech web app. The actions below guarantee that no future changes can be made to smart contracts deployed on Base which would raise or create new fees. These actions do not affect the current functionality of the Friend.tech web app in any way. Everything you know and use remains the same,” the team wrote.

Following this announcement, Friend.tech’s powering token, FRIEND, surged over 40% to trade for $0.094 as of writing.

Read more: What is Friend.Tech? A Deep Dive Into The Web3 Social Media App

The platform, which merges social media with decentralized finance (DeFi) principles, operates on Ethereum’s Layer-2 Base. Users can profit from content creation and monetize it through tradable tokenized shares known as “keys.”

The decision to relinquish control over its smart contract led to widespread speculation, with many seeing it as either “the final nails in the coffin or ribbons on a present.” This uncertainty caused FRIEND to drop over 42% on Monday, hitting an all-time low. The sell-off occurred as token holders realized that while the protocol still technically exists, surrendering control of the smart contract essentially signals the end of the project.

“Because the team has no interest in developing the platform, the best-case scenario for users was an acquisition. By removing the potential to generate revenue you have taken away this possibility. Abandoning the project but keeping the servers on is no better than shutting it down,” one user wrote.

As BeInCrypto reported, the team’s exit follows a significant collapse in revenue. Deposits plummeted from $52 million to just $4 million, while both revenue and daily user engagement dropped to single digits.

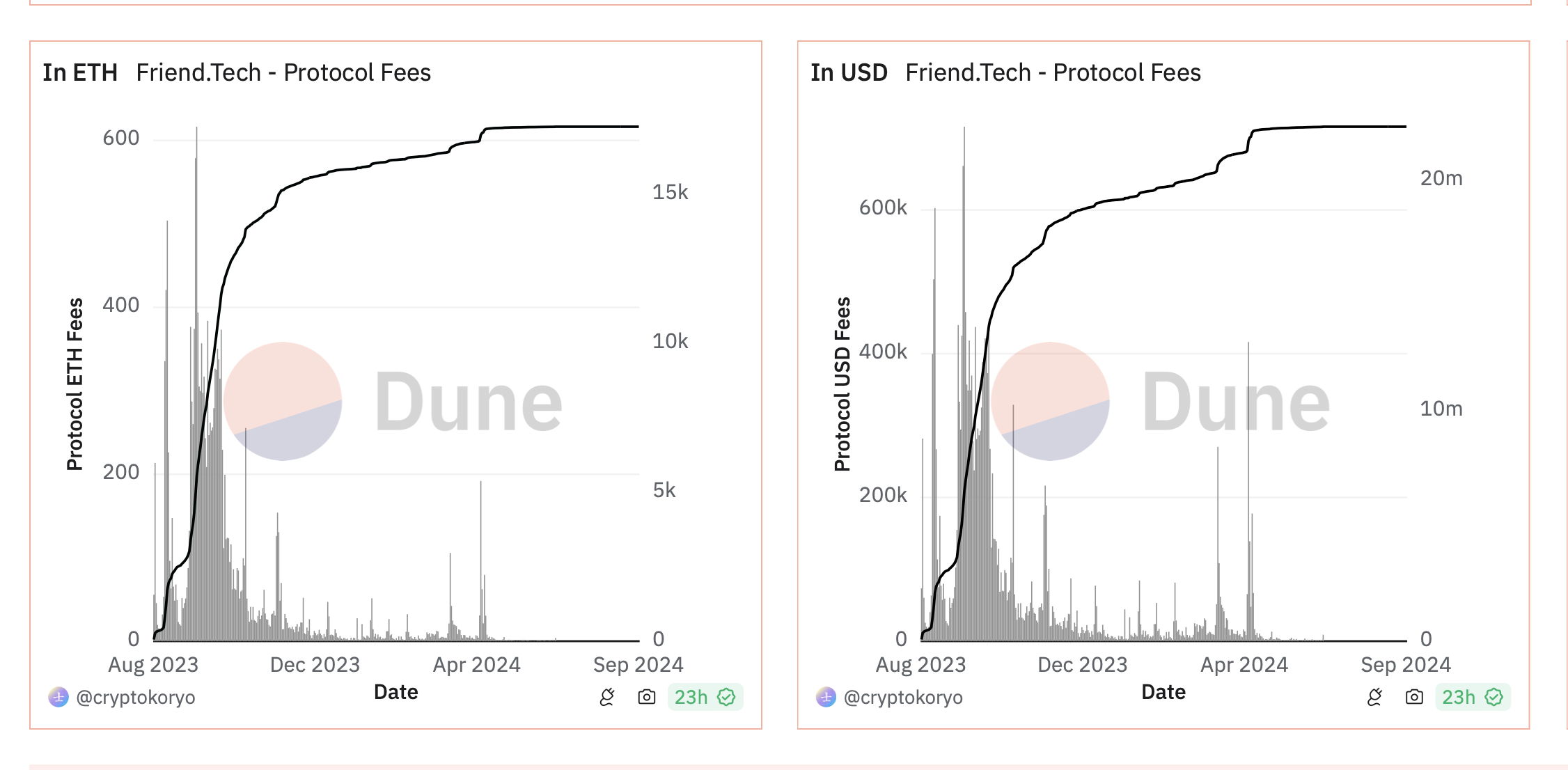

DefiLlama data reveals that daily generated fees have spiraled down to just $10,000, compared to a previous peak of $2 million. Data from Dune also shows a plateau in protocol fees and inflow metrics, further reflecting the platform’s decline.

Read more: DeFi Community Building: A Step-by-Step Guide

Meanwhile, analytics platform Arkham shows that the wallet linked to Friend.tech’s development team currently holds around $195,500 in various tokens. Since January, this wallet has deposited approximately $36 million worth of Ethereum (ETH) to Coinbase.

BeInCrypto was unable to reach Friend.tech’s pseudonymous co-founders, Racer and Shrimp. Racer’s X account appears to be either deleted or temporarily offline, while Shrimp has made their Twitter account private.

Despite the uncertainty, this may not mark the end for Friend.tech. In the crypto space, abandoned projects have been revived by new teams in the past. One notable example is Aerodrome, built on Base L2, which relaunched Andre Cronje’s abandoned protocol, Solidly.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.