In a report titled “DePIN: Traction in Supply & Early Signs of Increasing Demand,” Franklin Templeton explored the emerging sector of Decentralized Physical Infrastructure Network (DePin) projects. Franklin Templeton is a global asset management giant with over $1.5 trillion under its control.

As DePin projects continue to evolve, they present a compelling narrative of innovation and decentralization in the infrastructure sector.

Franklin Templeton Talks About 2 DePin Projects

DePin projects uniquely reduce overhead by outsourcing operational costs to third-party participants, who receive compensation in the project’s tokens. This method, known as token incentives, paves the way for a lean operation that could revolutionize sectors like computing, energy, telecommunications, and mapping.

“DePIN projects have become a popular sector in crypto as they have the potential to disrupt traditional infrastructure companies and business models,” Franklin Templeton said.

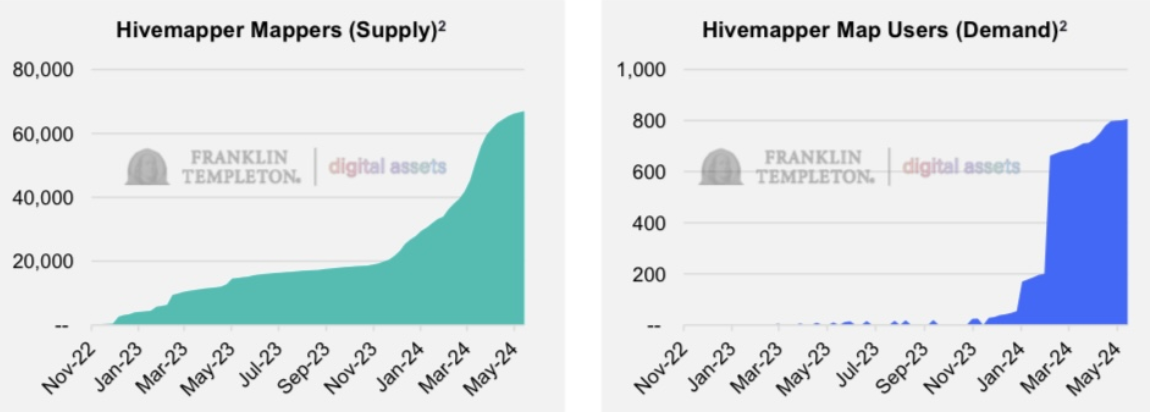

One standout example is Hivemapper, highlighted by Franklin Templeton as the world’s first blockchain-based decentralized mapping network. Drivers install a dashcam, contribute to road mapping, and earn Hivemapper (HONEY) tokens. Impressively, Hivemapper has charted 21% of global roads in 31 months, growing its contributor base to over 60,000.

Another significant player, Helium (HNT), has developed the largest decentralized wireless network. By partnering with T-Mobile to extend its reach, Helium expanded its 5G network to about 13,000 hotspots.

Read more: Top 8 Helium (HNT) Wallets to Consider in 2024

The project offers an unlimited phone plan at a competitive price, significantly lower than traditional carriers. According to a Dune dashboard, Helium has attracted nearly 93,000 subscribers. This model highlights the potential market disruption and cost-efficiency of DePin projects.

Despite these successes, the demand for such decentralized services has not escalated as fast as the supply. This imbalance could impact the long-term viability and attractiveness of DePin projects unless stronger consumer interest is cultivated.

According to the latest data from the DePin Ninja dashboard, the DePin ecosystem is thriving, with 1,215 active projects and a total market capitalization of $47 billion.

Read more: Top 9 Web3 Projects That Are Revolutionizing the Industry

Moreover, Aethir and io.net, two emerging DePin ventures, saw their respective tokens, ATH and IO, listed on multiple centralized exchanges this week. These listings enhance liquidity and validate the operational models of these projects, encouraging broader participation and investment.