The art market has changed a lot in the last few years. Now, with blockchain-based fractional art firms, investing in art is not just the domain of wealthy or institutional investors. BeInCrypto spoke to Colin Johnson, CEO of Freeport, about security tokens, registering with the SEC, and why smaller artists can benefit from a more open market.

Once, investing in the art market meant attending an auction at a place like Sotheby’s or Christie’s in New York or London. Or you would send a proxy bidder to fight for the artwork on your behalf. At the end of the event, you would either go home with a prized artwork or not. Now, the barriers to entry are lower, with investors no longer needing to own an entire item. Today collectors can own “shares” in a piece in what’s known as fractionalized ownership.

The Art Market Performs Better Than the S&P 500

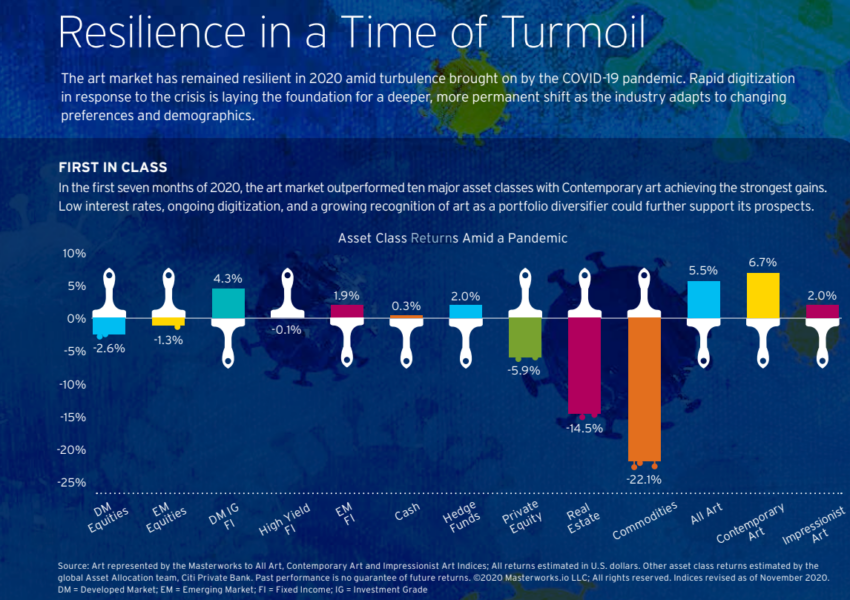

There is plenty of money to be made in the contemporary art market today, too. Over the last 25 years, contemporary art investments have outperformed the S&P 500, a stock market index that tracks the performance of 500 large publicly traded companies in the United States.

DollarSprout figures show that art consistently delivers average returns of 7.6% annually. (Although, a report by Citi GPS puts annual returns as high as 14%.)

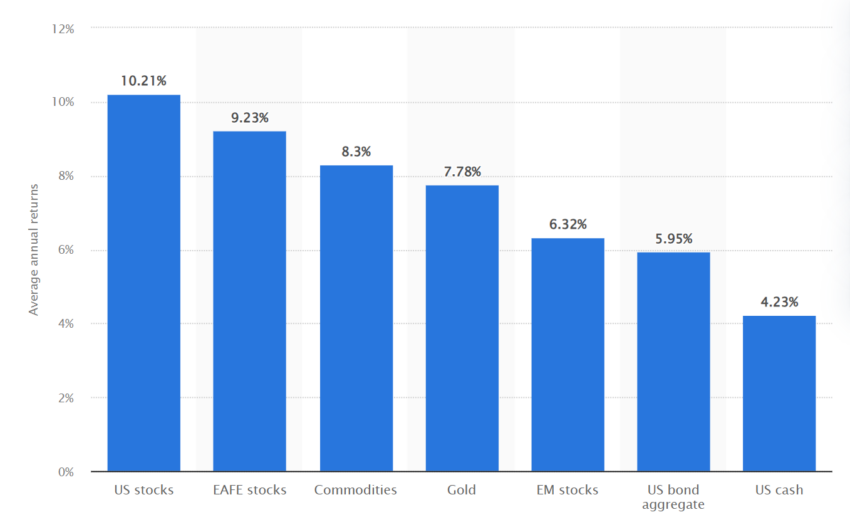

According to Statistica, those returns are nearly identical to gold, which recorded an average annual return of 7.78% from January 1971 to December 2022. For comparison, commodities—like crude oil, natural gas, and wheat—had average annual returns of 8.3%. US cash, on the other hand, registered only 4.23% over the same period.

So while we might not all agree on art’s aesthetic qualities, it’s safe to say that the contemporary art market is good for lining your pockets, even if your tastes lie elsewhere.

Fractionalized Ownership of Art

Masterworks, founded in 2017, was the first to allow investors to own part of an artwork, treating it more like a financial asset than a creative product (an innovation that will not be to everyone’s liking).

However, the barriers to entry were still quite high for most, requiring a $15,000 USD minimum buy-in. A hefty sum for the cautious investor. Then there’s a 1.5% annual management fee that includes security, insurance, and related costs.

However, a report by industry journal ARTnews has revealed signs that the fractionalized ownership pioneer may be in trouble, with sources telling the magazine of “conflicting business strategies, rifts between management and key teams… nonexistent human resources practices” and “ethically questionable” and potentially illegal selling tactics and employee incentive structures.

Begin to create and sell your own digital art with this helpful guide: 7 Ideas for Beginners To Create Digital Art

Johnson’s Freeport, then, is the attempt to give the idea another go, with the added benefits of blockchain technology thrown in. Its model uses “security tokens”—digital tokens on a blockchain that represent ownership of real-world assets.

They’re “still a relatively new concept, even in the most technologically advanced societies,” explains Johnson. “They are not yet widely understood.”

“The concept of tokenization, especially when linked to tangible assets like fine art, presents a new and exciting opportunity to increase global access to assets of value that have previously been inaccessible to many,” he continued.

Unlike Masterwork, the minimum buy-in for a slice of a Warhol print (one of ten thousand “shares”) is in the tens-to-hundreds of dollars.

A Compliance-First Route

In the United States, Freeport already has permission from the Securities and Exchange Commission (SEC) to sell Regulation A securities. A welcome relief to investors watching the ongoing regulatory drama in crypto world.

On June 5, the SEC charged Binance, the world’s largest crypto exchange, and its founder Changpeng Zhao, with 13 counts of violating securities laws. The day after, in a dramatic one-two punch, the SEC hit the world’s second-largest exchange, Coinbase, with similar charges. The SEC under Gary Gensler has also charged numerous other crypto firms operating in the United States.

“Navigating the SEC’s Regulation A review is a complex process that demands rigorous financial disclosure and legal compliance,” explained Johnson. He went on:

“This process is made especially difficult when taking into account the generally unregulated digital asset market. Freeport chose to build with a compliance-first approach. Our team was committed to transparency and thoroughness in our application process, which we believe contributed to our successful regulatory clearance despite the harsh enforcement environment.”

One barrier to SEC approval, and one reason why some firms avoid it, is the lengthy approval process. Getting audited, draft documents, and gather paperwork can take nine to twelve months, Johnson said.

Gensler’s SEC Applies 1930s Securities Laws

The second problem, Johnson told BeInCrypto, is cost. “Our first law firm wanted $350K for the Reg A filing alone, as an example. We were able to get that down using a more efficient firm, but it’s still considerable.”

The final barrier is the approval itself. As anyone familiar with Gary Gensler’s tenure as Chair of the SEC will note, the regulator is hell-bent on applying 1930s securities laws to 21st-century technology, including anything to do with crypto.

“The SEC is very willing to work with you if what you’re building fits within the confines of securities that have a precedent,” Johnson continued. He elaborated:

“For us, the tokens that are issued can be directly correlated to something familiar—stocks, or shares. Leaning on that familiarity is what ultimately allowed us to get approved. Much of the SEC enforcement is on entities who chose not to request qualification. We specifically chose the longer route so that we wouldn’t end up in that position.”

Own a Slice of a Warhol

Platforms like Freeport aim to offer the ability to own part of an instantly recognizable masterpiece. In the case of Johnson’s company, investors are able to choose from some of Andy Warhol’s most notable works.

However, while the appeal of part-owning a Warhol is obvious, can fractionalized ownership work for less notable artists?

Johnson told BeInCrypto that artists with less exposure still stand to benefit. “By tokenizing their work, they can access a global market of investors and art-lovers,” he said.

“Which can provide them with increased visibility and financial support. Moreover, investors get the opportunity to support emerging artists and potentially reap the benefits if these artists’ works appreciate over time.”

So, what’s next for an innovator in this space?

Like others in crypto, blockchain, and DeFi, Freeport is eyeing the next wave of investment opportunities. As regulation around digital assets settles, Johnson and his team are exploring multiple avenues. These include lending against art tokens, trading tokens on exchanges, and viewing owned art assets across chains.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.