Forward Industries, the largest corporate holder of Solana (SOL), has sent over $200 million worth of SOL to Coinbase Prime, raising concerns about potential sell-offs.

The move comes as the altcoin has slid nearly 29% over the past month, falling below the firm’s average acquisition price.

Is The Digital Asset Treasury Strategy Unraveling?

Forward Industries began acquiring SOL in September 2025, executing a $1.65 billion Private Investment in Public Equity deal to build its holdings. According to the latest update, the company held approximately 6.9 million SOL. This represents around 1.119% of SOL’s total supply.

“Forward Industries’ Total Holdings Rise to 6.9 Million SOL as of November 15, 2025. We remain focused on our goal of increasing SOL per share,” the team posted.

The firm’s strategy is to maximize shareholder value through on-chain activities like staking, lending, and DeFi participation. However, this approach is facing challenges as SOL’s price continues to fall.

According to CoinGecko, its reported treasury value has plunged from $1.59 billion to $908 million. The NASDAQ-listed company now sits on unrealized losses of $677 million after accumulating SOL at an average price of $232 just two months ago.

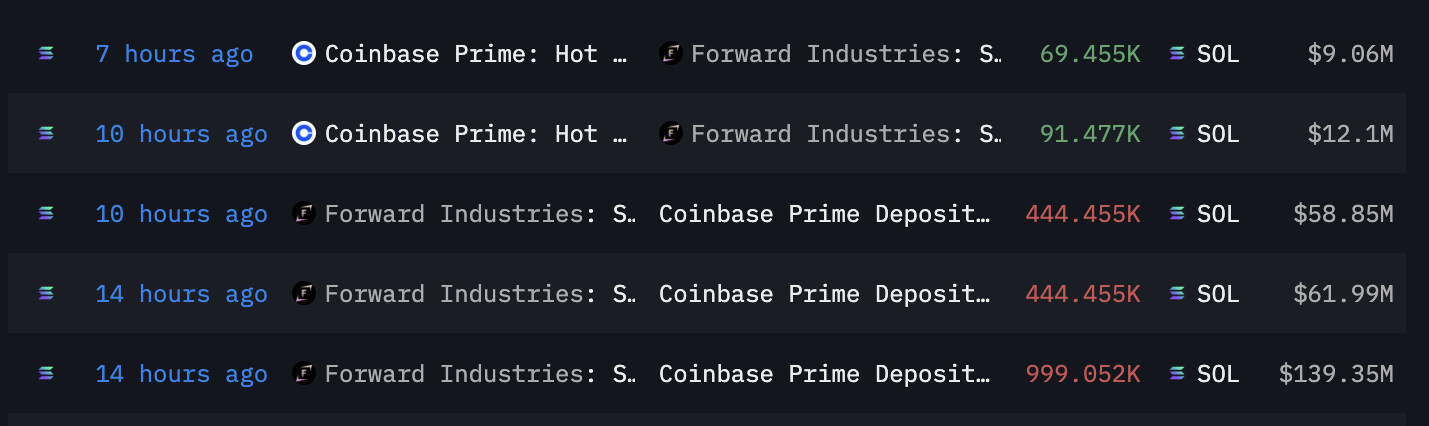

At the same time, analysts noticed significant movements from Forward Industries’ wallets. According to data from Arkham Intelligence, the firm transferred 1.8 million SOL valued at approximately $237.6 million at current market prices to Coinbase Prime. The movement was executed through three separate transfers.

“Forward Industries bought Solana just 2 months ago, but is now already dumping it at a massive loss. Why is every fund selling crypto? Is it really over?” an analyst stated.

However, the situation appears more complex. Shortly after the outbound transfers, on-chain data revealed that around 160,900 SOL were sent back from Coinbase Prime’s hot wallet to Forward’s address. Following these movements, the company’s wallet now holds 4.129 million SOL valued at approximately $552.21 million.

Whether these transfers signal planned sales or are part of routine internal restructuring remains unclear. Forward Industries has not issued any statement suggesting an intention to liquidate its position.

Still, the concerns about a potential sell-off are not unfounded. The crypto market has been under heavy pressure throughout Q4.

Earlier this month, BeInCrypto reported that a Bitcoin-focused digital asset treasury firm had liquidated nearly 30% of its BTC holdings in an effort to reduce its convertible debt.

Bearish Pattern Emerges as Solana Price Plunges Nearly 29%

Meanwhile, Solana has been facing mounting sell pressure of its own. BeInCrypto Markets data showed that SOL has dropped nearly 29% over the past month, deepening its downward trend.

The altcoin has pulled back to levels last seen in late June. At press time, SOL was trading at $132.47, marking a 5.4% decline in the past 24 hours.

Adding to the bearish sentiment, an analyst pointed to a developing head-and-shoulders pattern on SOL’s chart. This is a bearish setup that typically indicates fading buyer strength and the risk of a deeper correction once the neckline gives way.

“Just about testing neckline on this large head and shoulders. People get upset with me for posting charts like this when really they should be happy that I provide an early warning for exit when price was still high,” he wrote.

With Solana under heavy market pressure and technical indicators turning bearish, investors will be watching closely to see what comes next for the asset.