Crypto investment products saw inflows of up to $321 million last week, a surge linked to interest rate cuts by the Federal Open Market Committee (FOMC).

Bitcoin (BTC) remains the dominant asset, drawing most of the investment attention, while altcoins continue to take their lead from the pioneer cryptocurrency.

Bitcoin Leads $321 Million Crypto Investment Inflows

Digital asset investment products saw another round of positive inflows, with Bitcoin leading the charge, attracting $284 million. This uptick also inspired inflows into short-Bitcoin investment products.

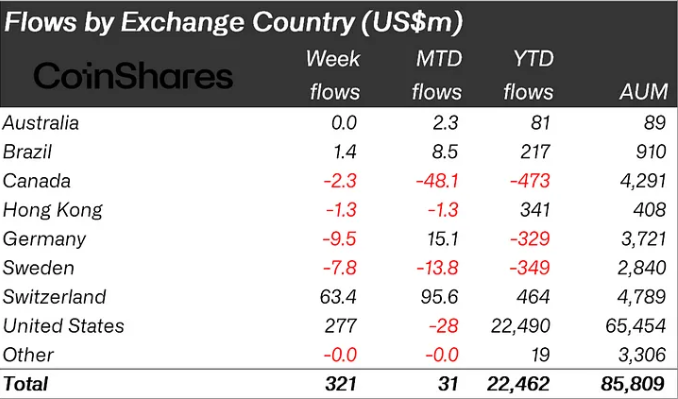

According to the latest CoinShares report, the Federal Reserve’s decision to cut interest rates by 50 basis points last week played a key role in driving these inflows. The US led regional inflows, contributing $277 million to the total. This reaction to the Fed’s rate cut highlights the growing impact of monetary policy on crypto investments.

“Considering our view of Bitcoin as a store of value — albeit an emerging one with significant volatility — it competes with other stores of value like the USD, Treasuries, and gold. As a result, Bitcoin should be regarded as an interest-sensitive asset, which is evident in its -70% correlation to the USD. When interest rate-sensitive macroeconomic data is released, we often observe an immediate intraday reaction in Bitcoin’s price. The recent positive price action was a direct response to the latest 50 basis point interest rate cut,” CoinShares Head of Research James Butterfill told BeInCrypto.

Read more: What Is a Bitcoin ETF?

On the other hand, Ethereum (ETH) saw its fifth consecutive week of outflows, totaling $28.5 million last week. The latest CoinShares report attributes this to ongoing Grayscale outflows and the underperformance of Ethereum ETFs.

Ethereum ETFs continue to struggle, with cumulative net outflows reaching $607.47 million, according to Sosovalue data. On September 20, Grayscale’s Ethereum ETF (ETHE) reported $2.77 billion in cumulative net outflows, though other issuers, including Grayscale’s Mini ETH ETF, posted positive flows.

“Several factors are at play with regards to Ethereum’s underperformance. First, the timing of the ETF launches was unfortunate. Second, the broader macroeconomic environment — marked by uncertainty around potential rate cuts, concerns about economic growth, and the unwinding of the yen carry trade — has not been favorable. Most importantly, ongoing concerns about Ethereum’s profitability on Layer-1 following the Dencun upgrade have caused unease,” Butterfill added.

Bitcoin Capital Rotation Into Altcoins

While Bitcoin continues to see rising demand, the long-awaited altcoin season remains delayed as capital has yet to flow into smaller market-cap coins. According to an analyst on X (formerly Twitter), this delay is partly due to Bitcoin ETFs positioning BTC as an asset in its own class, creating a distinct market for Bitcoin.

Institutional investors and Wall Street players have played a significant role in driving Bitcoin demand, particularly following the approval of Bitcoin ETFs in January. As a result, the focus on Bitcoin has slowed the rotation of capital into altcoins, postponing the expected altcoin rally.

“Institutions will not be rotating out of their Bitcoin to play alts. Bitcoin ETF buyers will not be rotating. Traders playing options on the Bitcoin ETFs won’t be rotating into shitters. It’s a totally different market now and most of you don’t own any BTC,” one analyst wrote.

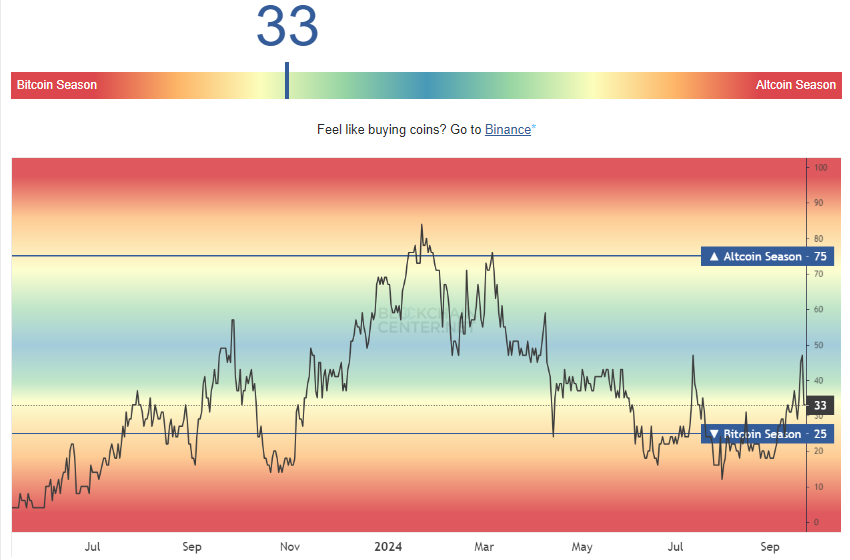

The anticipated “altcoin season” remains at bay, a phase when investing in altcoins typically yields better returns than Bitcoin or Ethereum. According to the Altcoin Season Index, the market is still in a Bitcoin season, with a score of 33/100. This indicates that Bitcoin continues to dominate, though altcoins are slowly gaining traction.

Read More: What Is Altcoin Season? A Comprehensive Guide

Historically, altcoin seasons have emerged after Bitcoin dominance peaks, which is why analysts are strategically positioning themselves. If current market conditions hold steady through the end of Q3 in September, investors may finally witness the start of an altcoin season.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.