With Republican candidate Donald Trump winning the 2024 US Presidential Elections, the crypto market noted an upswing. Bitcoin formed a new all-time high, and the total crypto market cap increased by $205 billion in a day.

However, with altcoins rallying as well, traders are seeking trade opportunities to take advantage of market volatility. Thus, in a report shared with BeInCrypto, 10x Research has presented five post-election crypto trade ideas.

Trade 1: Sell Bitcoin Puts With Elevated Volatility and Shorter Maturity

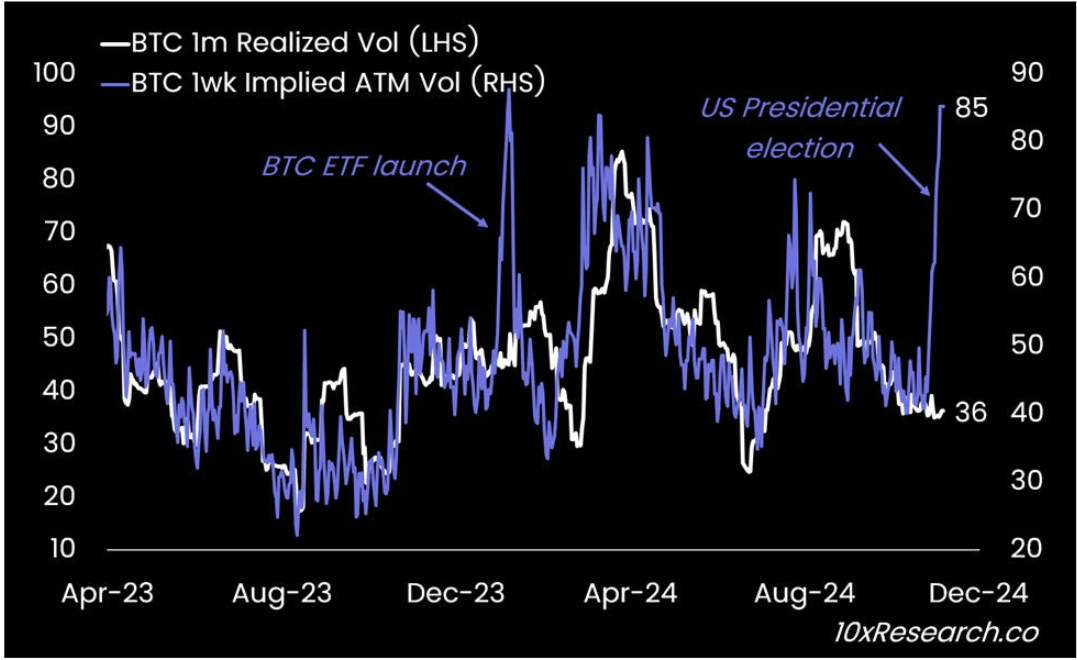

Implied volatility for Bitcoin’s at-the-money options has surged to 85%, similar to levels during January’s ETF launch. The gap between implied and realized volatility now stands at a record 50 points.

Volatility is expected to drop soon, allowing traders to shift to directional strategies. Hence, according to the analysts, managing gamma ahead of major events remains profitable.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Trade 2: Use Ethereum as a Funding Short

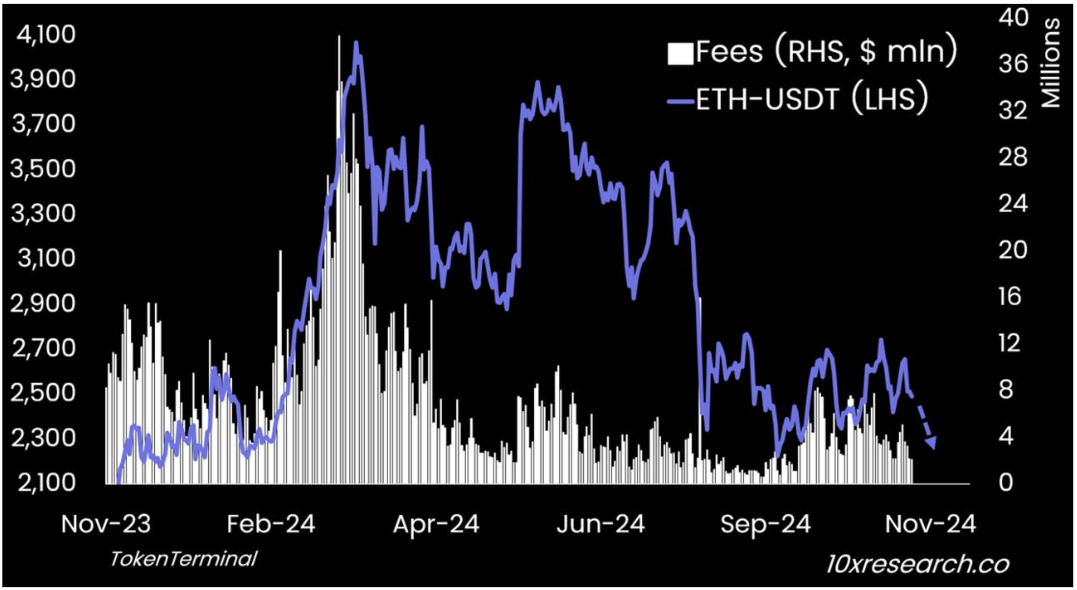

After the September FOMC meeting, Ethereum gas fees and DeFi activity briefly rose, narrowing the yield gap between traditional bonds and ETH staking. However, later, as treasury bond yields increased, DeFi activity declined, reducing Ethereum fees.

This trend suggests ETH may be less attractive until Ethereum ETFs from BlackRock enter the market.

“Until BlackRock begins marketing Ethereum ETFs, Ether may be better avoided or considered as a funding short,” 10X Research said in a report shared with BeInCrypto.

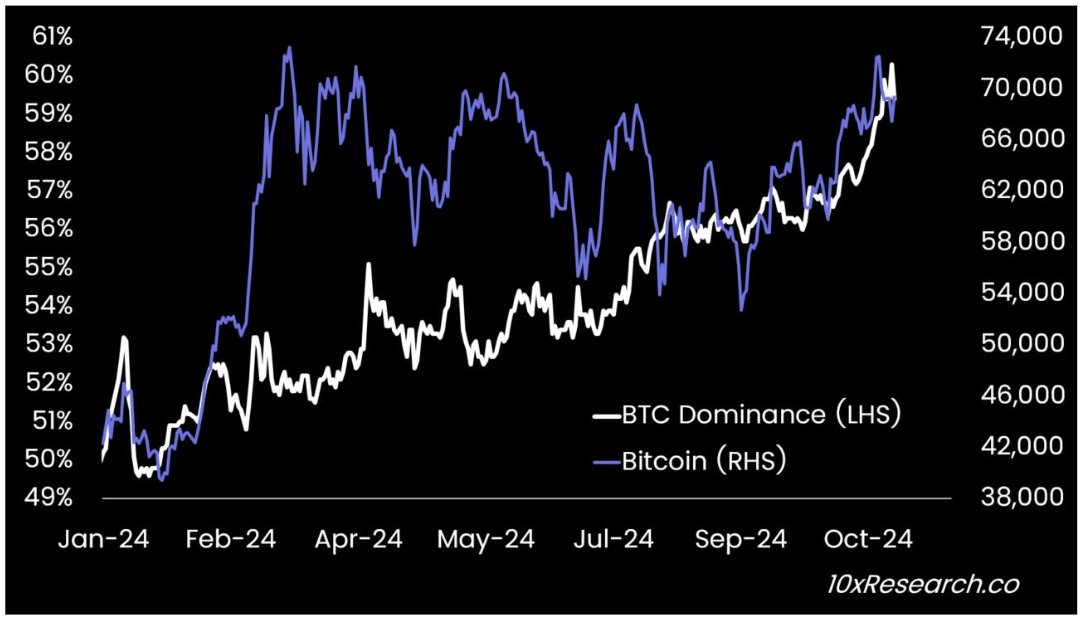

Trade 3: Rising Bitcoin Dominance Still Indicates BTC Outperformance

In 2024, Bitcoin dominance has surged from 50% to 60%, even as its price holds steady at around $74,000. This trend reflects a shift by both TradFi investors via ETFs and crypto holders reallocating from altcoins to Bitcoin.

Wallet activity shows investors are holding rather than trading Bitcoin, signaling trust and creating a supply shortage. Continued dominance suggests strong potential for Bitcoin to outperform.

“A supply shortage is emerging as traders increasingly trust Bitcoin, especially at the expense of higher-beta altcoins. As long as Bitcoin dominance continues to rise, the potential for Bitcoin to outperform remains strong,” 10X Research analysts said.

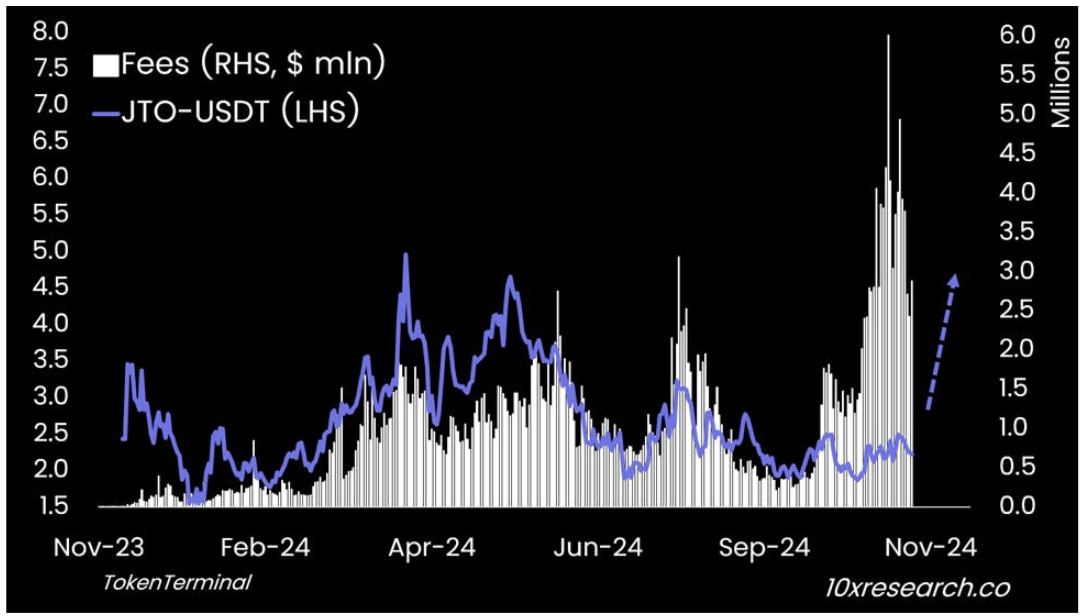

Trade 4: Jito Capitalizes on Solana’s Upside Momentum

Solana’s influence in the crypto market is sparking interest in protocols like Jito, a liquid staking platform on the network. Jito’s recent fee spikes have historically aligned with rallies in JTO-USDT, suggesting potential gains.

While governance holders may not benefit directly, airdrops offer possible rewards. If JTO-USDT surpasses its 20-day moving average, it could present a strong investment opportunity.

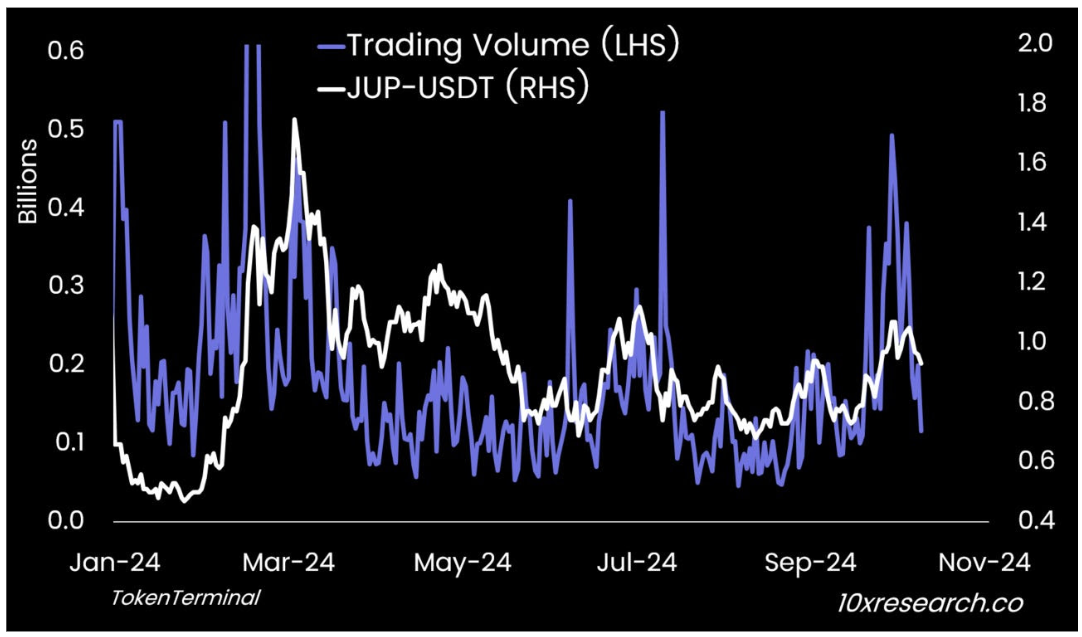

Trade 5: Activity on Jupiter Remains Strong

With Donald Trump’s win, speculation is arising about a Solana ETF approval under potential new SEC leadership. Consequently, this positive impact is also being observed in other protocols within the Solana ecosystem, such as Jupiter (JUP).

Read More: What Is Blockchain and How Does it Work?

Despite lower JUP-USDT volume, Jupiter maintained strong activity with $9 billion in trades last week. Fees remain steady at $5 million weekly, and swap transactions have increased significantly to 27-30 million weekly from 9 million in September.